- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Surges 11% As 5th Gen EPYC Embedded Processors Debut

Reviewed by Simply Wall St

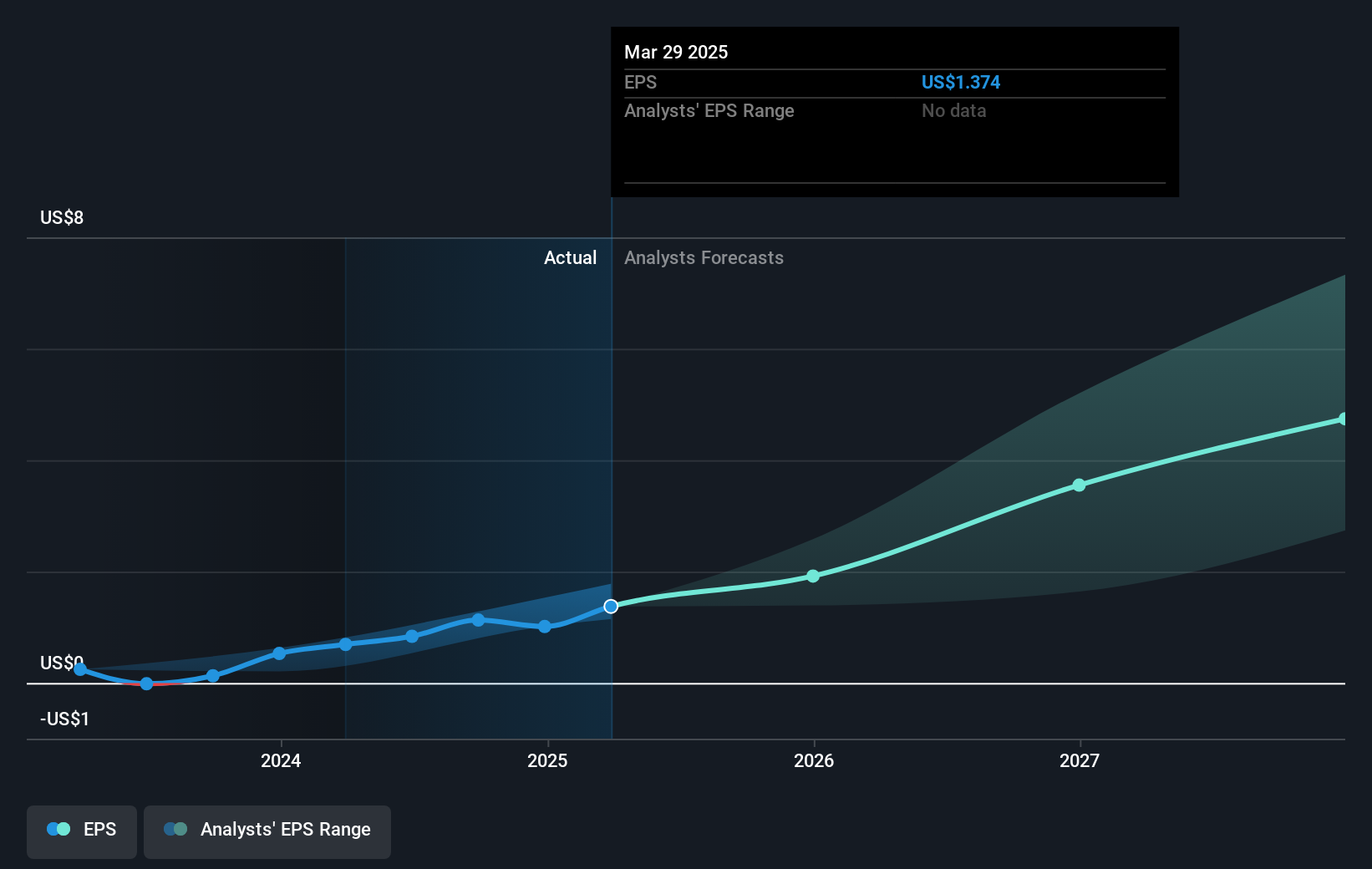

Advanced Micro Devices (NasdaqGS:AMD) experienced a notable 10.92% increase in its share price over the past week. This movement followed recent announcements, including the launch of the 5th Gen AMD EPYC™ Embedded processors, which could signify a strengthening of its market position in embedded systems. Concurrently, AMD's response to a shareholder proposal reflects ongoing corporate governance considerations. The increase in authorized shares and discussions surrounding investor activism presented at their recent filings may indicate strategic planning that might have influenced investor sentiment. Despite a broader tech sector decline impacted by Nvidia and Tesla's struggles, AMD's price move stands out amidst these dynamics.

Over the past five years, Advanced Micro Devices (AMD) has delivered a total return of 152.44%, underscoring its significant performance during this period. Key contributors to this performance include the company's expansion into the Data Center AI sector with the introduction of Instinct accelerators and ROCm updates aimed at enhancing its AI offerings. This strategic emphasis on AI and high-performance computing has likely propelled AMD's revenue growth within expanding markets. Additionally, AMD's collaboration with companies like Dell to offer Ryzen Pro processors has positioned it for competitive gains in client computing.

Concurrent with these efforts, AMD's financial strategies, including a share repurchase program and alliances to bolster its product portfolio, reflect its commitment to maintaining shareholder value. Despite increased competition in the server CPU market, these initiatives have supported AMD in capturing market share and delivering revenue growth. It's worth noting that over the past year, AMD's performance lagged behind both the US Semiconductor industry and US market, indicating challenges amidst broader economic headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives