- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

Analog Devices (ADI): Evaluating Valuation After Tech Sell-Off and Fresh AI Growth Momentum

Reviewed by Kshitija Bhandaru

Analog Devices (ADI) has found itself under the microscope after a sector-wide technology sell-off triggered by Oracle’s disappointing update on cloud margins and AI profitability. While recent volatility has raised questions, the company's long-term earnings outlook and growing presence in artificial intelligence remain focal points for investors.

See our latest analysis for Analog Devices.

Despite a drop sparked by the broader tech sell-off, Analog Devices' shares have held onto their solid year-to-date momentum, with a 12.55% share price gain so far in 2025. While volatility has crept in recently, the company’s long-term story remains compelling. Analog Devices has delivered an impressive 75.7% total shareholder return over the past three years and more than doubled investors’ money over the last five years, thanks to structural industry growth, expanding AI exposure, and a strong earnings trajectory.

If you’re looking to spot the next big trends in tech and artificial intelligence, it’s worth checking out See the full list for free..

With the stock now trading well above its estimated intrinsic value, investors are left to wonder: is Analog Devices an underappreciated AI growth play, or is the market already pricing in all future upside?

Most Popular Narrative: 11% Undervalued

According to the most widely followed narrative, Analog Devices is trading at a meaningful discount to fair value, with the implied price target well above the latest close. The setup reflects bullish analyst assumptions, despite some recent market caution and a near-term premium in the stock price.

Strategic investments in R&D, partnerships, and capacity, combined with electrification trends and green energy, position ADI for resilient earnings and broad-based financial strength. Rising competition, geopolitical risks, and elevated investment could squeeze margins and create volatility in revenue and earnings, especially if market conditions weaken.

Want a glimpse into the big valuation drivers? This narrative hinges on rapid earnings acceleration and a bold outlook for profit margins that defies sector trends. But there is a surprising assumption about future share count and growth that could turn the tables. If you crave the full playbook behind the price target, you will want to see how these numbers stack up.

Result: Fair Value of $267.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from lower-cost analog providers or renewed trade tensions with China could still disrupt Analog Devices’ impressive growth story.

Find out about the key risks to this Analog Devices narrative.

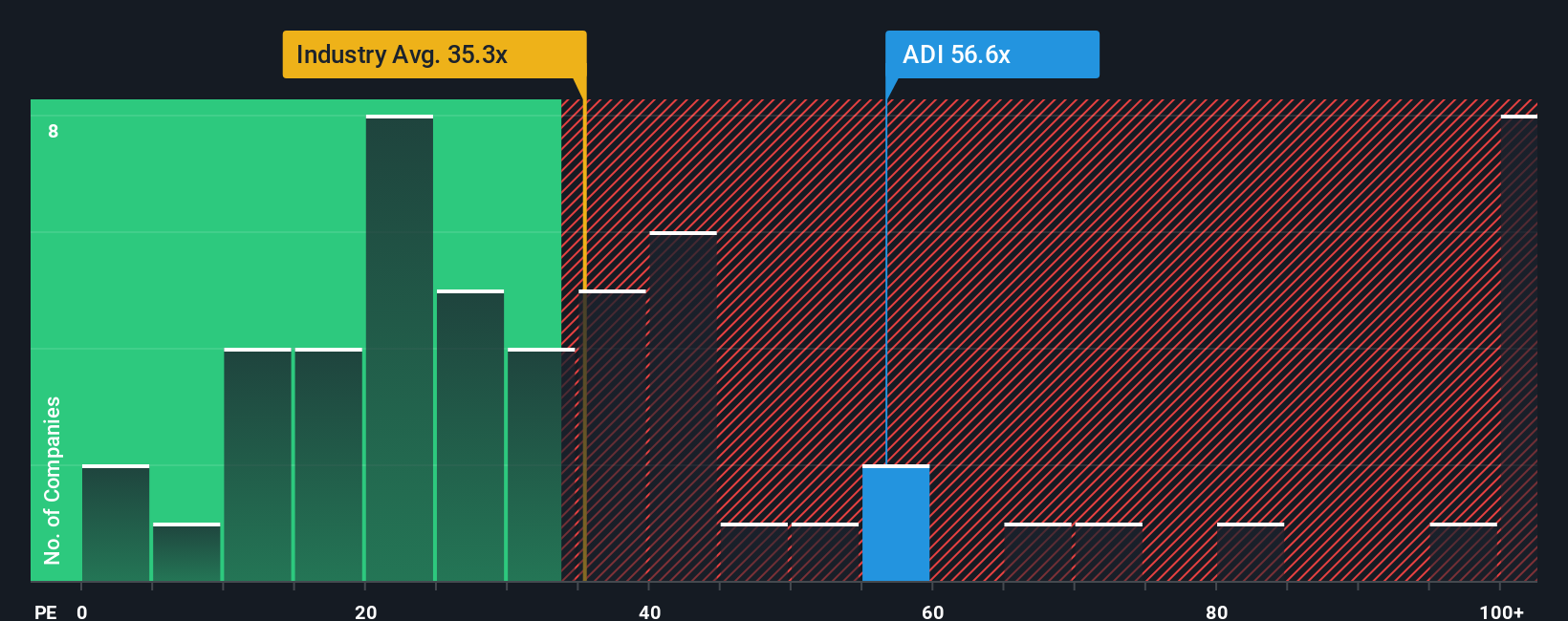

Another View: Watch the Price Tag

Looking through the lens of price-to-earnings, Analog Devices is trading at a hefty 59.8x, far above both its peer average of 24.8x and the US semiconductor industry at 38.3x. The fair ratio, based on our analysis, suggests a more sustainable level would be 40.6x. That gap raises important questions about valuation risk. Could the market’s excitement be running ahead of reality, or is premium pricing the new normal for innovative chipmakers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Analog Devices Narrative

If you want to see the data differently or put your own perspective on Analog Devices, you can dig in and create your own view in just a few minutes. Do it your way.

A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd by acting on trends before everyone else. Get inspired by these unique opportunities and build your smartest investment portfolio yet.

- Unlock hidden value with these 888 undervalued stocks based on cash flows, which stand out for strong fundamentals and significant upside potential beyond the obvious picks.

- Seize income opportunities with these 18 dividend stocks with yields > 3%, featuring solid payouts and yields above 3% for investors who want steady cash flow.

- Ride the innovation wave by targeting these 25 AI penny stocks, shaping tomorrow’s world of artificial intelligence and rapid technological advancement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives