- United States

- /

- Specialty Stores

- /

- NYSE:RH

RH (RH): Evaluating Valuation After Q2 Revenue Growth and International Expansion Momentum

Reviewed by Simply Wall St

RH (RH) delivered 8% revenue growth year over year in the second quarter, as demand continued to outpace sales. Investors are also watching the company’s recent international openings and margin improvements for signs of further strength this year.

See our latest analysis for RH.

Even with recent momentum from international openings and margin gains, RH’s share price return is down 54.2% year-to-date, as the broader market debates the sustainability of its growth. Over the past year, total shareholder return is also negative at -44.2%, underscoring renewed scrutiny of luxury retail’s long-term resilience. In the short term, shares have struggled to find traction, which signals investors are waiting for evidence of a real turnaround.

If volatility around RH has you thinking bigger, now is a good moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

With RH now trading at a steep discount to analyst price targets and intrinsic value, the question remains: is the recent weakness an opportunity for investors to buy in, or is the market already factoring in all future growth?

Most Popular Narrative: 31% Undervalued

RH’s widely followed narrative places its fair value far above today’s last close of $180.96. This suggests the market may be missing something significant. This stark discount draws attention to the core drivers that analysts believe could redefine RH’s fortunes in the years ahead.

RH’s platform expansion, including the opening of 7 Design Galleries and 2 Outdoor Galleries in 2025, is expected to create new opportunities for revenue growth and brand exposure across multiple markets. This could potentially boost overall sales revenue. The introduction of new product lines, such as the RH Outdoor Sourcebook and RH Interiors Sourcebook, along with a significant brand extension planned for fall 2025, may enhance product differentiation and drive increased demand, positively impacting future revenues.

Want to understand why analysts believe RH’s expansion could spark a new era of growth? There is one key forecast that stands out: a future leap in profitability tied to ambitious product and market moves. Ready to uncover which financial shifts power this bold price target? The full narrative breaks down the numbers behind the buzz.

Result: Fair Value of $262.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as a downturn in the housing market and ongoing tariff uncertainties could challenge RH’s ability to deliver on these growth forecasts.

Find out about the key risks to this RH narrative.

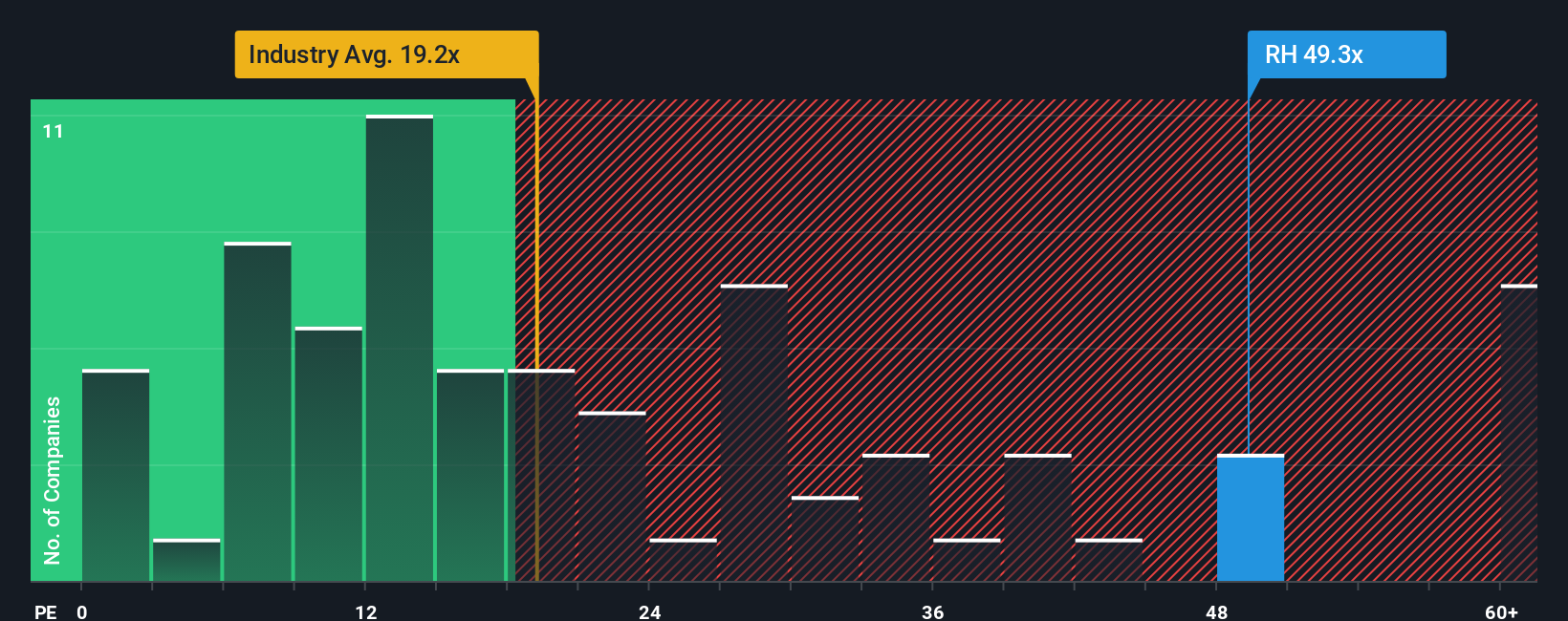

Another View: Multiples Raise Some Red Flags

While consensus narratives and intrinsic value suggest RH is undervalued, the reality looks different when we consider its price-to-earnings ratio. RH trades at 31.8x earnings, which is much higher than the peer average of 16.7x and also above the industry standard of 16.9x. Although the fair ratio points to 36.8x as a possible future target, today’s high multiple could signal limited upside unless profits accelerate. Is the market’s skepticism overdone, or is caution justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RH Narrative

If you see the story differently or want a hands-on approach, dive into the data and build a narrative of your own in just minutes, then Do it your way

A great starting point for your RH research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that the best opportunities come from casting a wider net. Check out these unique strategies and act now to stay ahead of the curve:

- Capture growth potential with these 27 AI penny stocks as these choices are reshaping the future of business, automation, and innovation through artificial intelligence breakthroughs.

- Snag bargain-priced picks by checking out these 873 undervalued stocks based on cash flows that could be flying under the radar but offer strong fundamentals and attractive valuations.

- Unlock hidden income streams and start building your portfolio with these 17 dividend stocks with yields > 3% offering yields above 3% for those seeking steady cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RH

RH

Operates as a retailer and lifestyle brand in the home furnishings market in the United States, Canada, the United Kingdom, Germany, Belgium, and Spain.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives