- United States

- /

- Specialty Stores

- /

- NYSE:W

How Investors May Respond To Wayfair (W) Expanding Affirm Buy Now Pay Later Across All Brands

Reviewed by Sasha Jovanovic

- Affirm announced that it has expanded its partnership with Wayfair, enabling consumers to use Affirm’s buy now, pay later payment options directly at checkout both online and in-store across all Wayfair brands.

- This development aims to meet growing demand for flexible payments ahead of Wayfair’s key Way Day sales event and the holiday season, potentially increasing sales during peak shopping periods.

- We'll examine how the integration of Affirm's buy now, pay later solution might impact Wayfair's efforts to enhance customer experience and drive revenue growth.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Wayfair Investment Narrative Recap

To be a Wayfair shareholder, you need to believe the company can grow sales and profitably capture more of the fragmented home goods market, even amid economic pressures like inflation and unstable housing trends. The expanded integration of Affirm’s buy now, pay later options may help boost customer conversion during key events like Way Day, but won’t meaningfully alter the short-term risks of high advertising spend and demand unpredictability that remain top concerns for investors.

One of Wayfair’s most relevant recent announcements is the ongoing rollout of physical retail stores, such as those in Denver and Yonkers, which potentially complement digital sales and drive brand awareness during critical sales periods. These developments support the company’s key growth catalysts but also add complexity in managing costs and execution as consumer behavior evolves.

On the other hand, investors should not lose sight of how elevated advertising costs could pressure margins if…

Read the full narrative on Wayfair (it's free!)

Wayfair's narrative projects $13.9 billion in revenue and $124.7 million in earnings by 2028. This requires a 4.9% yearly revenue growth and a $424.7 million increase in earnings from the current -$300.0 million.

Uncover how Wayfair's forecasts yield a $84.90 fair value, in line with its current price.

Exploring Other Perspectives

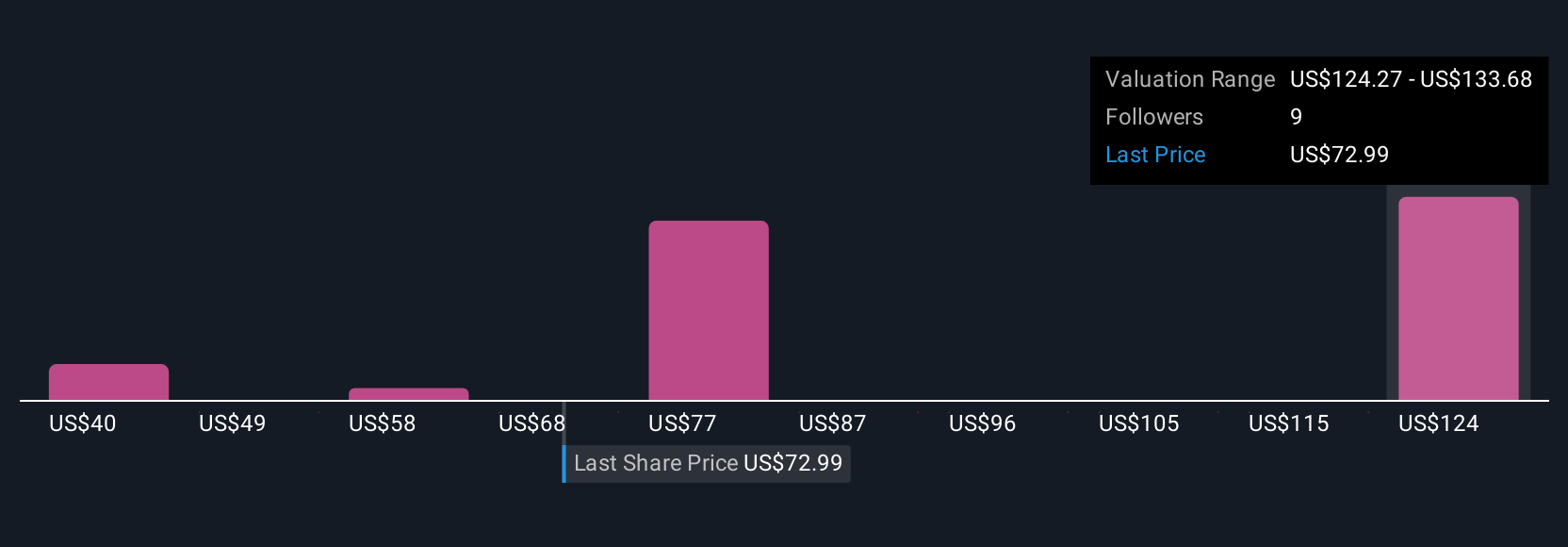

Five members of the Simply Wall St Community estimate Wayfair's fair value from US$39.54 up to US$157.81. Some see potential in initiatives like Affirm integration, while others remain concerned by macro risks limiting consumer demand, consider several community outlooks before forming your view.

Explore 5 other fair value estimates on Wayfair - why the stock might be worth as much as 90% more than the current price!

Build Your Own Wayfair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wayfair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wayfair's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives