- United States

- /

- Semiconductors

- /

- NasdaqGS:AMAT

Applied Materials (AMAT) Net Margin Decline Tests Bullish Long‑Term Growth Narrative After FY 2025 Results

Reviewed by Simply Wall St

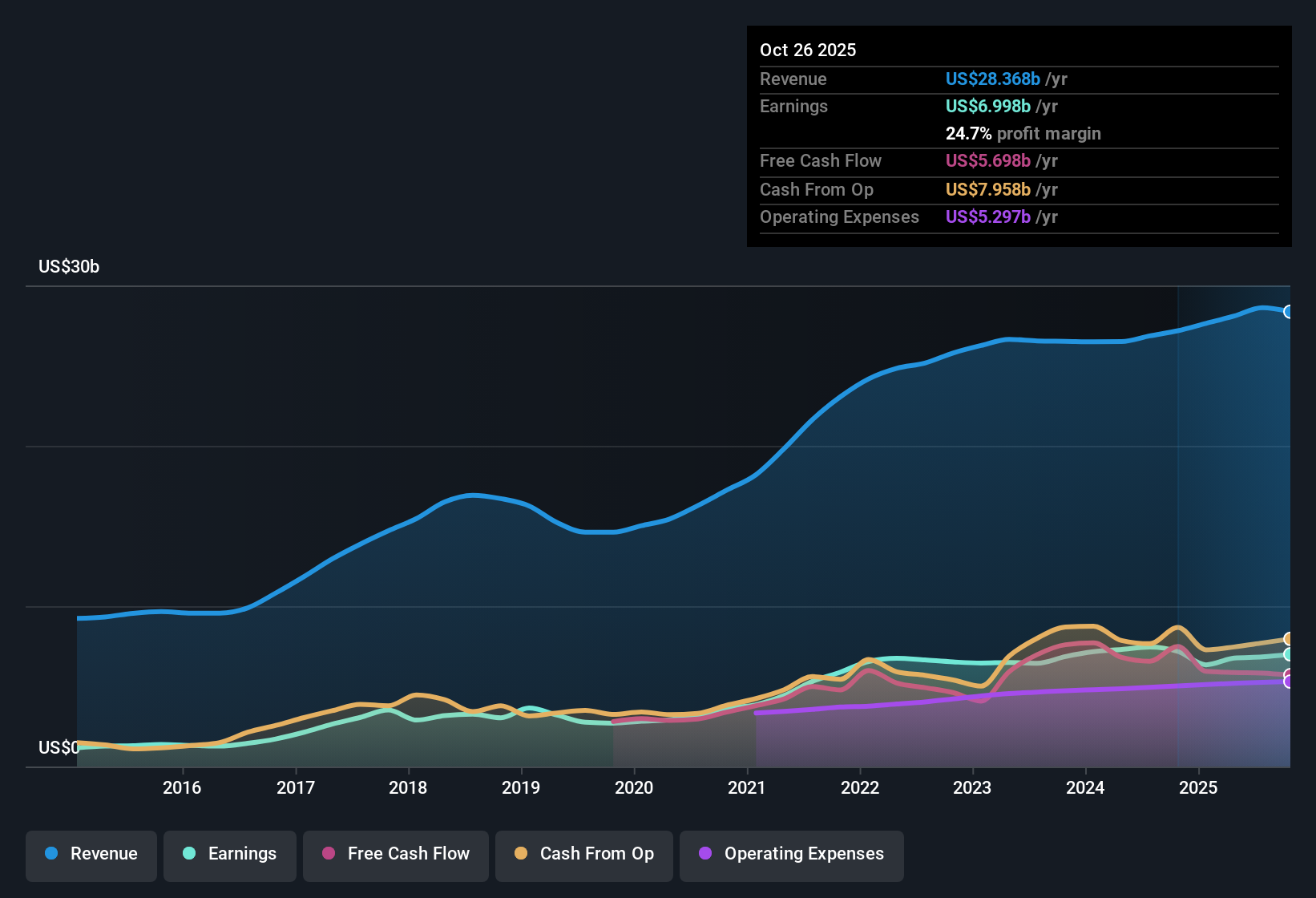

Applied Materials (AMAT) just closed out FY 2025 with Q4 revenue of about $6.8 billion and basic EPS of $2.39, capping a year in which trailing 12 month revenue was $28.4 billion and EPS reached $8.70. Over the last few quarters, the company has seen revenue move from $7.0 billion in Q4 2024 to a range between $6.8 billion and $7.3 billion in FY 2025, while quarterly EPS tracked between $1.46 and $2.64. This sets up a story where investors will be weighing solid top line scale against how efficiently those sales are being converted into profit.

See our full analysis for Applied Materials.With the headline numbers on the table, the next step is to see how this earnings print lines up with the dominant bull and bear narratives around Applied Materials and where the latest margin picture might be quietly reshaping those views.

See what the community is saying about Applied Materials

Net Margin Slips To 24.7 Percent

- Trailing 12 month net income of about $7.0 billion on $28.4 billion of revenue translates to a 24.7 percent net margin, down from 26.4 percent a year ago.

- Consensus narrative highlights Applied’s leadership in advanced packaging and services as long term margin supports. However, the recent step down in trailing margin shows that, even with recurring revenues and over two thirds of service income coming from services and spares, profitability can still move lower when factors like regional slowdowns or digestion in areas such as China and mature nodes weigh on the mix.

- While analysts expect profit margins to reach 28.3 percent in around three years, the current 24.7 percent level shows that the path there is not a straight line.

- Investors tracking AI driven wafer fab buildouts and packaging growth will want to see if future results reverse this one year margin decline or if it persists.

EPS Growth Tracks Around 8 To 9 Percent

- Over the past five years, earnings have grown about 8.6 percent per year and are forecast to grow around 8.7 percent per year, with trailing 12 month EPS at $8.70 supporting that steady compound growth profile.

- From a bullish perspective, this combination of mid single digit revenue growth, currently around 6.1 percent per year, and upper single digit earnings growth fits the view that Applied’s leadership in materials engineering, AI related device inflections and expanding recurring services can keep EPS rising as new technologies ramp.

- Analysts expect earnings to reach about $9.2 billion, or $11.94 per share, by roughly 2028, which would extend the current 8.6 percent historical growth trend if achieved.

- Forecast improvements in profit margin from about 23.9 percent to 28.3 percent over the next three years are a key piece of that bullish case because they imply earnings can outpace revenue even if top line growth stays near the mid single digit range.

Valuation Sits Between Peers And DCF

- At a current share price of $259.21, Applied trades on a P E of 29.4 times, below both the semiconductor industry at 37 times and broader peers at 42 times, yet notably above a DCF fair value estimate of about $157.55.

- Bearish arguments focus on this gap between the $259.21 market price and DCF fair value, suggesting investors are paying a premium even as net margin has eased from 26.4 percent to 24.7 percent, and future revenue growth of roughly 4.3 to 6.1 percent annually is expected to trail the broader US market.

- Critics highlight that for the analyst case to work, revenue would need to reach about $32.5 billion and earnings $9.2 billion by 2028 at a 20.4 times P E, while today’s multiple already sits at 29.4 times on current earnings.

- Relative value versus peers on P E helps the bulls, but the valuation premium to the $157.55 DCF fair value and the step down in trailing margin give bears concrete numbers to point to when questioning the upside from here.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Applied Materials on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently, and think the story should read another way? In just a few minutes you can shape your own view and share it with the community, Do it your way.

A great starting point for your Applied Materials research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Applied Materials faces mid single digit revenue growth, a recent slip in net margins and a valuation premium to DCF that may constrain future returns.

If rich pricing and moderating profitability worry you, use our these 908 undervalued stocks based on cash flows to quickly zero in on companies where cash flow backed value, not hype, drives the upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMAT

Applied Materials

Provides materials engineering solutions, equipment, services, and software to the semiconductor and related industries in the United States, China, Korea, Taiwan, Japan, Southeast Asia, Europe, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)