- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research (ACMR) Sees 36% Price Surge Over Last Quarter

Reviewed by Simply Wall St

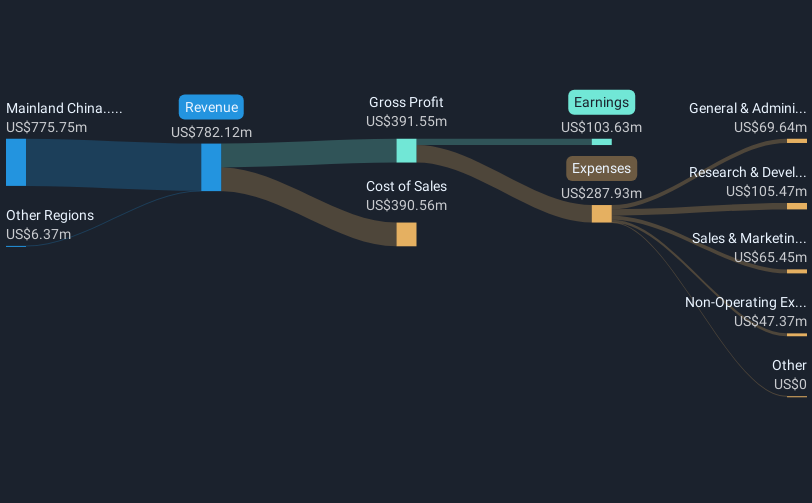

ACM Research (ACMR) reported strong second-quarter results, posting revenue growth to USD 215 million and an increase in net income to USD 30 million, alongside earnings per share improvements. Concurrently, upgrades to its Ultra C wb cleaning tool with patent-pending N2 bubbling technology reinforced its position in advanced-node manufacturing. During the same period, the company maintained its revenue guidance for 2025 between USD 850 million and USD 950 million. While the overall market experienced steady gains, Chairman Powell’s indication of possible rate cuts fueled optimism, supporting the company's share price rise of 36% over the past quarter.

Buy, Hold or Sell ACM Research? View our complete analysis and fair value estimate and you decide.

The recent advancements by ACM Research in enhancing its Ultra C wb cleaning tool with N2 bubbling technology underscore its commitment to maintaining a leading position in semiconductor manufacturing. These developments bolster ACM's narrative of leveraging AI and digitalization to drive growth in the semiconductor sector. The strong second-quarter results align with analyst forecasts, suggesting that sustained revenue from cutting-edge technology and global expansion could support long-term growth targets. As competitive pressures persist, ACM's strategic innovations and supply chain resilience may help mitigate potential market disruptions, underpinning revenue stability and profit margins.

Over the longer term, ACM Research's share performance has been robust, achieving a total return of 76.78% over the past three years, highlighting consistent value creation for shareholders. Over the past year, ACM outperformed the US Semiconductor industry and the broader US market, with a return that exceeded both benchmarks. Compared to industry averages, ACM's earnings and revenue projections suggest continued alignment with industry growth, supported by strategic investments and market positioning.

The company's current share price of $30.53 reflects a significant rise over the past quarter, but remains below the consensus analyst price target of $34.76. This indicates possible room for share value appreciation should ACM continue executing well on its growth strategies. The revenue guidance and advances in technology are anticipated to enhance earnings forecasts, though potential risks tied to U.S.-China relations and export controls remain critical factors to monitor. As analysts project revenue to reach $1.4 billion by 2028, investor sentiment and market conditions will be essential in determining ACM's ability to meet or exceed these expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells capital equipment worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)