- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Analog Devices (NasdaqGS:ADI) Forecasts US$2.5 Billion Revenue Q2 2025 Despite Q1 Earnings Dip

Reviewed by Simply Wall St

Analog Devices (NasdaqGS:ADI) has experienced a remarkable 18% increase in its share price over the past week, coinciding with several key developments. The company reported a cautious Q1 earnings announcement, with sales of $2,423 million and a net income of $391 million, marking a decline from the prior year. At the same time, the Board announced an 8% increase in the quarterly dividend, marking its 21st consecutive year of dividends. Analog Devices also updated its buyback program, repurchasing 698,000 shares for $151 million. These corporate initiatives may reflect efforts to bolster shareholder value amid broader market shifts. Meanwhile, major U.S. stock indexes, including the S&P 500, endured a downturn, despite recent record highs. While other market players like Walmart and Palantir faced downturns, Analog Devices' initiatives and market positioning appear to have positively impacted investor sentiment.

Click here and access our complete analysis report to understand the dynamics of Analog Devices.

Analog Devices (NasdaqGS:ADI) has delivered a total return of 130.57% over the last five years, indicating robust shareholder value. This performance stands out particularly when viewed against the past year's backdrop where ADI underperformed the US Semiconductor industry. Key factors driving this long-term success include consistent dividend increases over 21 years, with the most recent announcement on February 18, 2025, suggesting continued confidence in financial stability.

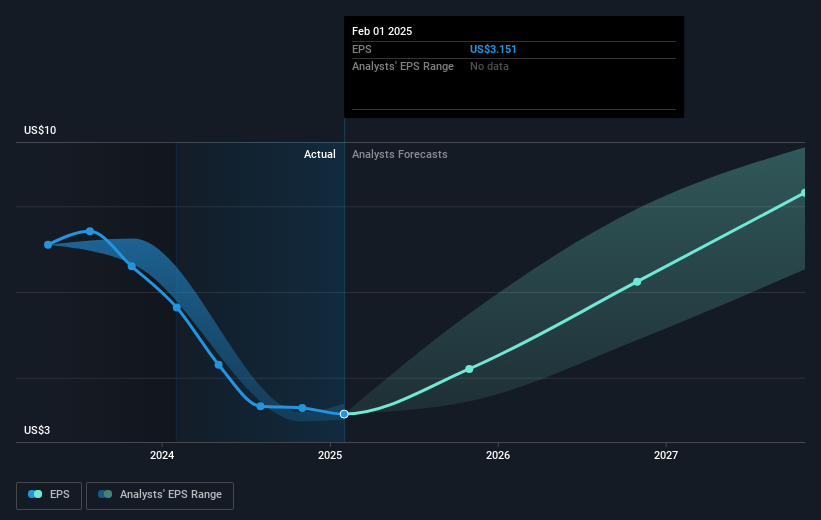

Share repurchases have also been significant, with US$12.05 billion spent since 2007, contributing to a tighter share base and potentially higher share value. Despite recent declines in performance metrics such as net income and sales, ADI's earnings have grown at an annual rate of 14.6% over the five-year period, and the forecast for earnings growth continues to outpace the broader US market. This earnings outlook, alongside a reliable dividend yield, enhances its attractiveness to long-term investors.

- Understand the fair market value of Analog Devices with insights from our valuation analysis—click here to learn more.

- Understand the uncertainties surrounding Analog Devices' market positioning with our detailed risk analysis report.

- Already own Analog Devices? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives