- United States

- /

- Semiconductors

- /

- NasdaqGS:ALGM

Allegro MicroSystems (ALGM) Is Up 5.5% After Strong Revenue Beat but EPS Misses Expectations - Has The Bull Case Changed?

Reviewed by Simply Wall St

- Allegro MicroSystems recently reported quarterly revenues of US$203.4 million, representing a 21.9% year-over-year increase and surpassing analysts’ forecasts, largely driven by e-Mobility and Industrial segment growth.

- Despite the strong top-line performance, the company’s earnings per share missed expectations, highlighting a contrast between revenue momentum and bottom-line delivery.

- We'll explore how this disconnect between robust sales growth and weaker earnings may influence Allegro MicroSystems' overall investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Allegro MicroSystems Investment Narrative Recap

To believe in Allegro MicroSystems as a shareholder, you need confidence that the long-term story of vehicle electrification and industrial automation will keep fueling demand for Allegro’s specialized chips, even as the company occasionally faces earnings volatility. The latest quarterly revenue surge, driven by e-Mobility and Industrial segments, reinforces near-term optimism about sustained top-line growth, but the disconnect with weaker earnings and a recent stock drop does bring margin pressures and operational challenges into sharp focus; the immediate risk from persistently narrowing margins, especially amid ongoing price pressures, has become more pronounced and is something of material relevance in the investment case.

Within recent news, Allegro’s July earnings announcement not only confirmed the robust revenue growth outpacing guidance, but also extended the company’s trend of missing profitability targets, with quarterly net loss improvement not enough to offset investor disappointment in earnings per share. This is particularly relevant as it highlights the importance of margin expansion and cost control as key short-term catalysts for confidence in Allegro’s path to sustained profitability and greater shareholder returns.

In contrast, even with strong revenue execution, investors should stay alert to ongoing margin compression as the company battles pricing pressure from major customers…

Read the full narrative on Allegro MicroSystems (it's free!)

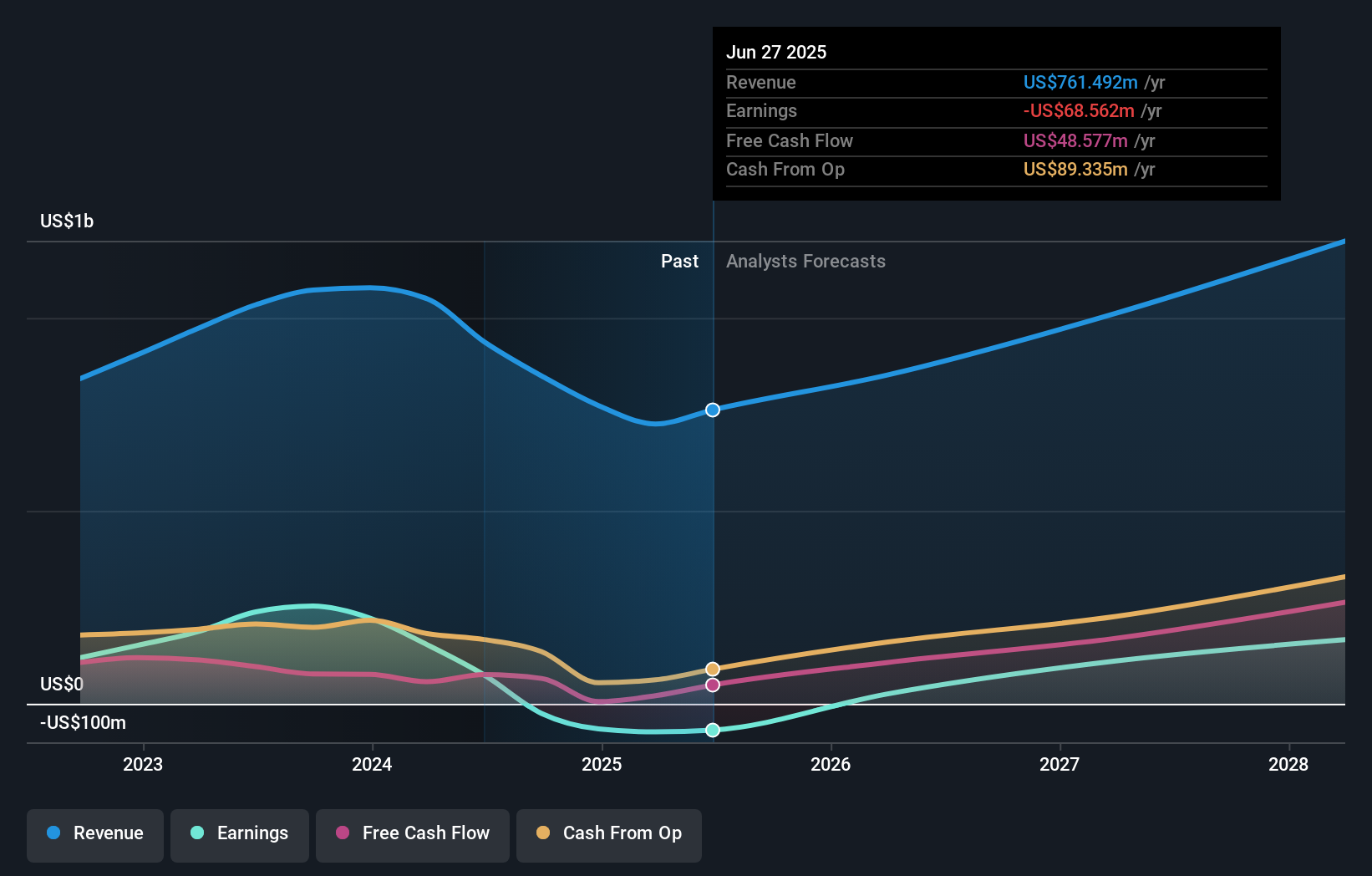

Allegro MicroSystems' outlook projects $1.2 billion in revenue and $249.0 million in earnings by 2028. This scenario requires 17.3% annual revenue growth and a $317.6 million increase in earnings from the current -$68.6 million.

Uncover how Allegro MicroSystems' forecasts yield a $37.83 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Fair value views from the Simply Wall St Community range from US$31.53 to US$37.83, across two contributors. Some see margin volatility as a pivotal challenge for Allegro’s future financial performance, inviting you to consider multiple angles as you assess potential.

Explore 2 other fair value estimates on Allegro MicroSystems - why the stock might be worth just $31.53!

Build Your Own Allegro MicroSystems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allegro MicroSystems research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allegro MicroSystems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allegro MicroSystems' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 30 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALGM

Allegro MicroSystems

Designs, develops, manufactures, and markets sensor integrated circuits (ICs) and application-specific power ICs for motion control and energy-efficient systems.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives