- United States

- /

- Semiconductors

- /

- NasdaqGS:AMBA

Ambarella (AMBA): Evaluating Valuation as CVflow AI Chips Expand into Global Bus Safety Systems

Reviewed by Kshitija Bhandaru

Ambarella (AMBA) is making headlines as its CVflow AI chips are now integral to Gauzy Ltd.’s next-generation safety systems, which have been rolled out in more than 20,000 buses worldwide. This showcases the growing demand for AI-powered safety solutions in public transportation and illustrates Ambarella’s expanding footprint in edge AI markets.

See our latest analysis for Ambarella.

Ambarella’s recent surge is catching plenty of attention, with the share price gaining over 26% in the past three months and propelling the latest close to $85.03. This pace of momentum adds to an impressive long-term run, as total shareholder return sits above 44% over the past year and more than 60% over three years. With the company at the center of growing demand for edge AI and safety systems, investors appear increasingly optimistic about both its growth prospects and shifting industry dynamics.

If you’re keen to see which other tech and AI stocks are making moves as demand accelerates, take the next step and explore See the full list for free.

But with Ambarella’s impressive rally and fast-paced growth, the big question remains: Is its current valuation a launchpad for future gains, or has the market already priced in its opportunity in edge AI?

Most Popular Narrative: 5.6% Undervalued

Ambarella’s last close of $85.03 sits just below the narrative’s fair value target of $90.05, highlighting optimism about the company’s growth trajectory and future margins as edge AI markets expand. This sets up a pivotal debate around whether projected business drivers can sustain the recent rally.

"Sharply increasing demand for AI-powered edge devices, including portable video, robotics (notably aerial drones), and edge infrastructure, has led to a rapid expansion of Ambarella's addressable markets, as evidenced by record edge AI revenue and multiple recent, diversified design wins. This is catalyzing strong, sustained revenue growth and positions Ambarella to benefit further as additional vertical applications for edge AI proliferate."

What does the narrative project for Ambarella’s future? The math behind this verdict relies on ambitious leaps in revenue, margins, and a striking multiple that outpaces most industry norms. Unpack the full blend of bullish assumptions and market expectations that drive this fair value. See which quantifiable catalysts anchor the analyst consensus.

Result: Fair Value of $90.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Ambarella’s reliance on volatile IoT end-markets and concentrated customer exposure could derail its growth outlook if demand or major contracts unexpectedly decline.

Find out about the key risks to this Ambarella narrative.

Another View: Market Ratios Tell a Different Story

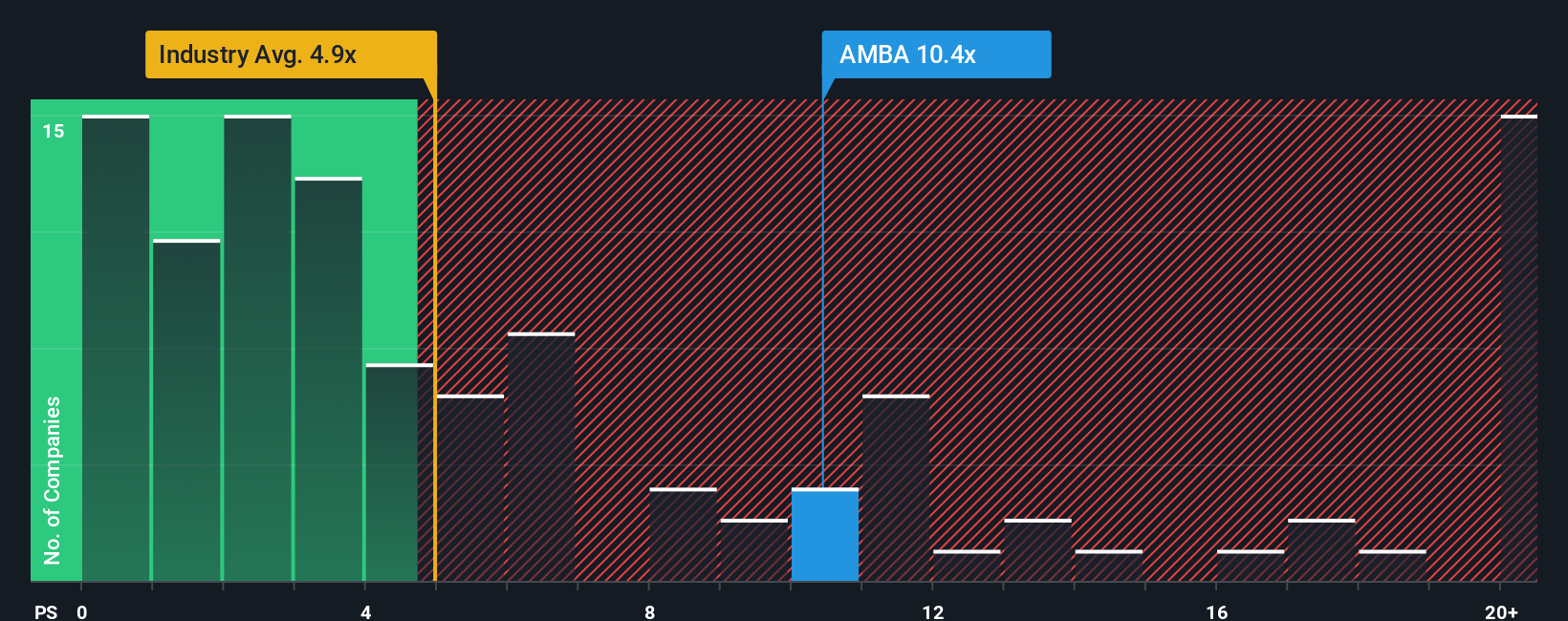

Looking at Ambarella through the lens of market ratios reveals a more expensive picture. Its price-to-sales ratio stands at 10.4x, which is nearly double both the US Semiconductor industry average of 4.8x and the calculated fair ratio of 5.5x. This suggests investors are paying a premium for growth that may already be priced in. Could Ambarella’s multiples come under pressure if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ambarella Narrative

If you’d prefer to chart your own course or think the data points in a different direction, you can easily craft your perspective on Ambarella’s valuation in just a few minutes. Do it your way

A great starting point for your Ambarella research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't miss your chance to stay ahead of the market. Amplify your strategy by searching for opportunities that fit your style and investment goals.

- Spot tomorrow’s breakout technology as you review these 26 AI penny stocks, which have strong potential to change the game in artificial intelligence.

- Strengthen your portfolio’s income stream by checking out these 19 dividend stocks with yields > 3%, featuring companies with attractive, high-yield payouts.

- Get in early on innovations in cryptography and blockchain by investigating these 78 cryptocurrency and blockchain stocks, which could benefit from the next wave of digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMBA

Ambarella

Develops semiconductor solutions that enable artificial intelligence (AI) processing, advanced image signal processing, and high-definition (HD) and ultra-HD compression.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives