- United States

- /

- Specialty Stores

- /

- NYSE:W

Did Wayfair’s Inclusion in S&P Homebuilders Index Just Shift Its (W) Investment Narrative?

Reviewed by Sasha Jovanovic

- On 13 December 2025, S&P Dow Jones Indices added Wayfair Inc. (NYSE: W) to the S&P Homebuilders Select Industry Index, recognizing the online retailer’s role within the broader housing-related ecosystem.

- This index inclusion can draw new attention from index-tracking funds and sector-focused investors, potentially increasing liquidity and broadening Wayfair’s institutional shareholder base.

- We’ll now examine how Wayfair’s addition to the S&P Homebuilders Select Industry Index may influence its investment narrative and future positioning.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Wayfair Investment Narrative Recap

To own Wayfair, you need to believe it can turn its large online home category presence into sustainable profitability despite a tough housing and macro backdrop. Inclusion in the S&P Homebuilders Select Industry Index may marginally support liquidity and attention, but it does not change that the key short term catalyst remains execution on cost efficiencies, while the biggest risk is still pressure on big-ticket home spending.

Recent announcements around new large format and smaller prototype stores in markets like Denver, Atlanta, Wilmette and Columbus connect directly to Wayfair’s catalyst of using physical locations to boost brand awareness and conversion. This bricks and clicks expansion, now viewed through a homebuilder sector lens after the index addition, could be an important test of whether offline presence can offset macro headwinds in furniture and home goods demand.

Yet for all the promise of stores and logistics investments, investors should be aware of how sustained weakness in big ticket home spending could...

Read the full narrative on Wayfair (it's free!)

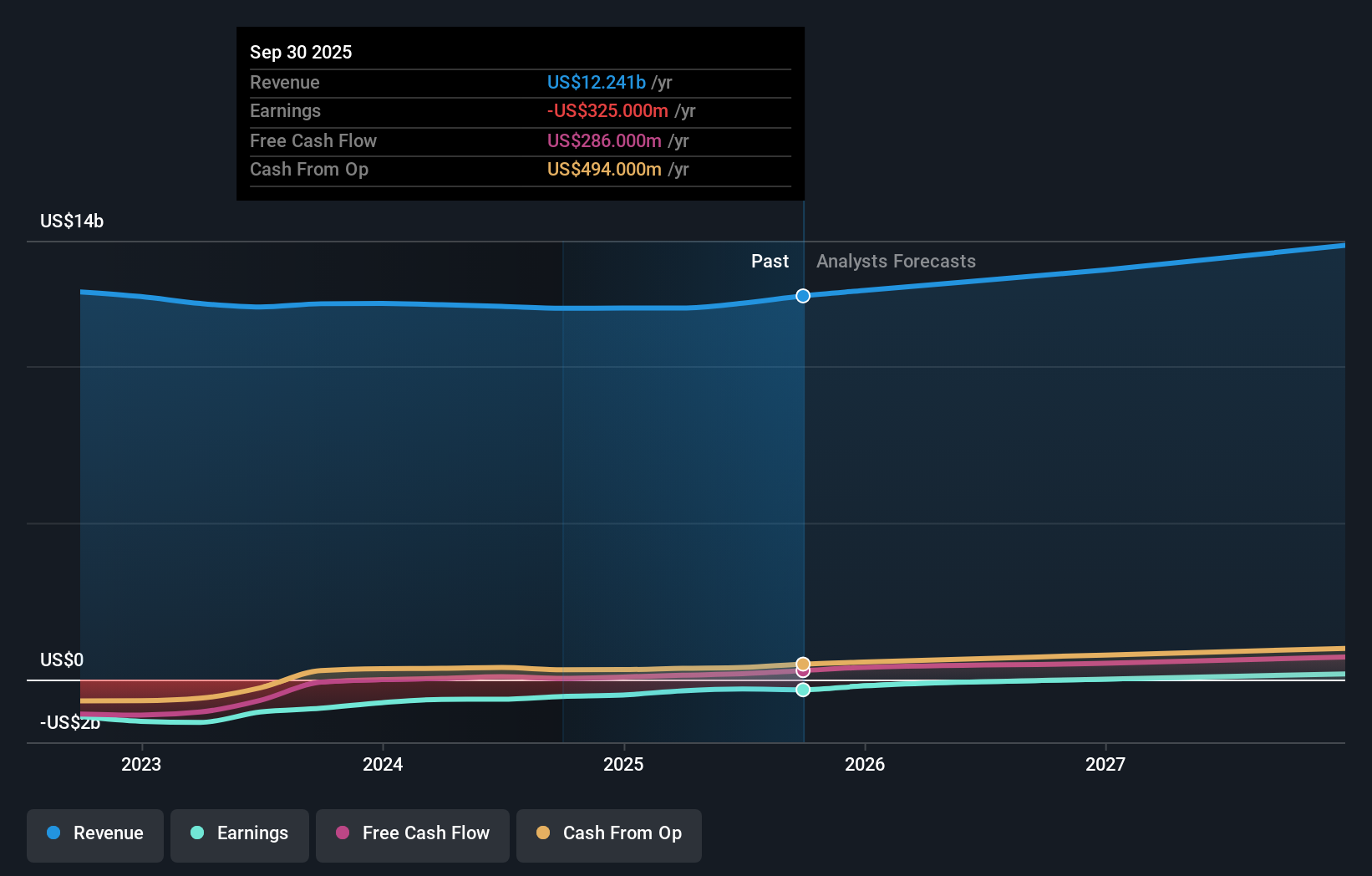

Wayfair's narrative projects $13.9 billion revenue and $124.7 million earnings by 2028.

Uncover how Wayfair's forecasts yield a $114.00 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community range widely, from about US$40 per share up to roughly US$184, showing very different expectations. You can weigh those views against the central risk that a weak housing and big ticket spending backdrop may keep testing Wayfair’s path to improved margins and profitability.

Explore 6 other fair value estimates on Wayfair - why the stock might be worth less than half the current price!

Build Your Own Wayfair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Wayfair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wayfair's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 34 companies in the world exploring or producing it. Find the list for free.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion