- United States

- /

- Specialty Stores

- /

- NYSE:PAG

Is Barclays’ Overweight Rating a Turning Point for Penske Automotive Group’s (PAG) Premium Market Position?

Reviewed by Sasha Jovanovic

- On November 12, 2025, Barclays initiated coverage on Penske Automotive Group, assigning an "Overweight" rating under analyst John Babcock.

- This coverage highlights institutional confidence in Penske’s global dealership model and its focus on luxury and import vehicles for diversified growth.

- We'll examine how Barclays' positive rating could influence Penske Automotive Group's investment narrative, particularly regarding its premium market positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Penske Automotive Group Investment Narrative Recap

For those considering Penske Automotive Group, the core belief is in the long-term strength of its luxury and import dealership network, underpinned by service and parts revenue from an aging vehicle fleet. Barclays’ new “Overweight” rating signals institutional support but does not materially shift the immediate focus away from demand risks tied to higher interest rates and consumer affordability, particularly in the U.K., which remains the leading short-term concern.

Recent quarterly dividend increases, with the October announcement raising the payout by 4.5%, directly relate to the company’s emphasis on returning capital to shareholders amid consistent cash flow. This move sits alongside continued share buybacks and reflects the company’s approach to balancing growth opportunities with shareholder rewards, even as it faces ongoing risks to per-store profitability and margins.

Conversely, investors should not overlook the risk posed by the accelerating shift to electric vehicles and how this might impact dealership-level profits...

Read the full narrative on Penske Automotive Group (it's free!)

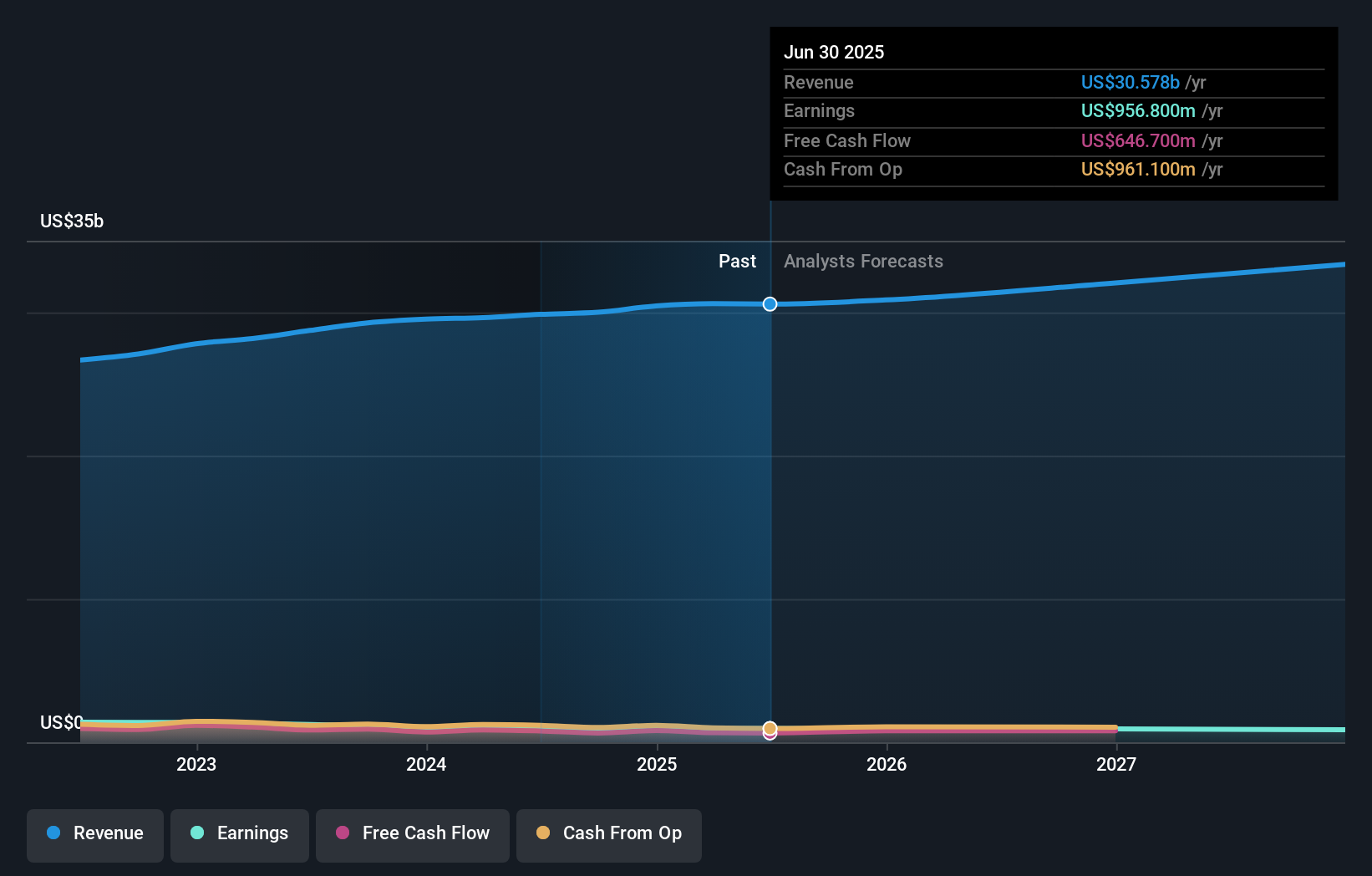

Penske Automotive Group’s outlook anticipates $34.2 billion in revenue and $924.8 million in earnings by 2028. This projection is based on an expected annual revenue growth rate of 3.8% and a decrease in earnings of $32 million from the current level of $956.8 million.

Uncover how Penske Automotive Group's forecasts yield a $179.86 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Only one Community estimate pins fair value at US$179.86. Service and parts earnings remain a focus among participants given current vehicle trends. Check out a range of individual perspectives on Penske’s outlook.

Explore another fair value estimate on Penske Automotive Group - why the stock might be worth just $179.86!

Build Your Own Penske Automotive Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Penske Automotive Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Penske Automotive Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Penske Automotive Group's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAG

Penske Automotive Group

A diversified transportation services company, operates automotive and commercial truck dealerships worldwide.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives