- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Will Analog Devices' (ADI) AI Push at GenAI Summit Accelerate Its Competitive Edge in Semiconductors?

Reviewed by Sasha Jovanovic

- Analog Devices recently participated in the GenAI Summit 2025 in San Francisco, where Head of AI Enablement Hira Dangol showcased the company's advancements in artificial intelligence solutions for the semiconductor industry.

- This high-profile presentation, combined with the release of new collaborative content by Mouser Electronics and growing analyst attention, has reinforced Analog Devices' position as a leader in developing AI-driven technologies for next-generation applications.

- We'll examine how Analog Devices' GenAI Summit focus on AI innovation strengthens its long-term investment narrative and industry outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Analog Devices Investment Narrative Recap

To be a shareholder in Analog Devices today, you need confidence in the ongoing integration of advanced AI, electrification, and automation across end-markets like industrial, automotive, and data centers. Despite a recent sector-wide selloff caused by renewed scrutiny of AI profitability, there is little to indicate that these macro headlines have affected Analog Devices' most important short-term catalyst: robust demand for its high-margin analog and mixed-signal solutions supporting next-generation AI infrastructure. Geopolitical risks, such as US-China trade tensions and tariff threats, remain the largest underappreciated external risk, but recent volatility appears more sentiment-driven than specific to ADI’s core business.

One of the most relevant announcements is the new collaborative ebook from Mouser Electronics and Analog Devices, which highlights ADI’s innovations in power management solutions critical for processors, FPGAs, and data centers. This underscores how Analog Devices continues to position itself as an essential supplier behind the infrastructure enabling AI breakthroughs, the very narrative reinforced at the GenAI Summit. As businesses increase focus on energy-efficient, low-noise, and high-performance chips to address global AI opportunity, this technical emphasis adds weight to near-term catalysts rooted in rising content per device.

Yet, in contrast to expectations for growth, investors should not overlook how...

Read the full narrative on Analog Devices (it's free!)

Analog Devices is projected to reach $14.3 billion in revenue and $4.9 billion in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 11.3% and a $2.9 billion increase in earnings from the current $2.0 billion.

Uncover how Analog Devices' forecasts yield a $267.47 fair value, a 19% upside to its current price.

Exploring Other Perspectives

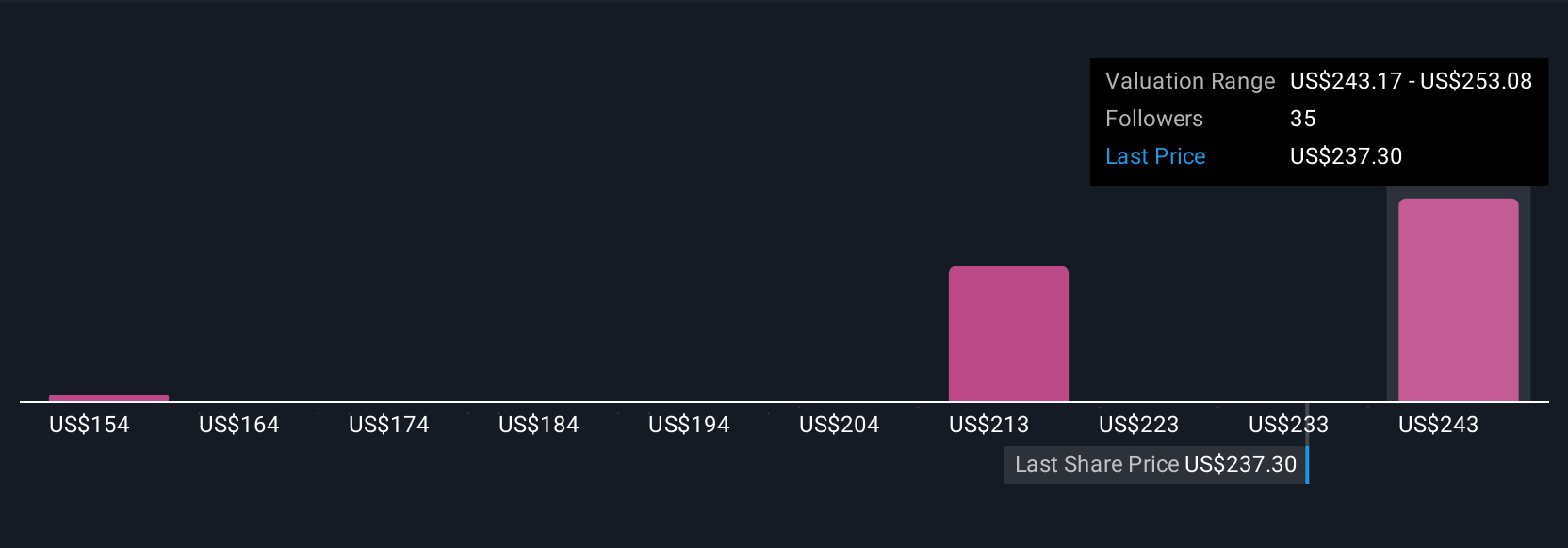

The Simply Wall St Community includes 9 recent fair value estimates for Analog Devices, ranging from US$157.50 to US$310. Earnings growth forecasts remain strong, but geopolitical volatility could still impact future momentum. Consider these different analyses as you weigh your own view.

Explore 9 other fair value estimates on Analog Devices - why the stock might be worth as much as 38% more than the current price!

Build Your Own Analog Devices Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Analog Devices research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Analog Devices' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)