- United States

- /

- Specialty Stores

- /

- NYSE:WSM

Williams-Sonoma (WSM): Evaluating Valuation After Recent Share Price Dip

Reviewed by Simply Wall St

See our latest analysis for Williams-Sonoma.

Despite the recent dip, Williams-Sonoma’s shareholders are still sitting on a solid one-year total return of 41.6%, with gains stacking up even more impressively over the last few years. Recent share price weakness suggests momentum is cooling in the short term. However, the long-term performance paints a far more resilient picture for investors keeping an eye on value and growth potential.

If you’re looking for your next investing idea, now could be a great time to expand your search and discover fast growing stocks with high insider ownership

But with shares now trading below analyst targets and Williams-Sonoma’s fundamentals steady, investors may be wondering if the market is offering a rare window for value seekers or if Wall Street has already anticipated the retailer’s future growth.

Most Popular Narrative: 10.8% Undervalued

The most popular narrative values Williams-Sonoma shares meaningfully above the last close price, with fair value projections suggesting room for upside if forecasts play out. These estimates are grounded in factors that could reshape the company’s financial trajectory in the years ahead.

Continued investment and advances in AI-powered tools and digital platforms are driving higher conversion rates, improved customer experience, and measurable productivity gains. This supports both revenue growth and expanded operating leverage at the margin level.

Curious what’s fueling these bullish targets? The secret lies in a strategic mix of innovation bets, operational upgrades, and financial assumptions that tip the scale. Want to discover the pivotal numbers analysts believe could ignite the next phase of Williams-Sonoma’s growth and justify this price tag? Unlock the details behind the calculation to see what could set the company apart.

Result: Fair Value of $204.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global tariff volatility or a downturn in housing demand could quickly undermine Williams-Sonoma’s positive outlook and challenge its growth projections.

Find out about the key risks to this Williams-Sonoma narrative.

Another View: Multiples Tell a Different Story

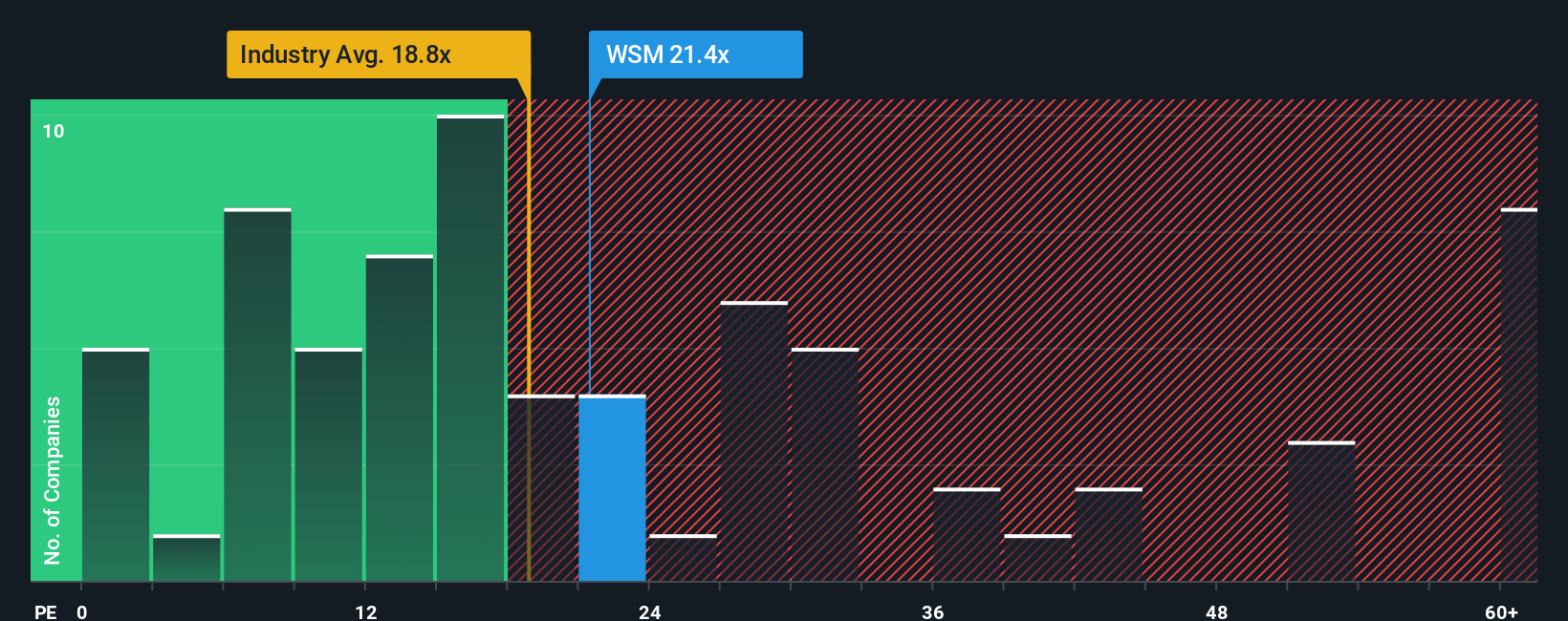

Looking through the lens of price-to-earnings, Williams-Sonoma currently trades at 19.7x, higher than both the US Specialty Retail industry average of 17.6x and above its own fair ratio of 18.2x. While still below peer averages, this could signal less upside than the consensus suggests. Will the market re-rate, or is risk creeping in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Williams-Sonoma Narrative

Not sure these conclusions fit your own perspective? Dive into the numbers yourself and craft a personalized view in just a few minutes, or simply Do it your way.

A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investing Opportunities?

Open the door to fresh opportunities and get ahead of market trends by uncovering unique stock ideas handpicked for powerful growth and long-term potential. Don’t let these chances pass you by.

- Tap into tomorrow’s medicine by checking out these 32 healthcare AI stocks, where breakthrough companies are fusing AI with healthcare innovation.

- Unlock reliable income streams through these 16 dividend stocks with yields > 3%, which showcases strong dividend growers with yields above 3% for serious investors seeking stability and returns.

- Embrace the future of finance and technology by tracking these 82 cryptocurrency and blockchain stocks, which highlights standout companies involved in the blockchain and crypto evolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives