- United States

- /

- Semiconductors

- /

- NasdaqGS:ADI

A Fresh Look at Analog Devices (ADI) Valuation After Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for Analog Devices.

Even after a recent dip, Analog Devices is still holding onto a solid stretch. The stock is up 12.6% year-to-date in terms of share price, while its total shareholder return over the past year sits at 5.2%. Momentum has cooled a bit from its earlier highs, but the company’s long-term track record, with a 73% total return in three years, keeps it firmly on investors’ radars.

If you’re looking for more opportunities in the fast-evolving tech and semiconductor world, check out See the full list for free..

With shares trading below some analyst price targets but recent gains giving pause, investors now face a classic dilemma: is Analog Devices undervalued and ripe for a rebound, or is the market already factoring in future growth?

Most Popular Narrative: 11% Undervalued

With Analog Devices trading at $238.01 and the narrative’s fair value estimate landing at $267.47, the gap suggests room for upside if expectations hold. Forecasts for the coming years play a big role in this upbeat assessment.

Strategic investments in R&D, partnerships, and capacity, combined with electrification trends and green energy, position ADI for resilient earnings and broad-based financial strength.

Ever wonder what ambitious projections fuel this fair value? The underlying assumptions hint at sustained double-digit growth, margin surges, and robust future earnings. Only a full read will reveal if the narrative’s bold targets align with the real numbers and competitive landscape.

Result: Fair Value of $267.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from lower-cost rivals and ongoing global economic uncertainty could still disrupt Analog Devices' growth story and put pressure on its profit margins.

Find out about the key risks to this Analog Devices narrative.

Another View: What Do Price Ratios Signal?

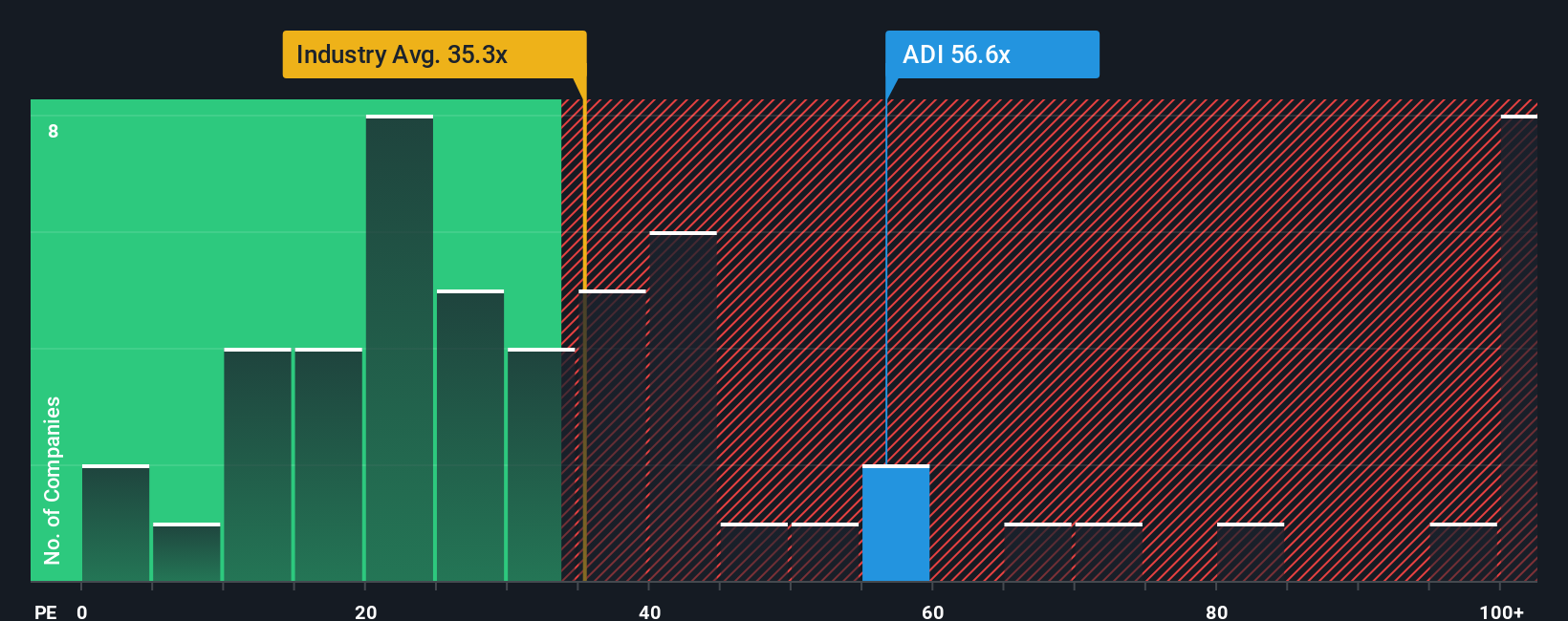

Taking a look through the lens of the price-to-earnings ratio, Analog Devices trades at 59.8x, noticeably higher than the US semiconductor industry average of 39.5x and the peer average of just 25.2x. The fair ratio, which many investors use as a benchmark, stands at 40.7x. This gap may suggest the market is pricing in strong growth, but it raises the risk of fast sentiment changes if expectations slip. Is the premium justified, or is downside risk building?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Analog Devices Narrative

If you want to dig into the numbers and craft your own perspective, you can analyze the details and shape a narrative yourself in just minutes. Do it your way.

A great starting point for your Analog Devices research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know opportunities rarely wait around. Broaden your portfolio by checking out standout stocks picked by our screeners, each offering untapped market potential.

- Explore opportunities among innovators by checking out these 27 AI penny stocks, focused on artificial intelligence trends transforming industries today.

- Enhance your income strategy while managing risk with these 17 dividend stocks with yields > 3%, tailored for strong, reliable yields above 3%.

- Take advantage of market inefficiencies and find hidden gems with these 877 undervalued stocks based on cash flows, highlighting stocks trading below their real worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADI

Analog Devices

Engages in the design, manufacture, testing, and marketing of integrated circuits (ICs), software, and subsystems products in the United States, rest of North and South America, Europe, Japan, China, and rest of Asia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)