- United States

- /

- Specialty Stores

- /

- NYSE:WSM

Does Williams-Sonoma’s Valuation Still Make Sense After a 42% Rally in 2024?

Reviewed by Bailey Pemberton

Thinking about whether to buy, sell, or simply hold on to your Williams-Sonoma shares right now? You are definitely not alone. Whether you are an active trader who has been watching the stock’s sudden upswings, or a long-term investor satisfied with the impressive gains over the years, it is easy to see why this name keeps showing up on everyone’s watchlist.

After climbing a whopping 42.5% over the last twelve months and over 350% across five years, Williams-Sonoma still refuses to sit still. Just this past week, shares nudged higher by 2.1% following optimism around retail trends and home design demand. That is in stark contrast to the last month’s rough patch, where the stock dipped 5.6% as Wall Street weighed competitive pressures in the home goods sector. Despite these fluctuations, the company’s resilience is hard to ignore, especially against a backdrop of shifting consumer habits and recent strategic investments designed to boost supply chain strength and in-house design capabilities.

Of course, the real question most investors are asking is simple: is Williams-Sonoma undervalued or overvalued at its current price of $189.17? According to a value score that weighs six different valuation checks, Williams-Sonoma gets a 2 out of 6, suggesting it is undervalued on just a couple of metrics. But there is more to the story than a number. Diving into the different ways analysts assess this stock reveals both surprises and opportunities. Ultimately, there is an even smarter way to look at valuation that we will get to by the end of this article.

Williams-Sonoma scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Williams-Sonoma Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's true value by projecting its expected future cash flows and discounting them back to today’s dollars. For Williams-Sonoma, this analysis starts with its current Free Cash Flow, which stands at $1.05 Billion. Analysts expect cash flow to grow each year, with projections reaching $1.37 Billion by 2028. After the initial five years, additional years are projected using generally conservative growth rates, resulting in a 10-year FCF outlook that trends upwards each year.

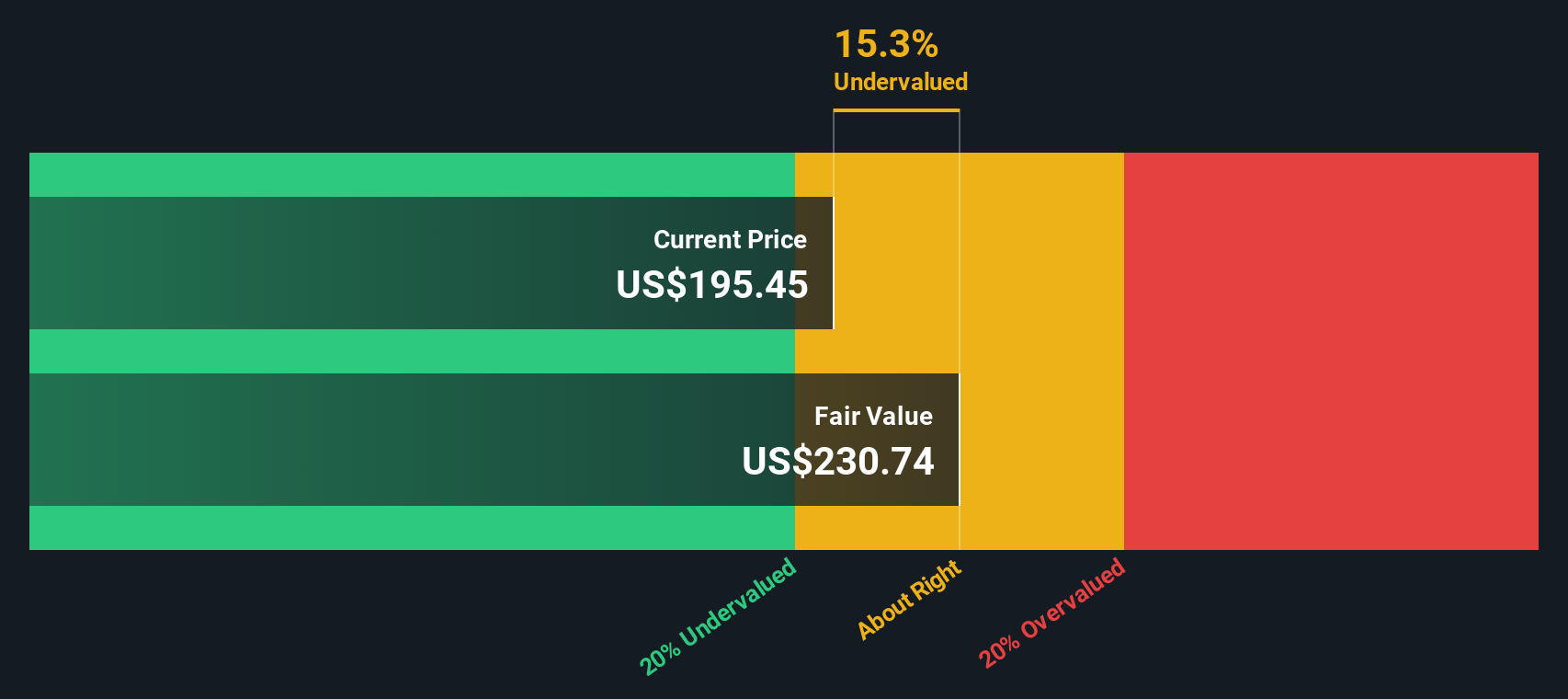

According to this two-stage DCF model, Williams-Sonoma’s intrinsic value is estimated at $233.62 per share. With the stock currently trading at $189.17, this implies the market price is about 19% below what this model considers fair value.

In summary, the DCF approach suggests Williams-Sonoma stock may be significantly undervalued at current levels, reflecting optimism about the company’s ability to generate robust cash flows over the coming decade.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Williams-Sonoma is undervalued by 19.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Williams-Sonoma Price vs Earnings

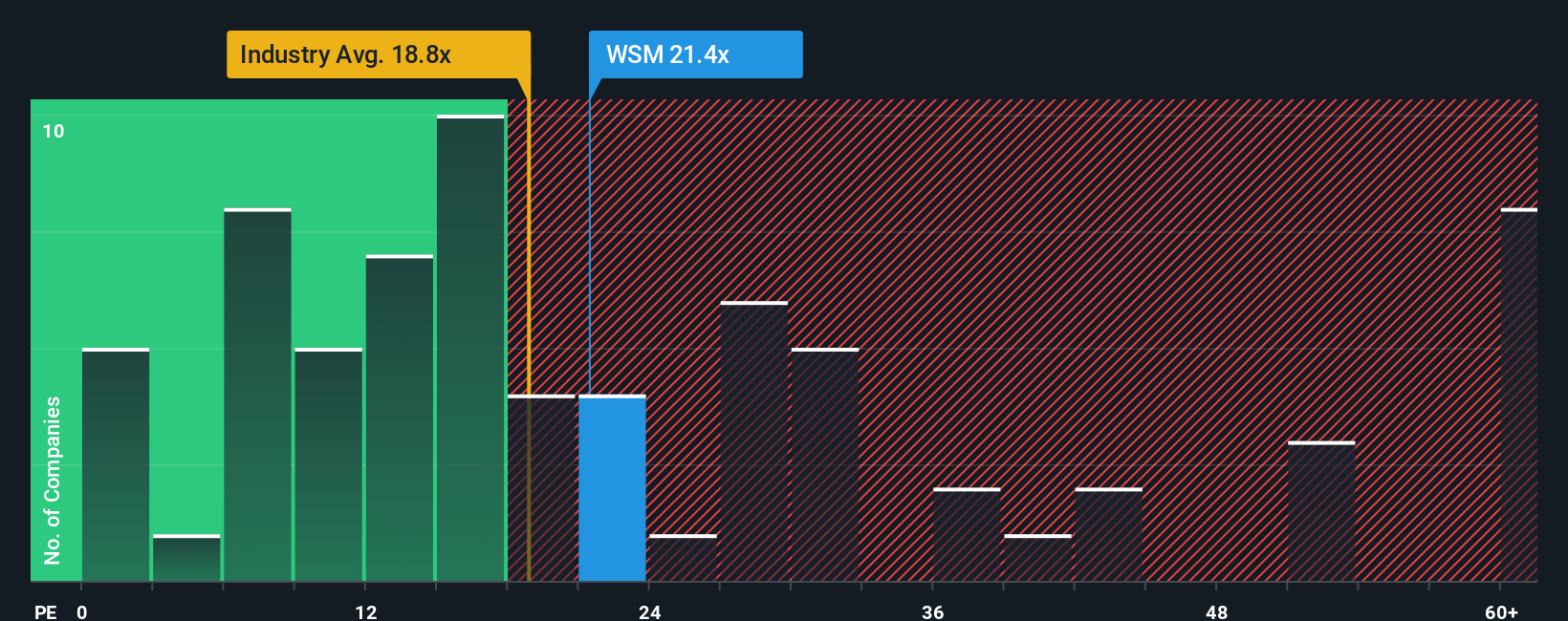

For companies that generate consistent profits like Williams-Sonoma, the Price-to-Earnings (PE) ratio is often the go-to tool for valuation because it boils down the relationship between what investors pay and what the company actually earns. PE ratios are especially useful when evaluating mature, profitable businesses, since they provide a direct snapshot of market expectations versus a company's proven earning power.

That said, not all PE ratios are created equal. Growth expectations, business risks, and market sentiment all affect what is considered a "normal" or "fair" PE for a given stock. Companies with higher expected earnings growth or lower risk profiles often deserve higher PE multiples, while riskier or slower-growing firms usually trade at lower ones.

Williams-Sonoma currently trades at a PE ratio of 20.45x. This sits above the Specialty Retail industry average of 16.45x, but a bit below its peer group average of 23.57x. To provide an even more tailored benchmark, Simply Wall St's proprietary "Fair Ratio" for Williams-Sonoma is calculated at 18.37x. The Fair Ratio blends in real company specifics like earnings growth, profit margins, market capitalization, and business risk. This makes it a more precise yardstick than just comparing to broad industry or peer averages.

With Williams-Sonoma’s actual PE ratio just slightly above its Fair Ratio (20.45x vs. 18.37x), the shares look to be valued about right relative to expected growth and risk. Investors can take some comfort that the current market price is not meaningfully out of line with what would be expected based on the company’s fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

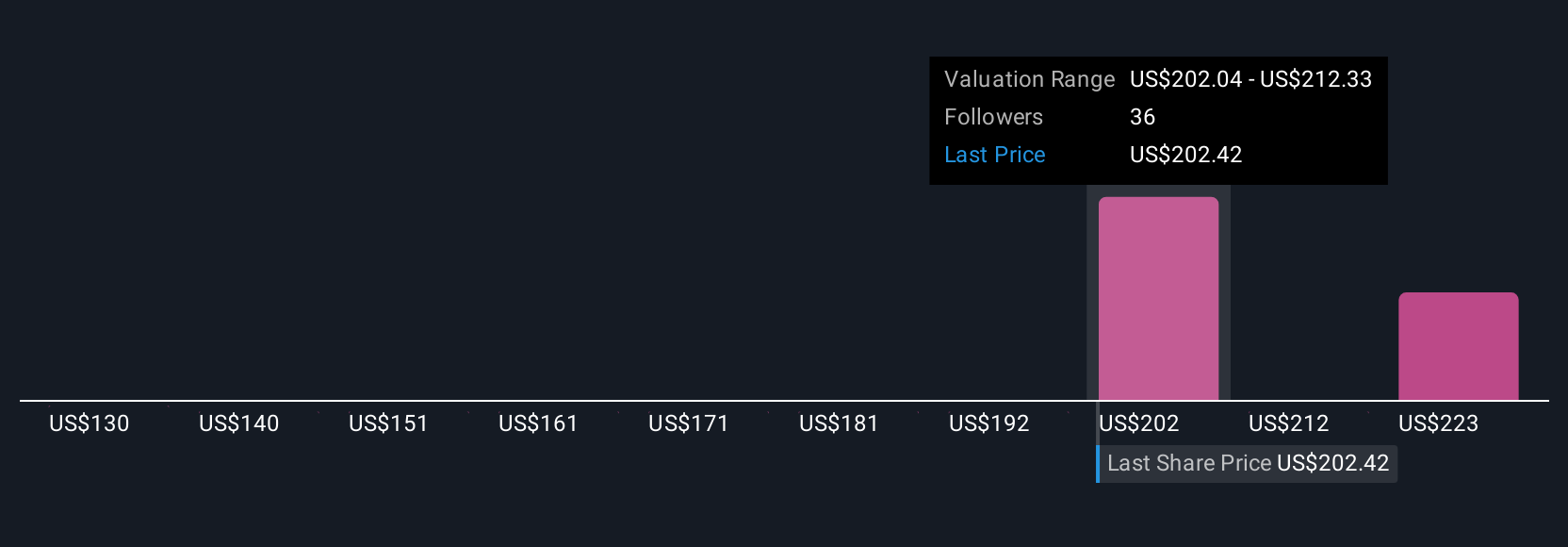

Upgrade Your Decision Making: Choose your Williams-Sonoma Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful, story-driven method to make investment decisions. A Narrative translates your perspective about Williams-Sonoma into a story that connects real-world catalysts (like digital investments or supply chain innovations) to concrete financial forecasts, such as future revenue, margins, and ultimately, a fair value per share. On Simply Wall St’s Community page, millions of investors use Narratives as a dynamic, easy-to-use tool to blend numbers with personal insights. Because Narratives automatically update as fresh news or earnings reports come in, they always reflect the latest outlook. Narratives also make it much easier to track whether you should buy or sell, letting you compare your fair value against the current market price at a glance. For example, some Williams-Sonoma investors anticipate digital upgrades and market expansion will justify a high target value near $230, while others, concerned by margin pressures or housing weakness, see fair value closer to $138. This shows that the “right” value depends on the story you believe and the assumptions you’re willing to make.

Do you think there's more to the story for Williams-Sonoma? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Williams-Sonoma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WSM

Williams-Sonoma

Operates as an omni-channel specialty retailer of various products for home.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives