- United States

- /

- Specialty Stores

- /

- NYSE:TJX

Does Rising Analyst Optimism and a Premium Valuation Reinforce the Growth Story for TJX (TJX)?

Reviewed by Sasha Jovanovic

- Over the past week, analyst optimism has strengthened around The TJX Companies, with upward revisions to earnings estimates for 2026 and growing expectations for profit expansion in the coming years.

- An interesting aspect is that TJX is currently trading at a price-to-earnings ratio well above the industry average, reflecting heightened confidence in the company’s long-term growth prospects among market participants.

- Given analysts' recent upward revisions to earnings forecasts, we will explore how these improved profit expectations could influence the investment case for TJX Companies.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

TJX Companies Investment Narrative Recap

For someone considering TJX Companies, the core belief typically centers on whether its off-price retail model can deliver continued growth as consumer demand for value-oriented shopping remains strong. This latest round of analyst optimism, with upward earnings estimate revisions, may support near-term momentum, but the key immediate catalyst remains TJX’s ability to consistently drive higher in-store traffic and comparable sales. The biggest ongoing risk still centers on the gradual shift toward e-commerce, which has yet to materially affect TJX’s fundamentals, but remains a long-term concern.

The most relevant recent announcement is TJX Companies raising its full-year FY2026 guidance, now expecting a 3% comparable sales increase and 6%-7% growth in diluted EPS. This upward revision follows recent earnings figures and aligns with growing analyst optimism. These developments are important, as stronger earnings support the confidence baked into TJX’s premium valuation, but whether this translates into sustained outperformance depends on the company’s resilience against digital competitors.

However, investors should also keep a close eye on the ongoing risk that improving brand supply chains could eventually reduce the availability of quality off-price merchandise for TJX…

Read the full narrative on TJX Companies (it's free!)

TJX Companies is projected to reach $68.6 billion in revenue and $6.3 billion in earnings by 2028. This outlook assumes a 5.8% annual revenue growth rate and reflects an earnings increase of $1.3 billion from the current $5.0 billion.

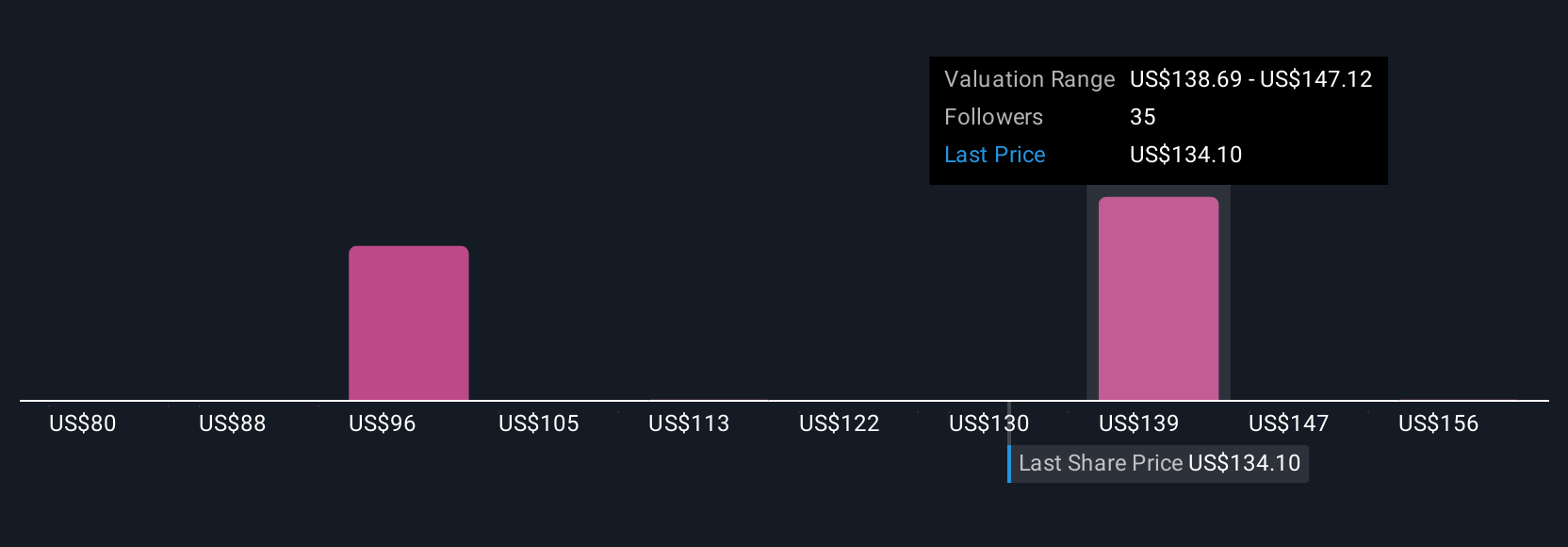

Uncover how TJX Companies' forecasts yield a $149.44 fair value, a 4% upside to its current price.

Exploring Other Perspectives

While consensus analysts see steady growth, the most optimistic forecasts prior to the news assumed annual revenue could reach US$71 billion by 2028, reflecting confidence in global store openings and e-commerce. This shows how investor expectations can vary widely, especially if you believe recent news may accelerate or challenge those bullish assumptions.

Explore 7 other fair value estimates on TJX Companies - why the stock might be worth as much as 15% more than the current price!

Build Your Own TJX Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TJX Companies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free TJX Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TJX Companies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TJX Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TJX

TJX Companies

Operates as an off-price apparel and home fashions retailer worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives