- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices, Inc.'s (NASDAQ:AMD) Popularity With Investors Under Threat As Stock Sinks 27%

Advanced Micro Devices, Inc. (NASDAQ:AMD) shares have had a horrible month, losing 27% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 25% in the last year.

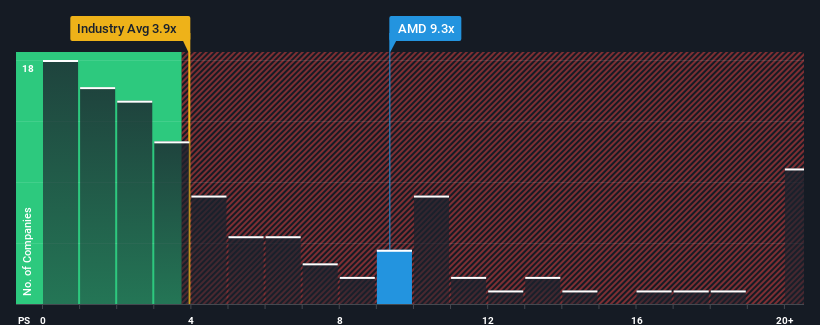

Although its price has dipped substantially, Advanced Micro Devices may still be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 9.3x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 3.9x and even P/S lower than 1.6x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Advanced Micro Devices

What Does Advanced Micro Devices' Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Advanced Micro Devices has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Advanced Micro Devices.How Is Advanced Micro Devices' Revenue Growth Trending?

Advanced Micro Devices' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.3% last year. This was backed up an excellent period prior to see revenue up by 74% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 22% each year as estimated by the analysts watching the company. With the industry predicted to deliver 27% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Advanced Micro Devices is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Advanced Micro Devices' P/S?

Even after such a strong price drop, Advanced Micro Devices' P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Advanced Micro Devices, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Advanced Micro Devices with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.