- United States

- /

- Specialty Stores

- /

- NYSE:WSM

How Williams-Sonoma's Margin Beat Could Shape the Investment Case for WSM Investors

Reviewed by Sasha Jovanovic

- Williams-Sonoma recently reported a strong quarter, delivering revenues in line with expectations and surpassing analyst projections on gross margin and EBITDA performance.

- This performance highlights the company's resilience in maintaining profitability and operational efficiency, especially as other home furnishings peers struggled during the same period.

- We'll explore how Williams-Sonoma's stronger-than-expected margin performance could impact its future investment outlook and analyst assumptions.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Williams-Sonoma Investment Narrative Recap

To own shares in Williams-Sonoma, you need confidence in its ability to maintain strong profitability through disciplined cost management and sustained demand for premium home furnishings, even as economic headwinds persist. The recent quarterly results, which delivered revenue in line with expectations and exceeded analyst forecasts on gross margin and EBITDA, reinforce the importance of margin execution as a short-term catalyst; while strong, the news does not fundamentally alter the most pressing risks, particularly those tied to unpredictable tariff costs.

One recent announcement that stands out is Williams-Sonoma’s raised fiscal year 2025 revenue guidance, issued alongside this results release. This adjustment underscores management’s belief in continued sales resilience, tying directly to analyst models and investor assumptions about the company’s ability to offset headwinds through operational and digital strengths.

Yet against this margin outperformance, investors should be aware of potential gross margin volatility if tariff pressures escalate...

Read the full narrative on Williams-Sonoma (it's free!)

Williams-Sonoma's outlook projects $8.7 billion in revenue and $1.2 billion in earnings by 2028. This assumes 3.4% annual revenue growth and a $0.1 billion increase in earnings from the current $1.1 billion.

Uncover how Williams-Sonoma's forecasts yield a $204.32 fair value, a 5% upside to its current price.

Exploring Other Perspectives

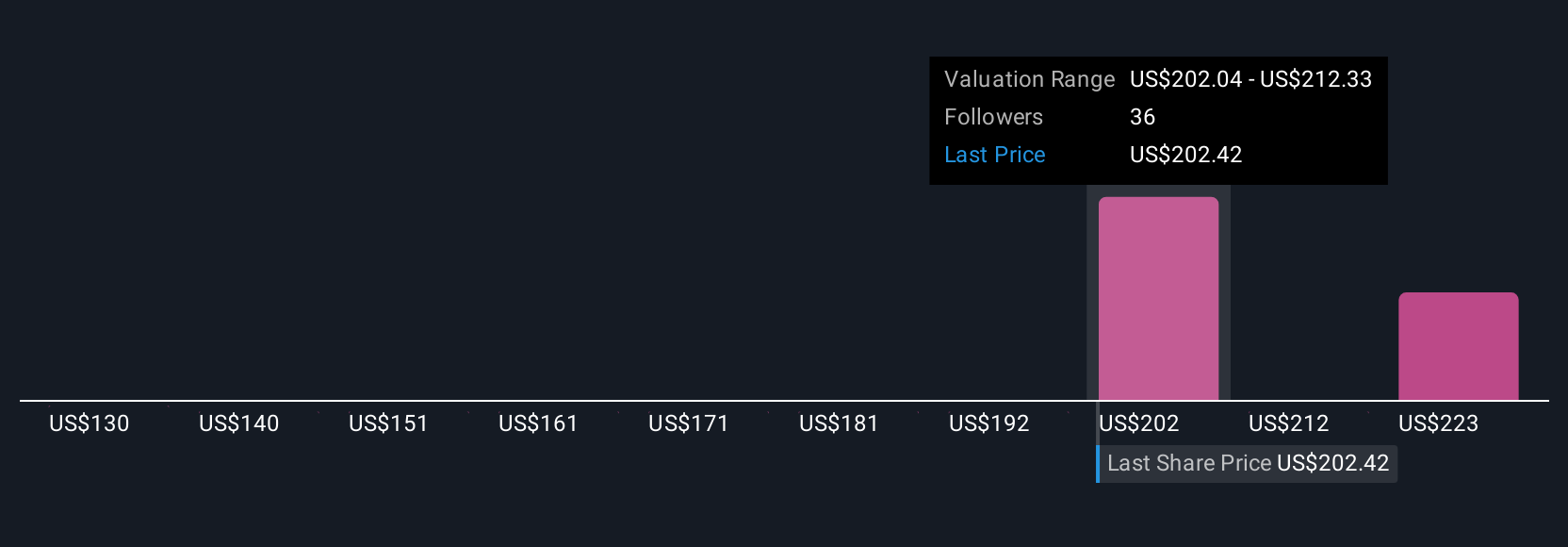

Three community members at Simply Wall St estimate Williams-Sonoma’s fair value between US$204.32 and US$232.17 per share. While many see upside, persistent global tariff uncertainty remains a key risk that could reshape the outlook, explore how your own forecast compares.

Explore 3 other fair value estimates on Williams-Sonoma - why the stock might be worth just $204.32!

Build Your Own Williams-Sonoma Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams-Sonoma research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Williams-Sonoma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams-Sonoma's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives