- United States

- /

- Semiconductors

- /

- NasdaqGS:ACLS

Axcelis Technologies (ACLS): Assessing Valuation After Dual Product Launches in Semiconductor Market

Reviewed by Simply Wall St

Axcelis Technologies (ACLS) has grabbed investor attention with a double product launch that is turning heads across the semiconductor industry. The company recently introduced the GSD Ovation ES, a high current ion implanter designed for engineered substrates like SiC, LiTaO3, and LiNbO3, as well as the Purion Power Series+ platform, built to boost productivity for next-generation power devices, including new superjunction architectures. These launches put Axcelis firmly in the spotlight for their focus on flexibility and capital efficiency. These traits could set the stage for broader adoption as customers look for solutions addressing more specialized manufacturing needs.

This flurry of product news arrives after a mixed stretch for Axcelis’s stock. While shares have picked up momentum with a jump of 16% over the past three months, marking a clear shift from the sluggishness seen earlier this year, returns are still down 16% over the past year. Taking a step back, Axcelis’s three- and five-year gains are still impressive, suggesting there is a longer-term growth narrative in play even as current annual revenue and earnings have dipped. That leaves investors gauging if recent innovation can reinvigorate performance, or if cautious sentiment is justified.

With the stock now riding a wave of interest thanks to these launches, is Axcelis Technologies offering a true bargain, or are markets factoring in all the potential for growth ahead?

Most Popular Narrative: 4.3% Undervalued

The leading narrative suggests Axcelis Technologies is trading below fair value, pointing to hidden opportunities in the company’s future outlook.

Adoption of silicon carbide (SiC) power devices in electric vehicles and industrial applications remains early stage. Penetration rates and SiC content per vehicle are expected to rise globally and across hybrids. Axcelis's leadership in high-energy ion implantation positions it to benefit from this ramp, supporting future revenue and gross margin expansion as SiC demand multiplies.

Are future declines already priced in? The narrative behind this valuation includes bold calls about shrinking profit margins and a profit multiple typically reserved for market darlings. Curious about which underlying financial forecasts and market shifts push Axcelis above consensus value? Explore how these surprising projections shape the fair price analysts see ahead.

Result: Fair Value of $85.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, heavy reliance on China and muted demand for advanced technologies could quickly challenge the assumptions that support Axcelis’s undervaluation narrative.

Find out about the key risks to this Axcelis Technologies narrative.Another View: DCF Model Tells a Different Story

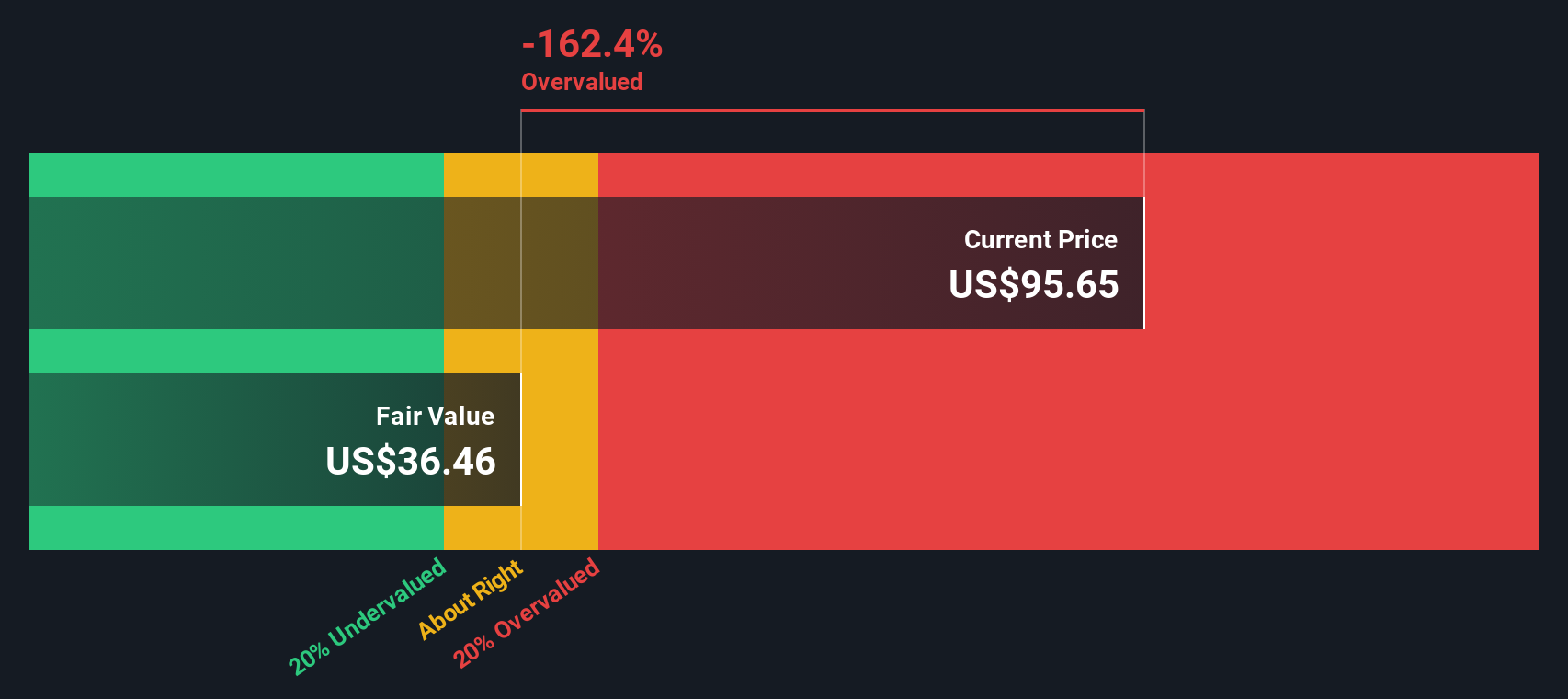

Using the SWS DCF model, Axcelis Technologies comes up as overvalued. This challenges the earlier narrative that the shares are undervalued. Which method do you trust more, and what does it mean for your decision?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Axcelis Technologies Narrative

If you want to dig into the numbers or prefer drawing your own conclusions, you can build an Axcelis Technologies narrative quickly and easily. Do it your way.

A great starting point for your Axcelis Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity slip by. With the right approach, you can uncover standout stocks most investors are missing using the Simply Wall Street Screener. Start your next search here:

- Unlock the potential of tomorrow’s market leaders and tap into growth by using AI penny stocks to find innovators pioneering artificial intelligence.

- Pinpoint undervalued bargains with strong fundamentals by starting your search with undervalued stocks based on cash flows for companies currently trading below their intrinsic worth.

- Secure stable income streams by checking out dividend stocks with yields > 3% featuring stocks that offer consistent dividends above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ACLS

Axcelis Technologies

Designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and the Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>