- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

AMD's (NASDAQ:AMD) Value is in the Future, and Here is Why that's Good

Advanced Micro Devices, Inc. (NASDAQ:AMD) has substantially increased its stock price from 2019, and some investors might be weary if the company is overvalued. In order to get a good perspective of the worth of a stock, we will consider present and future earnings as a basis for the value of AMD stock.

AMD's Current Price to Earnings

Advanced Micro Devices is a profitable company whose stock increased from about US$30 per share in 2019 to US$115 today. However, after taking one look at its 59.1x P/E ratio, investors might worry if they are overpaying for the company.

Check out our latest analysis for Advanced Micro Devices

In order for this valuation to make sense, investors need to see high future growth potential in the bottom line of the company, as well as favorable factors that will allow them to execute on their vision.

How Is Advanced Micro Devices' Growth Trending?

In order to justify its P/E ratio, Advanced Micro Devices would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 25% last year. The latest three-year period has also seen an excellent 466% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

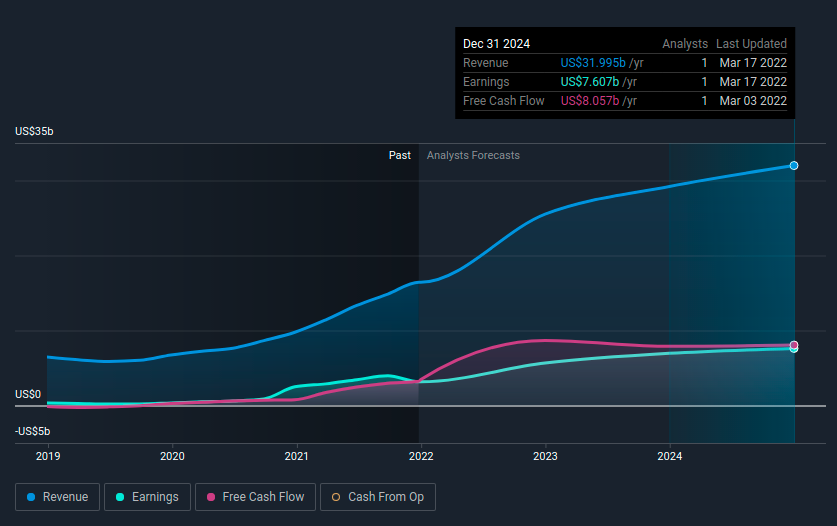

In the chart below, we can see that analysts are expecting AMD to drive more growth in the future, shedding light on the reasoning behind the high investor enthusiasm.

It seems that analysts are highly optimistic on AMD's future. By 2025, they expect to see around US$32b in revenue, some 93% more than the last 12 months. Earnings are also expected to grow 140% to 7.6b.

Most importantly, free cash flows are expected to stabilize around US$8b by 2025, which is a large 150%. This is party why investors have been so optimistic on AMD, as growth continues the company should more than double its cash flows.

Valuing AMD's Future Cash Flows

Now that we have a picture of AMD's future cash flows, we can attempt to estimate their value.

First, we revise the P/E multiple for forward earnings. In this case, we use the projected US$7.6b in earnings as our basis and come up with a forward P/E of 24.5x. This is almost in lock-step with the industry value of 25.6x PE. In order to be a bit more precise, we need to apply a discount (6.72%) to AMD's future earnings, which puts their value at US$7.09b. This gives us an adjusted forward PE of 26.2x, indicating that the stock is still in-line with the industry average, albeit slightly more expensive.

In our second approach, we will use an intrinsic value model, which estimates the present value of future cash flows for the company in the next 10 years. While it is hard to forecast the future, a DCF might be more appropriate for growing companies such as AMD. Our model shows that AMD is 18% undervalued, and the cash flows yield a fair value per share of US$140 or a total value of US$228.4b.

An 18% upside is within the margin of error for these models, so take the result with a grain of salt.

Keep in-mind that there are a lot of assumptions about growth and risk underlying these models, and you can inspect the details HERE.

Alternatively, if you want to see how much the company is worth in terms of 2025 cash flows, you can use the terminal value formula on them: FCF / (Discount rate - Riskfree rate) = 8b / (0.0672-0.0192) = 8 / 0.048 = US$166.6b. Since this is 3 years in the future, we need to add this to the present value of FY 2022 and 2023 cash flows.

We get 8.13 + 6.925 +166.6 = US$181.7b. I used the discount rate and present value of cash flows from our valuation model.

Key Takeaways

AMD is a high performing, growth company. While analysts may disagree on the level of upside for the firm, we can see that the high valuations are likely justified on an intrinsic and relative basis. Investors should monitor the company's growth execution, as small changes in future performance can have a large impact on value.

Additionally, AMD is exposed to Taiwan Semiconductor Manufacturing (NYSE:TSM) as their key business partner, as well as interest rate and supply chain risks. Considering that the company has strong fundamentals, price corrections stemming from these risks, may be considered temporary and potential opportunities.

Before you take the next step, you should know about the 2 warning signs for Advanced Micro Devices that we have uncovered.

Of course, you might also be able to find a better stock than Advanced Micro Devices. So you may wish to see this free collection of other companies that sit on P/E's below 20x and have grown earnings strongly.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)