- United States

- /

- Specialty Stores

- /

- NYSE:W

Could Wayfair's (W) New Retail Strategy Reflect a Deeper Shift in Leadership Priorities?

Reviewed by Sasha Jovanovic

- Wayfair recently appointed Hal Lawton, CEO of Tractor Supply Company and former Macy's executive, to its board of directors and announced plans to open a smaller-format retail store in Columbus, Ohio in late 2026.

- This dual move showcases Wayfair's push to strengthen executive leadership while piloting new approaches to physical retail aimed at enhancing customer experience and operational efficiency.

- We'll explore how Hal Lawton's board appointment could shape Wayfair's broader investment outlook and physical retail strategy.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Wayfair Investment Narrative Recap

For shareholders, the core belief underpinning a Wayfair investment is confidence that the company can achieve sustained improvement in efficiency and customer experience, even as headwinds like housing market pressures and inflation persist. While Wayfair’s addition of Hal Lawton to the board and the new Columbus store prototype reinforce focus on retail execution and leadership depth, the biggest near-term catalyst remains the performance and impact of its physical retail expansion, and the largest risk is continued volatility in consumer demand for big-ticket home goods; these developments are directionally supportive but not a material shift to those priorities.

The announcement of Wayfair’s upcoming smaller-format Columbus store stands out for its direct connection to the ongoing push for operational efficiency and experimentation with new retail concepts. By testing a more compact, highly curated in-store experience, Wayfair seeks to fine-tune the balance between convenience, local engagement and broader e-commerce-driven reach, a potential catalyst for engaging new customer segments and gathering learnings for future investment decisions.

However, even as these efforts bolster optimism, investors should be aware that persistent softness in the housing market and high mortgage rates...

Read the full narrative on Wayfair (it's free!)

Wayfair's outlook anticipates $13.9 billion in revenue and $124.7 million in earnings by 2028. This projection is based on a 4.9% annual revenue growth rate and an earnings increase of $424.7 million from current earnings of -$300.0 million.

Uncover how Wayfair's forecasts yield a $112.31 fair value, a 5% upside to its current price.

Exploring Other Perspectives

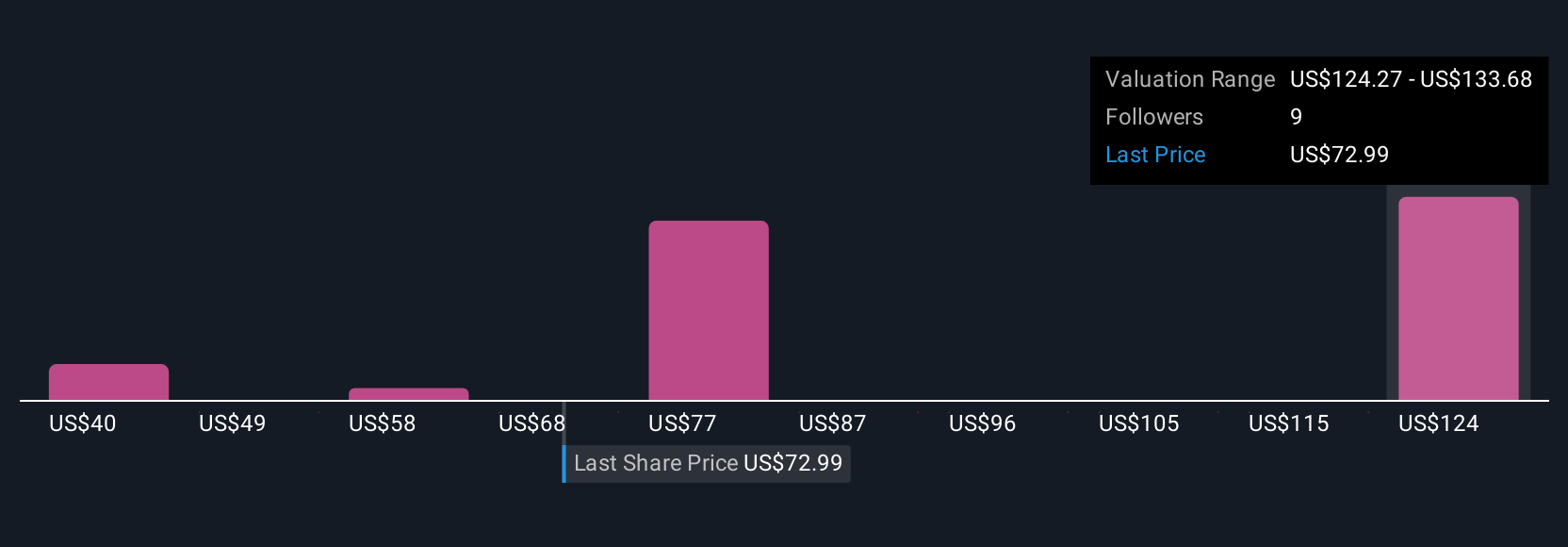

Five Simply Wall St Community members estimate Wayfair’s fair value from as low as US$39.54 to as high as US$204.14. With consumer demand for home goods remaining uncertain, your own viewpoint on Wayfair’s path forward may differ from the rest, consider the range of community opinions and alternative outcomes before making decisions.

Explore 5 other fair value estimates on Wayfair - why the stock might be worth as much as 92% more than the current price!

Build Your Own Wayfair Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wayfair research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wayfair research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wayfair's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wayfair might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:W

Wayfair

Engages in the e-commerce business in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives