- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Has Applied Materials Run Too Far After Its 62% 2025 Surge?

Reviewed by Bailey Pemberton

- If you are wondering whether Applied Materials is still worth considering after its massive run, or if you are late to the party, you are in the right place to unpack what the current price may really imply.

- The stock has climbed 6.1% over the last week, 11.6% over the past month, and is up 61.9% year to date, building on a multiyear gain of 215.5% that has many investors rethinking both its potential upside and its risk.

- Recent headlines have focused on the strong demand for semiconductor manufacturing equipment, as chipmakers ramp capacity to serve AI infrastructure and high performance computing. At the same time, increased policy attention on chip supply chains and government incentives for domestic manufacturing are reinforcing the narrative that Applied Materials sits at the center of a long term industry build out.

- Despite that backdrop, Applied Materials only scores 2 out of 6 on our basic undervaluation checks. Next, we break down how different valuation methods look at the stock, before circling back at the end to an even more useful way of thinking about what fair value really means for long term investors.

Applied Materials scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Applied Materials Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today.

For Applied Materials, the latest twelve month Free Cash Flow is about $6.4 billion. Analysts provide detailed forecasts for the next few years, and Simply Wall St then extrapolates those estimates further out, using a 2 Stage Free Cash Flow to Equity model. Under this approach, Free Cash Flow is projected to rise to roughly $10.3 billion by 2030, with growth moderating in later years as the business matures.

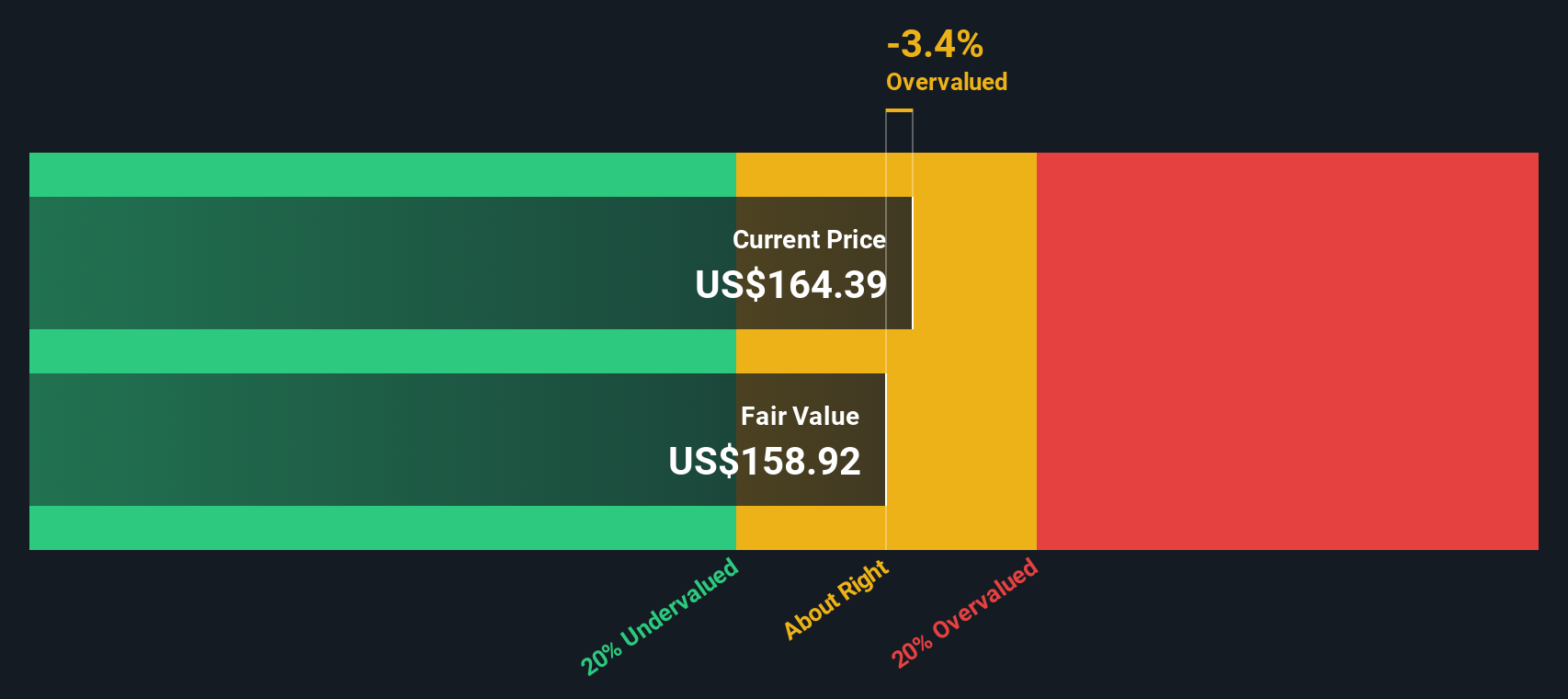

When all those projected cash flows are discounted back to today, the DCF model arrives at an estimated intrinsic value of about $157.50 per share. Compared with the current market price, that implies the stock is roughly 68.5% overvalued. This suggests investors are paying a substantial premium for future growth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Applied Materials may be overvalued by 68.5%. Discover 933 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Applied Materials Price vs Earnings

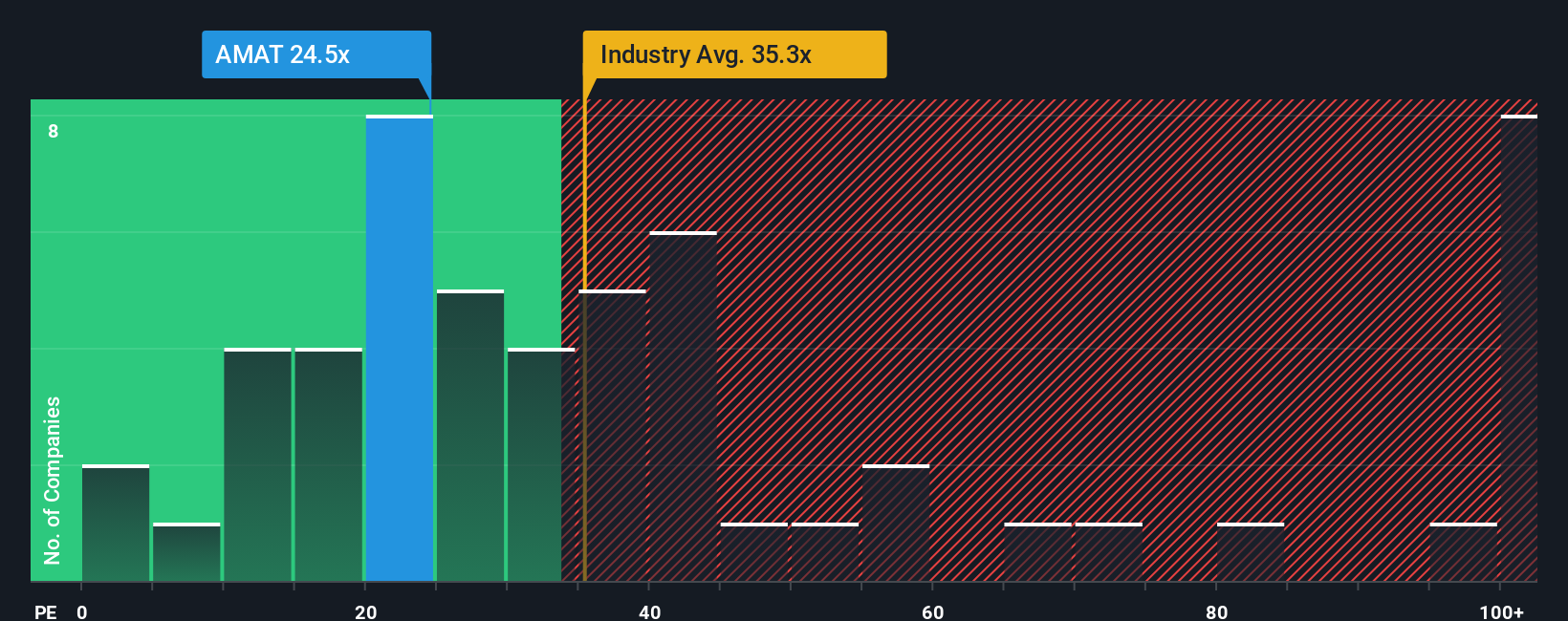

For profitable companies like Applied Materials, the Price to Earnings (PE) ratio is a practical way to gauge valuation because it directly links what investors pay to the profits the business is generating today. In general, faster earnings growth and lower risk justify a higher PE multiple, while slower growth or higher uncertainty should command a lower, more cautious multiple.

Applied Materials currently trades on a PE of about 30.2x. That sits below the semiconductor industry average of roughly 36.2x and also below the broader peer average of around 41.1x, which might initially make the stock look modestly priced relative to many chip names. However, Simply Wall St also uses a proprietary Fair Ratio, which estimates what PE you would expect for Applied Materials given its earnings growth profile, margins, industry, market cap and risk factors. For Applied Materials, this Fair Ratio is 29.7x.

Because the Fair Ratio is tailored to the company rather than a blunt comparison with peers, it offers a more precise anchor for valuation. With the actual PE only slightly above the Fair Ratio, the stock screens as slightly expensive on earnings.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

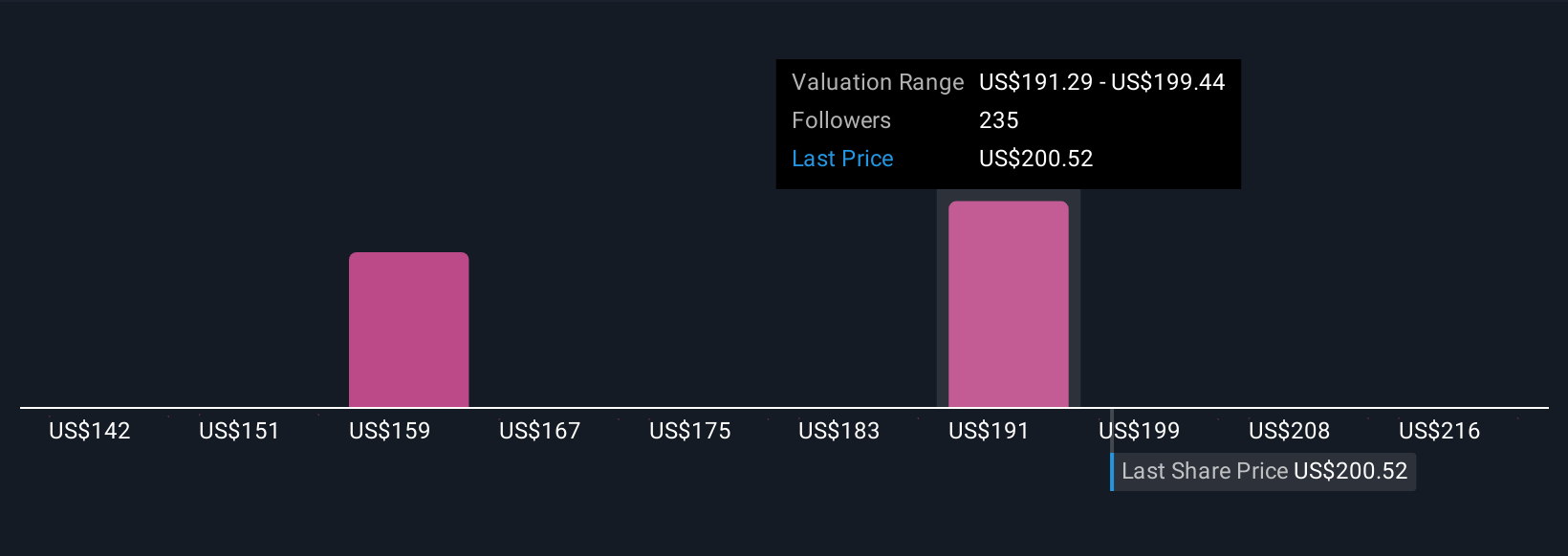

Upgrade Your Decision Making: Choose Your Applied Materials Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is an easy tool on Simply Wall St’s Community page that lets you attach your own story about Applied Materials to the numbers. You can link your view of its catalysts, risks and long term positioning to specific forecasts for revenue, earnings and margins. The tool converts that into a Fair Value you can compare with today’s price to help you decide whether to buy, hold or sell. It also automatically updates that Fair Value as new news or earnings arrive. For example, one investor might build a more cautious Narrative around lower growth, tighter margins and a Fair Value closer to about $160 per share. Another, more optimistic investor might assume stronger AI driven demand, higher profitability and a Fair Value nearer to about $240. Both perspectives are clearly quantified, easy to track over time and directly comparable to the live market price.

Do you think there's more to the story for Applied Materials? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Engages in the provision of manufacturing equipment, services, and software to the semiconductor, display, and related industries.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026