- United States

- /

- Specialty Stores

- /

- NYSE:SAH

With EPS Growth And More, Sonic Automotive (NYSE:SAH) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Sonic Automotive (NYSE:SAH). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Sonic Automotive

How Fast Is Sonic Automotive Growing Its Earnings Per Share?

Over the last three years, Sonic Automotive has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, Sonic Automotive's EPS shot from US$4.79 to US$9.92, over the last year. Year on year growth of 107% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

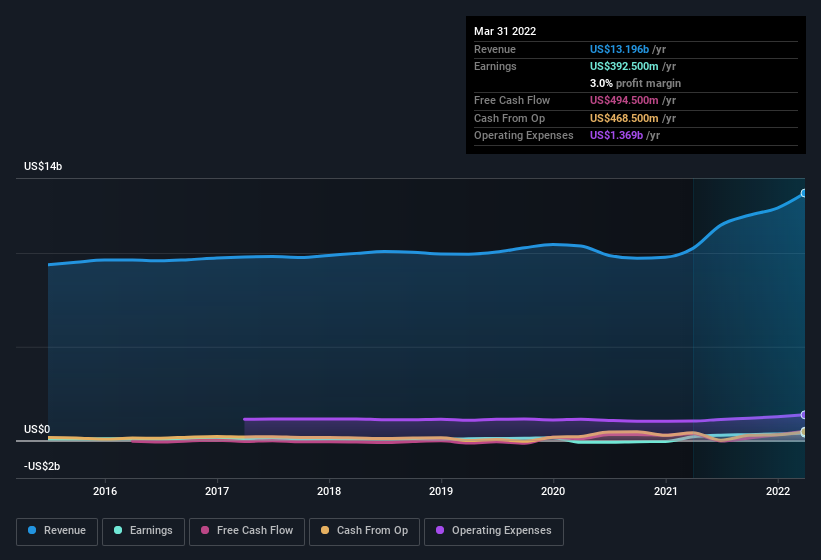

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Sonic Automotive's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. Sonic Automotive maintained stable EBIT margins over the last year, all while growing revenue 29% to US$13b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Sonic Automotive's forecast profits?

Are Sonic Automotive Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One shining light for Sonic Automotive is the serious outlay one insider has made to buy shares, in the last year. Indeed, Paul Rusnak has accumulated shares over the last year, paying a total of US$5.5m at an average price of about US$41.87. It doesn't get much better than that, in terms of large investments from insiders.

The good news, alongside the insider buying, for Sonic Automotive bulls is that insiders (collectively) have a meaningful investment in the stock. Notably, they have an enormous stake in the company, worth US$502m. Coming in at 28% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. So it might be my imagination, but I do sense the glimmer of an opportunity.

Does Sonic Automotive Deserve A Spot On Your Watchlist?

Sonic Automotive's earnings have taken off like any random crypto-currency did, back in 2017. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Sonic Automotive deserves timely attention. We should say that we've discovered 2 warning signs for Sonic Automotive that you should be aware of before investing here.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Sonic Automotive, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SAH

Sonic Automotive

Operates as an automotive retailer in the United States.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives