- United States

- /

- Banks

- /

- NasdaqGS:ONB

3 US Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market continues to rally, with major indices like the S&P 500 and Dow Jones Industrial Average reaching record highs, investors are increasingly on the lookout for opportunities that may be trading below their estimated value. In such a buoyant market environment, identifying undervalued stocks requires careful analysis of fundamentals and potential growth catalysts that could unlock hidden value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victory Capital Holdings (NasdaqGS:VCTR) | $72.24 | $144.03 | 49.8% |

| NBT Bancorp (NasdaqGS:NBTB) | $50.12 | $99.93 | 49.8% |

| UMB Financial (NasdaqGS:UMBF) | $125.88 | $243.34 | 48.3% |

| Synovus Financial (NYSE:SNV) | $57.97 | $115.67 | 49.9% |

| West Bancorporation (NasdaqGS:WTBA) | $24.01 | $46.82 | 48.7% |

| First Advantage (NasdaqGS:FA) | $19.73 | $38.66 | 49% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.53 | $30.25 | 48.7% |

| Nutanix (NasdaqGS:NTNX) | $72.35 | $143.99 | 49.8% |

| Snap (NYSE:SNAP) | $11.60 | $22.76 | 49% |

| Roku (NasdaqGS:ROKU) | $66.31 | $128.59 | 48.4% |

Let's dive into some prime choices out of the screener.

Analog Devices (NasdaqGS:ADI)

Overview: Analog Devices, Inc. is a company that designs, manufactures, tests, and markets integrated circuits, software, and subsystems globally with a market cap of approximately $111.01 billion.

Operations: Analog Devices generates revenue through its design, manufacturing, testing, and marketing of integrated circuits, software, and subsystems across various regions including the United States, the Americas, Europe, Japan, China, and other parts of Asia.

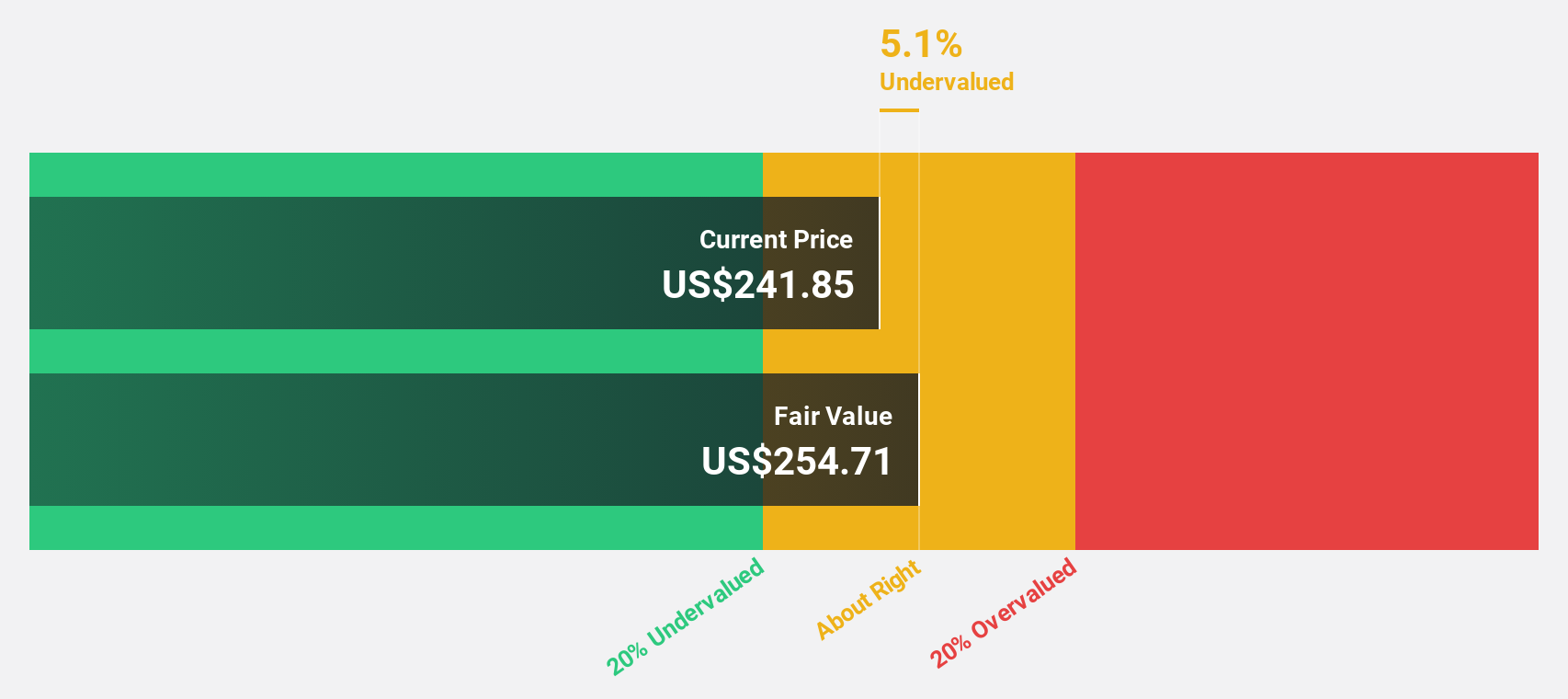

Estimated Discount To Fair Value: 16.3%

Analog Devices, Inc. is trading at US$219.05, below its estimated fair value of US$261.86, suggesting it may be undervalued based on cash flows. Despite a decline in recent quarterly earnings to US$478.07 million from the previous year's US$498.43 million, the company's earnings are forecast to grow significantly at 25% annually over the next three years, outpacing market expectations and indicating potential for future value realization amidst strategic alliances and leadership changes.

- Our growth report here indicates Analog Devices may be poised for an improving outlook.

- Click here to discover the nuances of Analog Devices with our detailed financial health report.

Light & Wonder (NasdaqGS:LNW)

Overview: Light & Wonder, Inc. is a cross-platform games company operating in the United States and internationally, with a market cap of $8.69 billion.

Operations: The company's revenue is derived from three main segments: Gaming ($2.05 billion), Igaming ($293 million), and Sciplay ($821 million).

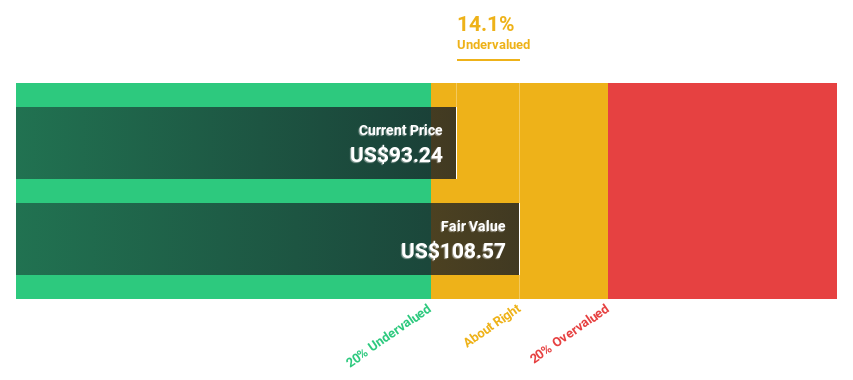

Estimated Discount To Fair Value: 10.6%

Light & Wonder is trading at US$97.94, below its estimated fair value of US$109.5, reflecting potential undervaluation based on cash flows. The company reported Q3 revenue growth to US$817 million from US$731 million year-on-year, though net income decreased to US$64 million from US$75 million. With earnings projected to grow 22.1% annually over the next three years and ongoing share buybacks, Light & Wonder demonstrates promising financial momentum despite lower-than-market revenue growth expectations and interest coverage challenges.

- The analysis detailed in our Light & Wonder growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Light & Wonder stock in this financial health report.

Old National Bancorp (NasdaqGS:ONB)

Overview: Old National Bancorp is a bank holding company for Old National Bank, offering a range of financial services to individual and commercial clients in the United States, with a market cap of approximately $7.32 billion.

Operations: The company generates revenue primarily through its Community Banking segment, which amounts to $1.75 billion.

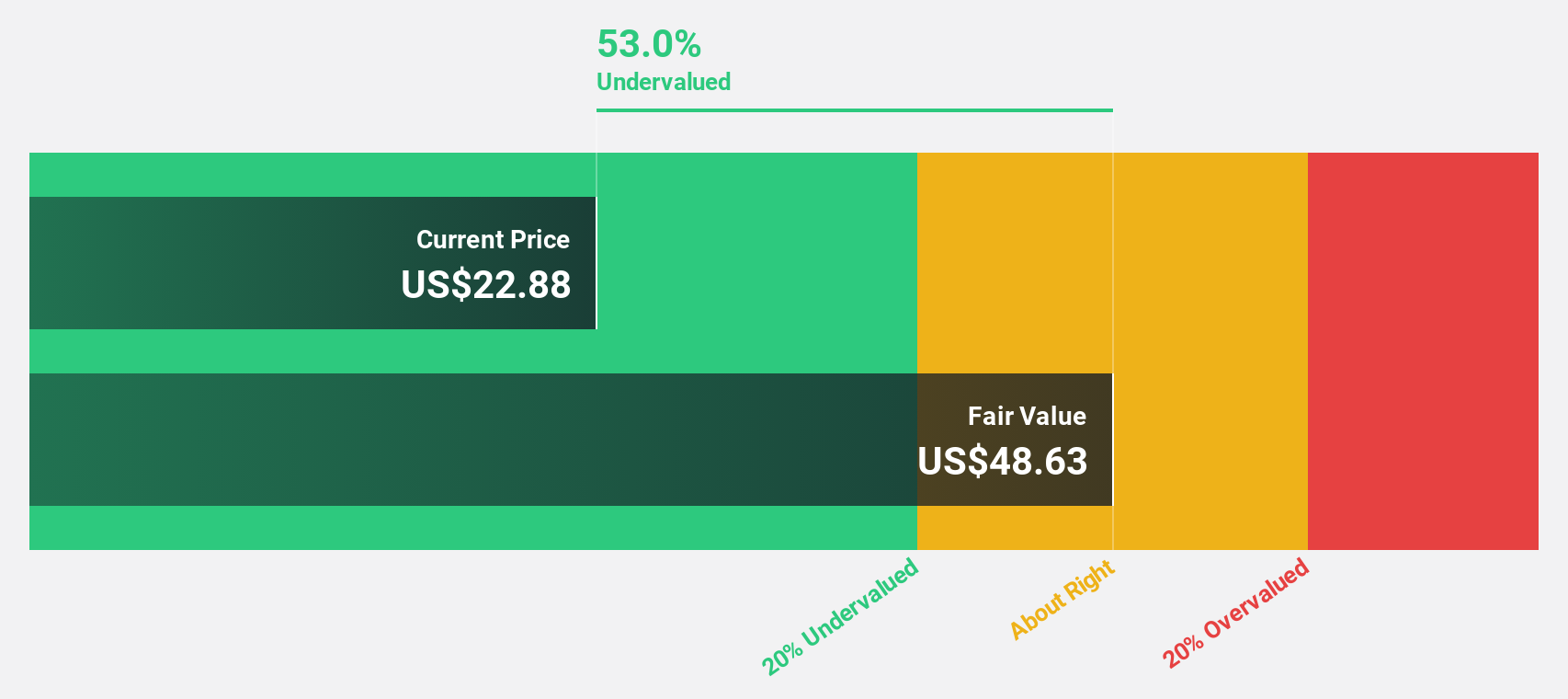

Estimated Discount To Fair Value: 40.9%

Old National Bancorp, priced at US$23.14, is significantly undervalued compared to its estimated fair value of US$39.18, suggesting potential based on cash flows. Despite recent shareholder dilution from a US$399.99 million equity offering and low return on equity projections (10.8%), the company anticipates strong earnings growth of 29.6% annually over three years, outpacing the broader market's forecasted growth rate of 15.2%.

- Our comprehensive growth report raises the possibility that Old National Bancorp is poised for substantial financial growth.

- Get an in-depth perspective on Old National Bancorp's balance sheet by reading our health report here.

Summing It All Up

- Reveal the 193 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONB

Old National Bancorp

Operates as the bank holding company for Old National Bank that provides various financial services to individual and commercial customers in the United States.

High growth potential with excellent balance sheet and pays a dividend.