- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

PHLX Semiconductor Index Addition Could Be a Game Changer for Astera Labs (ALAB)

Reviewed by Sasha Jovanovic

- Astera Labs, Inc. was recently added to the PHLX Semiconductor Sector Index, highlighting its growing importance in semiconductor and AI infrastructure markets.

- This inclusion underscores the company's expanding influence as providers of cloud and AI connectivity solutions, with partnerships involving industry leaders like Nvidia, AMD, and Alchip.

- We will explore how Astera Labs' index addition and prominent industry partnerships shape its evolving investment narrative in the AI sector.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Astera Labs Investment Narrative Recap

To be an Astera Labs shareholder, you need to believe that AI infrastructure buildout and hyperscaler demand will remain strong, allowing the company’s connectivity solutions to expand their role in the cloud and data center sectors. The recent addition to the PHLX Semiconductor Sector Index reinforces market visibility but is unlikely to materially impact the near-term catalyst, adoption of Scorpio P-Series switches, or the biggest risk, which remains concentrated customer exposure and pricing pressures from intensifying competition.

Astera Labs’ May 2025 partnership with NVIDIA to enhance NVLink Fusion connectivity is highly relevant, as it positions the company at the forefront of AI platform innovation, a major growth driver underpinning current optimism. While market inclusion broadened its exposure, these partnerships with ecosystem leaders are more likely to move the needle in addressing its short-term growth engines.

But in contrast, relying on a handful of hyperscale customers also means investors should be aware of ...

Read the full narrative on Astera Labs (it's free!)

Astera Labs' outlook forecasts $1.5 billion in revenue and $393.5 million in earnings by 2028. This implies 34.1% annual revenue growth and a $293.3 million increase in earnings from the current $100.2 million.

Uncover how Astera Labs' forecasts yield a $182.62 fair value, a 13% downside to its current price.

Exploring Other Perspectives

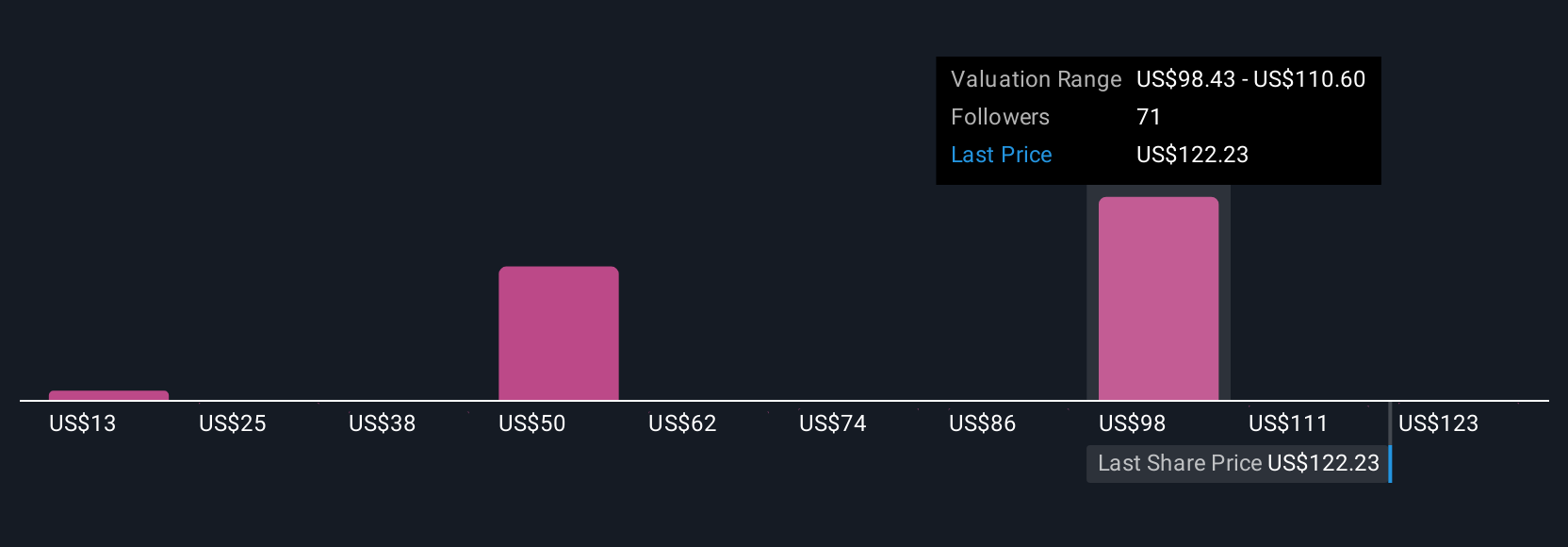

Thirty Simply Wall St Community members estimated fair values for Astera Labs, ranging from US$15.98 to US$262.56 per share. With such different views, consider how dependence on a handful of large customers could weigh on both risk and opportunity for the company’s future performance.

Explore 30 other fair value estimates on Astera Labs - why the stock might be worth less than half the current price!

Build Your Own Astera Labs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Astera Labs research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Astera Labs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Astera Labs' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives