- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research (NasdaqGM:ACMR) Jumps 60% After Reporting US$104 Million Net Income Increase

Reviewed by Simply Wall St

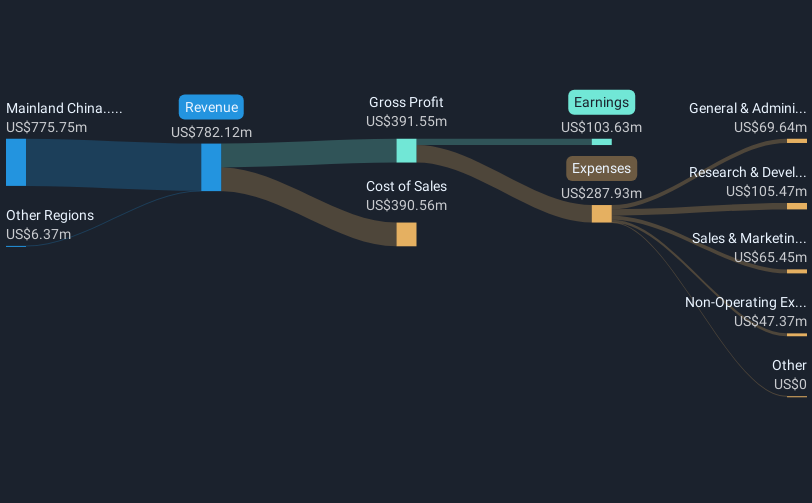

ACM Research (NasdaqGM:ACMR) witnessed a significant price move of 60% over the last quarter, coinciding with its recent earnings announcement for the full year ended December 2024. The company reported impressive sales growth to $782 million from $558 million previously, boosting its net income by 34% to $104 million, which likely supported positive investor sentiment. Furthermore, ACM Research confirmed its revenue guidance for 2025, maintaining an outlook between $850 million and $950 million, which can contribute to investor confidence. In contrast, broader market trends exhibited a modest downturn with major indexes declining slightly amid economic concerns, such as the Dow Jones' 0.2% drop. Notably, technology stocks, including those in the semiconductor sector like Nvidia, faced volatility, which might have drawn investor attention to alternatives. This specific alignment of strong earnings performance and forecast confidence allowed ACM Research to stand out amid a mixed market environment.

Unlock comprehensive insights into our analysis of ACM Research stock here.

ACM Research has delivered a total shareholder return of 188.12% over the past five years. During this period, the company achieved significant earnings growth, with profits increasing by 37.8% annually. This strong financial performance has been a key factor in the company's long-term success. Despite recent underperformance relative to the U.S. market and semiconductor industry over the past year, ACM Research's five-year trajectory remains impressive.

Several product-related developments have also contributed to ACM Research's long-term success. Innovations such as the Ultra C Tahoe Cleaning Tool and Ultra ECP ap-p tool, introduced in late 2024 and mid-2024, respectively, highlight the company's commitment to technological advancement. Furthermore, the appointment of Ernst & Young Hua Ming LLP as the new independent auditor in September 2023 underscores ACM Research's focus on maintaining robust corporate governance practices, reinforcing investor confidence over time.

- Unlock the insights behind ACM Research's valuation and discover its true investment potential

- Assess the potential risks impacting ACM Research's growth trajectory—explore our risk evaluation report.

- Already own ACM Research? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells single-wafer wet cleaning equipment for enhancing the manufacturing process and yield for integrated chips worldwide.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives