- United States

- /

- Semiconductors

- /

- NasdaqGS:ALAB

Astera Labs (NasdaqGS:ALAB) Appoints Dr. Craig Barratt To Board As Stock Falls 15% Last Week

Reviewed by Simply Wall St

Astera Labs (NasdaqGS:ALAB) recently launched its Scorpio Smart Fabric Switches, aiming to enhance AI and cloud infrastructure performance. Additionally, the company expanded its Cloud-Scale Interop Lab and appointed Dr. Craig Barratt to the board, reflecting a focus on innovation and leadership. Despite these advancements, the company's share price declined by 15% over the past week. This downturn coincided with a broader market retreat of 1.8%, fueled by concerns over new tariffs and falling technology stocks. While these macroeconomic pressures likely influenced investor sentiment, Astera's long-term growth initiatives remain noteworthy.

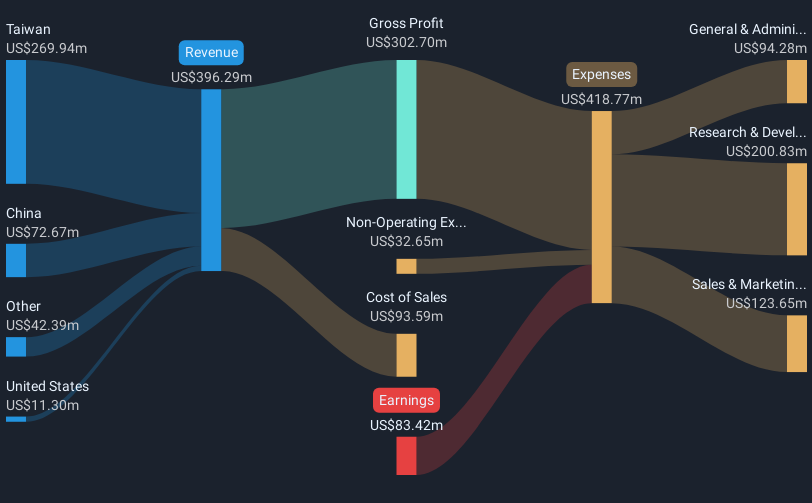

Astera Labs experienced an 18.08% decline in total shareholder returns over the past year, lagging behind both the US Market's 5.5% and the Semiconductor industry's 2.5% increases during the same period. Key influences included the volatile nature of its share price, highlighted by significant fluctuations over recent months. Despite displaying strong revenue growth, rising from US$115.79 million to US$396.29 million, the company faced a net loss of US$83.42 million for the financial year. Moreover, the announcement of new products like the PCIe® 6-ready Scorpio Smart Fabric Switches may have added short-term expectations that did not immediately translate into profitability.

Further impacting investor sentiment was the substantial insider selling that occurred in the past quarter, coupled with company shares being priced higher than industry averages based on Price-To-Sales ratios. These factors, amidst high hopes for upcoming profitability milestones, likely contributed to the overall decline in long-term shareholder returns.

Take a closer look at Astera Labs' potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Astera Labs, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ALAB

Astera Labs

Designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives