- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (NasdaqGS:AMD) Expands Share Buyback Plan By US$6 Billion

Reviewed by Simply Wall St

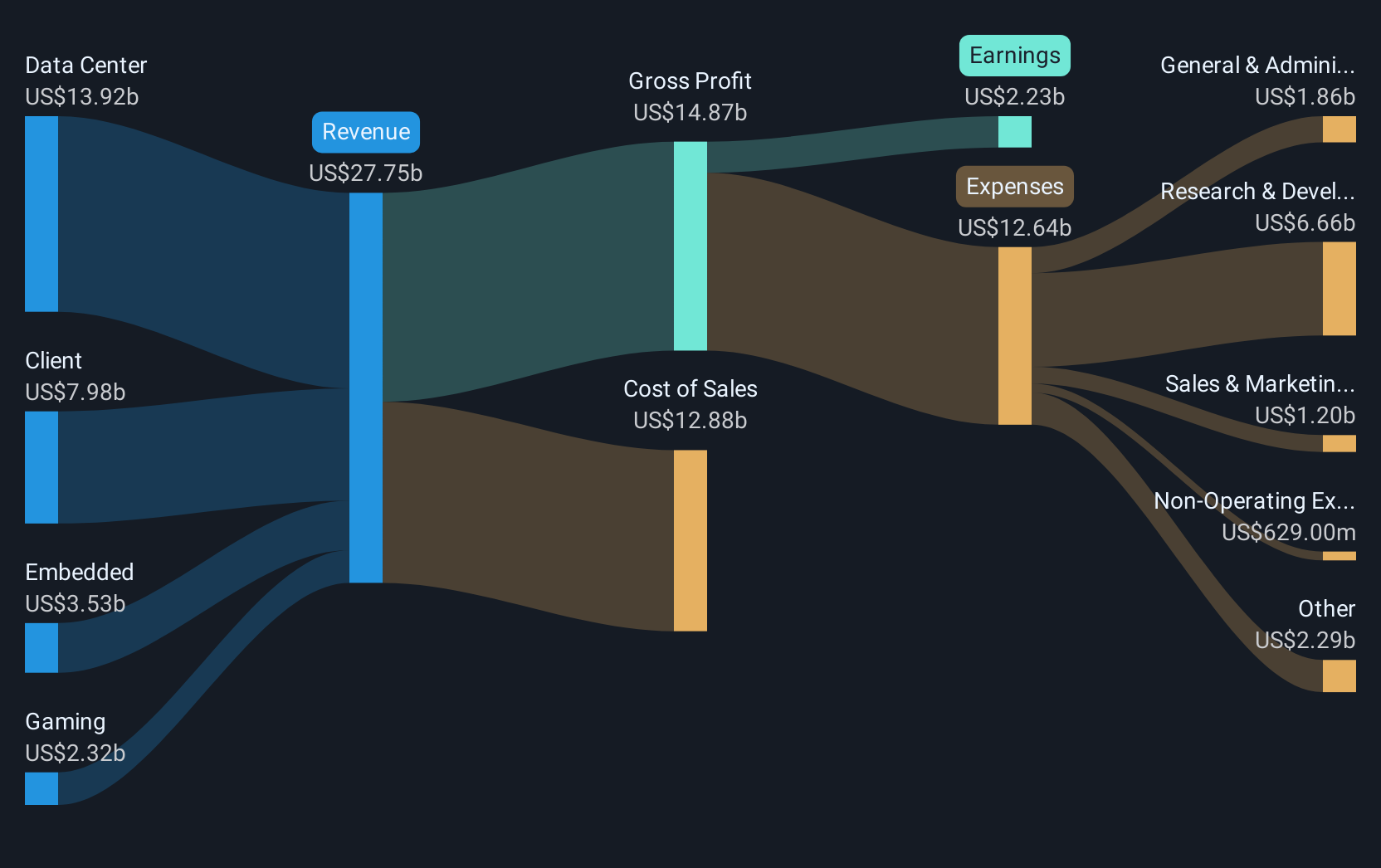

Advanced Micro Devices (NasdaqGS:AMD) recently increased its equity buyback plan by $6 billion, raising the total authorization to $14 billion. This decision comes alongside the company's Q1 earnings report, which showed significant growth in both sales and net income, reinforcing AMD's financial robustness. In the context of a broader market uptrend of 5.1% over the past week and an 11% increase over the past year, AMD's stock price movement of approximately 25% upward in the last month was likely supported by these financial strides. The new partnership with HUMAIN to build global AI infrastructure and the launch of the EPYC 4005 Series processors further positions AMD in a favorable light. These developments align with the Nasdaq Composite's ongoing winning streak, suggesting that AMD's recent announcements and financial performance have added weight to its positive price movements.

Advanced Micro Devices' recent expansion of its equity buyback plan by US$6 billion is likely to reinforce investor confidence and could contribute to supporting its stock value, especially in light of its strong Q1 earnings performance. Over the longer term, AMD's stock has seen impressive gains, with a total return of 108.76% over five years. In comparison, over the past year, AMD's stock experienced a significant rise, although it slightly underperformed relative to the broader US semiconductor industry, which saw a notable annual return.

This renewed buyback plan, along with substantial growth in sales and net income, has the potential to positively impact the company's revenue and earnings forecasts as analysts accommodate these financial enhancements. However, challenges such as regulatory barriers and fierce competition, as highlighted in the narrative, remain significant hurdles. The share price appreciation of around 25% over the last month places it closer to the consensus price target of $126.29, a modest discount to AMD's evaluated market value, suggesting room for further evaluation of strategic positioning and growth prospects.

Evaluate Advanced Micro Devices' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion