- United States

- /

- Semiconductors

- /

- NasdaqGS:ACLS

Axcelis Technologies (NasdaqGS:ACLS) Drops 13% As Q4 2024 Earnings Fall

Reviewed by Simply Wall St

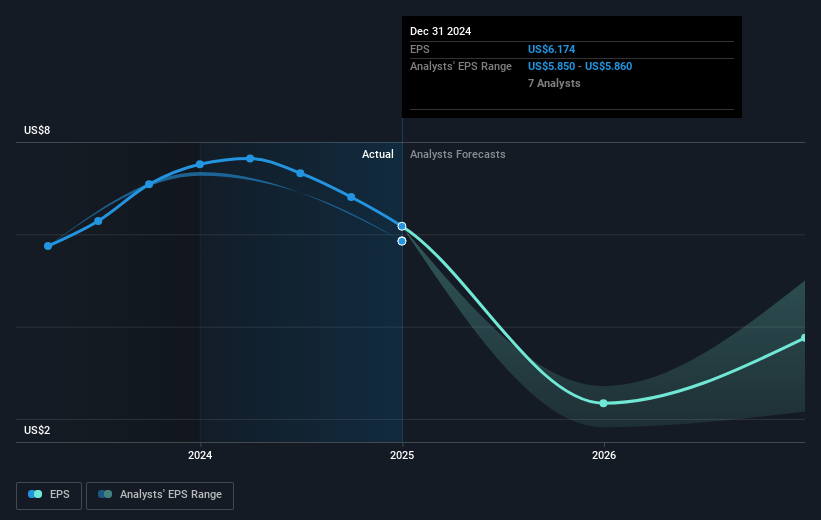

Axcelis Technologies (NasdaqGS:ACLS) saw its stock price decline by 13.32% over the past week, coinciding with several key developments. The company reported a significant drop in both revenue and net income for Q4 2024 compared to the previous year, possibly impacting investor sentiment. Additionally, while the company announced the upcoming showcase of its Purion platform at SEMICON Korea, market attention appeared to focus more on the broader market downturn. The U.S. market experienced a 2.5% decline amid concerns over new tariffs and their potential impact on global trade. The introduction of tariffs by the U.S. and responses from Canada and China contributed to market volatility, affecting technology stocks broadly. Against this backdrop, Axcelis's weaker earnings likely exacerbated selling pressure, impacting its total shareholder returns over the week.

Get an in-depth perspective on Axcelis Technologies's performance by reading our analysis here.

Over the past five years, Axcelis Technologies achieved a total shareholder return of 151.12%, illustrating strong long-term growth despite recent challenges. This performance came amid various developments. In early 2023, Axcelis completed a significant share repurchase, buying back shares worth approximately US$57.45 million, which positively impacted shareholder value. Additionally, the company's full-year 2023 results showcased revenue growth to US$1.13 billion from the previous year's US$920 million, with net income rising as well. The expansion into Japan with new service offices in 2024 further positioned the company for growth in the region's semiconductor market.

However, the last year presented hurdles. Axcelis underperformed compared to the US Semiconductor industry and broader market, which returned 8.9% and 13.1% respectively. Negative earnings growth of 18.4% in 2024, coupled with diminishing net profit margins, increased pressure. Despite this, ongoing buybacks and strategic business expansions continued to underpin the company's robust five-year return.

- See whether Axcelis Technologies' current market price aligns with its intrinsic value in our detailed report

- Uncover the uncertainties that could impact Axcelis Technologies' future growth—read our risk evaluation here.

- Is Axcelis Technologies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ACLS

Axcelis Technologies

Designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Japan, Europe, and Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives