- United States

- /

- Semiconductors

- /

- NasdaqGS:AMD

Advanced Micro Devices (AMD) Partners With USC ISI To Revolutionize AI Model Training

Reviewed by Simply Wall St

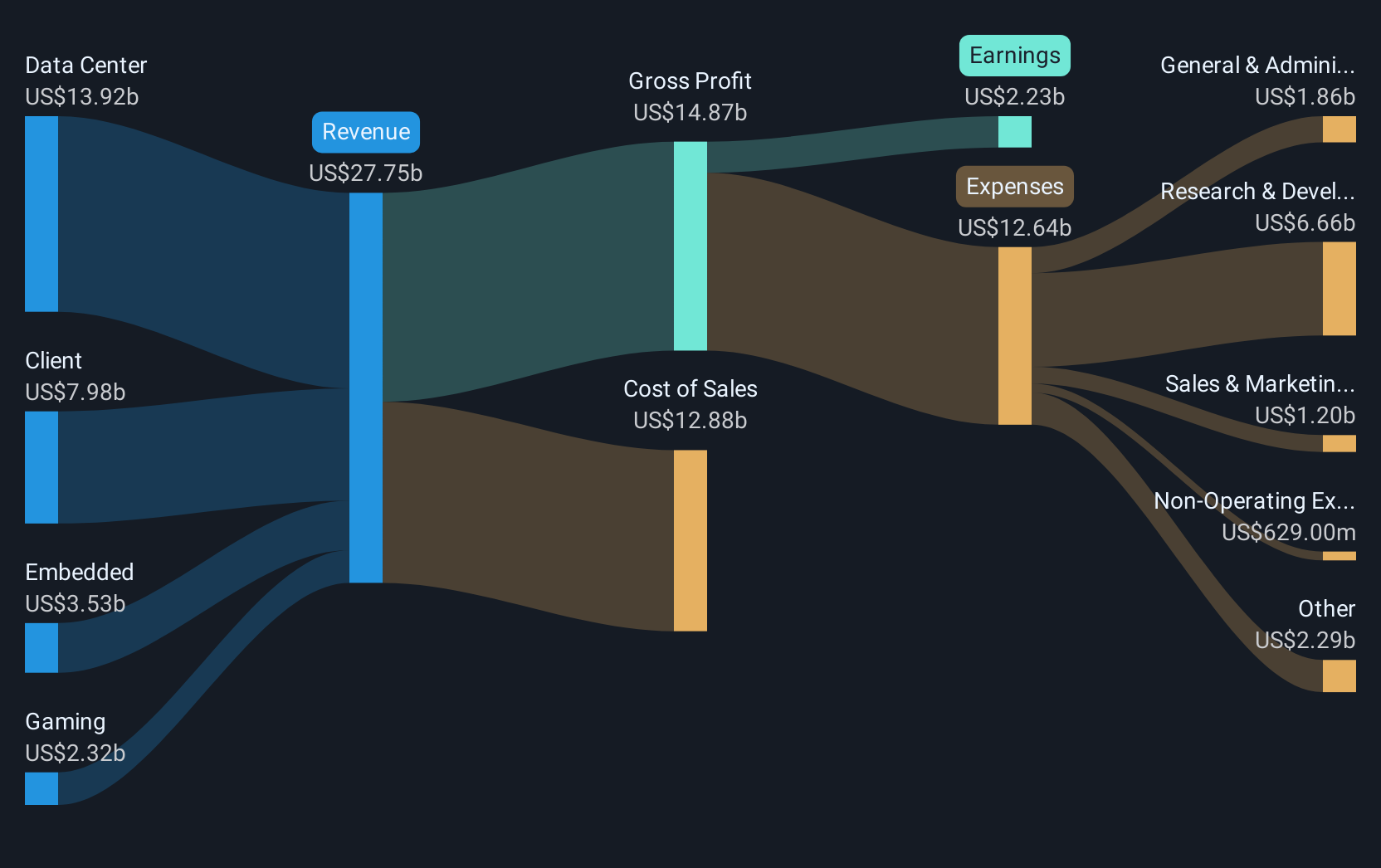

Advanced Micro Devices (AMD) saw a 68% price increase last quarter, highlighted by its strategic collaboration with Aligned and USC ISI to develop the MEGALODON model, leveraging AMD's Instinct MI300 GPUs. This project marks a significant shift, emphasizing non-NVIDIA architectures. Complementing this, AMD reported Q1 earnings with substantial growth in sales and income. Together, these developments coincided with broader market trends, as the Nasdaq and S&P 500 hit record highs due to strong corporate earnings. While the market remained relatively stable, AMD's advances in AI and strong financial results likely enhanced its appeal to investors.

Find companies with promising cash flow potential yet trading below their fair value.

Advanced Micro Devices (AMD) has experienced substantial share price growth, rising 68% in the last quarter, driven by its collaboration to develop the MEGALODON model. This move may bolster AMD's revenue and earnings projections, as it emphasizes non-NVIDIA architectures, potentially diversifying its market presence and influencing future forecasts positively. Over the past five years, AMD's total return, including dividends, was 107.31%, demonstrating strong performance despite some industry pressures and regulatory concerns highlighted in recent narratives.

When considering AMD's performance relative to the market, it's important to note that while it matched the US market's 18% return over the previous year, it underperformed compared to the US Semiconductor industry's 38.6% return during the same period. As AMD advances in AI capabilities, this could impact revenue forecasts positively despite existing challenges. However, the current share price of US$162.12 being above the analyst consensus target of approximately US$145.97 suggests market expectations might be high. If bearish forecasts materialize, the share price could adjust closer to those target levels.

Assess Advanced Micro Devices' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMD

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives