- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Analog Devices (NasdaqGS:ADI) Jumps 11% With US$10 Billion Share Buyback Expansion

Reviewed by Simply Wall St

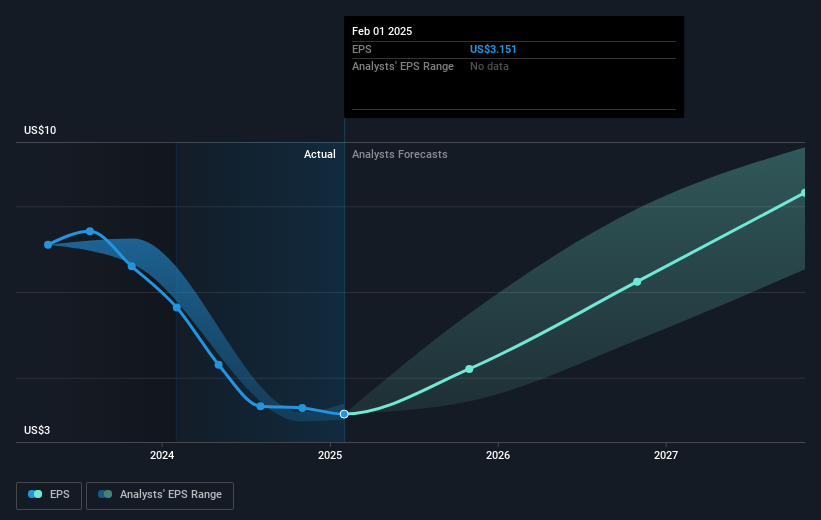

Analog Devices (NasdaqGS:ADI) has been in the spotlight following a quarterly share price increase of 11.33%. This uptick comes amidst significant corporate developments, including an 8% dividend increase and an expansion of its share buyback authorization by $10 billion, reflecting a strong commitment to shareholder value. Despite reporting a dip in both sales and net income for the first quarter, ADI provided positive forward guidance, suggesting revenue growth in the upcoming quarter. This proactive financial maneuvering is particularly notable against the backdrop of recent market volatility, where major indexes experienced declines, with the tech-heavy Nasdaq Composite dropping 2.2%. These strategic fiscal actions have likely bolstered investor confidence in Analog Devices, enhancing its market performance relative to the broader downward trends. As the market continues to digest broader economic and sector-specific dynamics, ADI's initiatives demonstrate a focused approach to navigating challenging conditions.

Take a closer look at Analog Devices's potential here.

Over the past five years, Analog Devices has achieved a total shareholder return of 138.75%. During this period, several key events have played significant roles in this performance. The company has consistently grown its earnings by 14.6% per year, signaling a robust financial trajectory. Meanwhile, Analog Devices' commitment to shareholder value is evident through its share buyback initiatives, which, as of early 2025, accounted for 33.19% of shares repurchased for approximately US$12.05 billion. This buyback activity has likely contributed to the stock's appreciation over the years.

Further enhancing shareholder returns, Analog Devices has maintained 21 consecutive years of dividend increases, reinforcing investor confidence in its long-term growth potential. Bylaw amendments to simplify voting rules also suggest a shift towards more investor-friendly governance, possibly boosting market perception. Despite recent challenges in earnings growth within the semiconductor industry, these factors have contributed positively to the company's overall market performance, making it stand out over one year compared to an 18.3% return for the US Market.

- See whether Analog Devices' current market price aligns with its intrinsic value in our detailed report

- Uncover the uncertainties that could impact Analog Devices' future growth—read our risk evaluation here.

- Are you invested in Analog Devices already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives