- United States

- /

- Semiconductors

- /

- NasdaqGM:ACMR

ACM Research (ACMR): Evaluating Valuation as Market Awaits Revenue Growth and Lower EPS in Upcoming Results

Reviewed by Kshitija Bhandaru

ACM Research (ACMR) is in the spotlight as the market anticipates its upcoming earnings release. Investors are weighing forecasts for a sharp rise in revenue, along with a marked drop in earnings per share from last year.

See our latest analysis for ACM Research.

After an impressive rally that saw ACM Research's share price surge more than 47% in the past month and 164% year-to-date, momentum has cooled slightly with a recent pullback. Despite this dip, the company’s one-year total shareholder return remains a remarkable 98%, which highlights sustained optimism from investors based on its resilient revenue growth and history of exceeding earnings targets.

If this kind of fast-moving growth story interests you, now is the perfect time to expand your search and discover fast growing stocks with high insider ownership

With shares rallying on robust revenue growth while earnings forecasts point downward, the question remains: is ACM Research undervalued at current levels, or is the market already accounting for its future potential?

Most Popular Narrative: 40% Overvalued

At a fair value of $35.36, the most widely followed narrative positions ACM Research’s last close price of $41.07 above analyst expectations. This sets up one central question: do growth catalysts justify such a bullish valuation premium?

Advanced digitalization and AI adoption are driving a surge in demand for next-generation semiconductor manufacturing, with ACM's differentiated cleaning and plating solutions (such as its proprietary N2 bubbling and SPM tools) positioned to capture increased orders as foundries invest in more complex 3D NAND, DRAM, and logic nodes, supporting long-term revenue growth.

What if ACM’s path to a higher valuation is hiding in these very growth drivers? The real story lurks beneath headline numbers. It is a growth formula founded on bold, industry-defining assumptions about future demand, competitive technology, and aggressive scaling. Is ACM’s projected performance deserving of this large valuation leap? Dive in to see what could propel or shake up expectations next.

Result: Fair Value of $35.36 (OVERVALUEED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on China's semiconductor market and exposure to shifting export controls could quickly disrupt ACM's growth story and earnings momentum.

Find out about the key risks to this ACM Research narrative.

Another View: Multiples Tell a Different Story

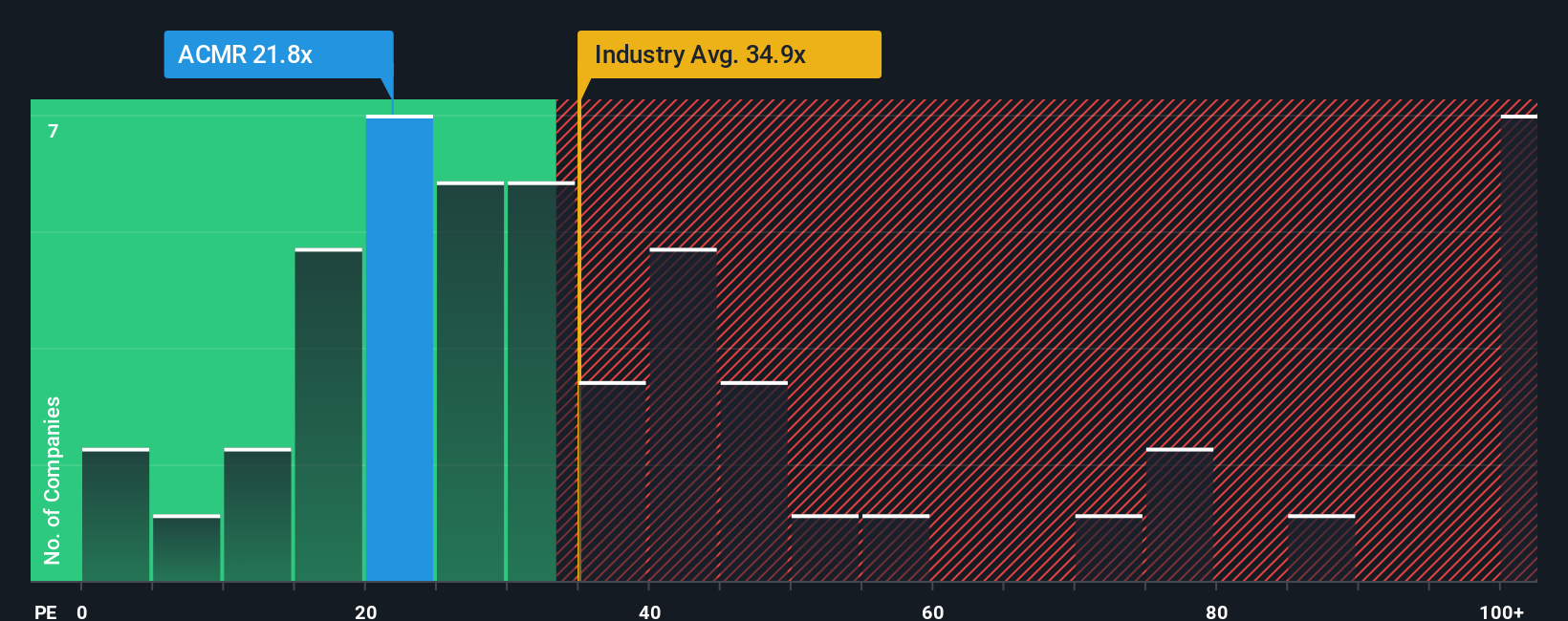

Looking through the lens of earnings-based valuation, ACM Research is trading at 23.5 times earnings, which is noticeably lower than both industry peers at 38x and the broader US Semiconductor sector at 38.3x. Notably, the fair ratio stands at 27.3x, suggesting some upside if market sentiment shifts closer to sector norms. But does this gap indicate genuine value, or is there an overlooked risk keeping the discount in place?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ACM Research Narrative

If you see the data differently or want to test your own assumptions, it takes under three minutes to craft a personal take and see where your research leads. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ACM Research.

Looking for More Smart Investment Ideas?

Why limit your search to just one opportunity? The Simply Wall Street Screener unlocks hand-picked ideas backed by deep research. If you want your portfolio to keep up with innovation and value, these trending strategies can open doors you might be missing.

- Uncover high-yield potential by checking out these 18 dividend stocks with yields > 3% offering attractive returns above 3% for solid income growth.

- Accelerate your tech exposure and tap into next-level trends with these 25 AI penny stocks as these selections are reshaping industries through artificial intelligence.

- Boost your search for the market’s best-priced opportunities by starting with these 897 undervalued stocks based on cash flows which trade below their cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ACMR

ACM Research

Develops, manufactures, and sells capital equipment worldwide.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion

Thanks for sharing these. They really help when I pick what dividend stocks to invest in