Savers Value Village, Inc. (NYSE:SVV) Not Flying Under The Radar

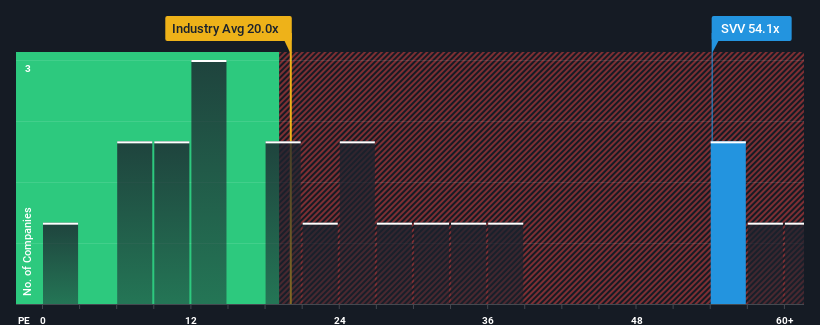

Savers Value Village, Inc.'s (NYSE:SVV) price-to-earnings (or "P/E") ratio of 54.1x might make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 16x and even P/E's below 9x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Savers Value Village as its earnings have been falling quicker than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Savers Value Village

Is There Enough Growth For Savers Value Village?

The only time you'd be truly comfortable seeing a P/E as steep as Savers Value Village's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 41% decrease to the company's bottom line. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 21% each year as estimated by the nine analysts watching the company. With the market only predicted to deliver 10% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Savers Value Village's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Savers Value Village's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Savers Value Village maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Savers Value Village (1 shouldn't be ignored!) that you should be aware of.

Of course, you might also be able to find a better stock than Savers Value Village. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SVV

Savers Value Village

Sells second-hand merchandise in retail stores in the United States, Canada, and Australia.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives