- United States

- /

- Specialty Stores

- /

- NYSE:PAG

Did Penske Automotive Group's (PAG) 20th Straight Dividend Hike Signal Enduring Confidence or Cautious Optimism?

Reviewed by Sasha Jovanovic

- Penske Automotive Group announced that its Board of Directors approved a quarterly dividend of US$1.38 per share, marking a 4.5% increase and the company's 20th consecutive quarterly rise; the dividend was payable as of December 2, 2025, to shareholders of record on November 14, 2025.

- This sustained pattern of dividend growth highlights management’s ongoing emphasis on returning capital to shareholders and signals confidence in the company's financial stability.

- We'll explore how Penske Automotive Group’s continued dividend growth shapes the broader investment narrative for the company.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Penske Automotive Group Investment Narrative Recap

To be a shareholder in Penske Automotive Group, you typically need to believe in the durability of premium automotive retail, the company's diversified operating model, and management’s ability to generate consistent cash returns despite industry cycles. The recently announced 4.5% dividend increase supports the narrative of steady capital returns but does not alter the near-term catalyst of expanding service and parts profitability, nor does it significantly mitigate the company’s pronounced exposure to economic cycles or regulatory shifts.

Among recent announcements, strong growth in service and parts revenues, driven by an aging vehicle fleet and greater vehicle complexity, remains a central catalyst, creating a recurring revenue stream that can temper earnings volatility during weaker new vehicle demand. The focus on premium brands and growing after-sales contribution reinforces the company's current investment story, while also highlighting how stable cash flow supports ongoing dividend increases.

But against recent dividend growth, investors should remain attentive to the underlying risks from luxury market exposure and shifting industry regulations, especially as...

Read the full narrative on Penske Automotive Group (it's free!)

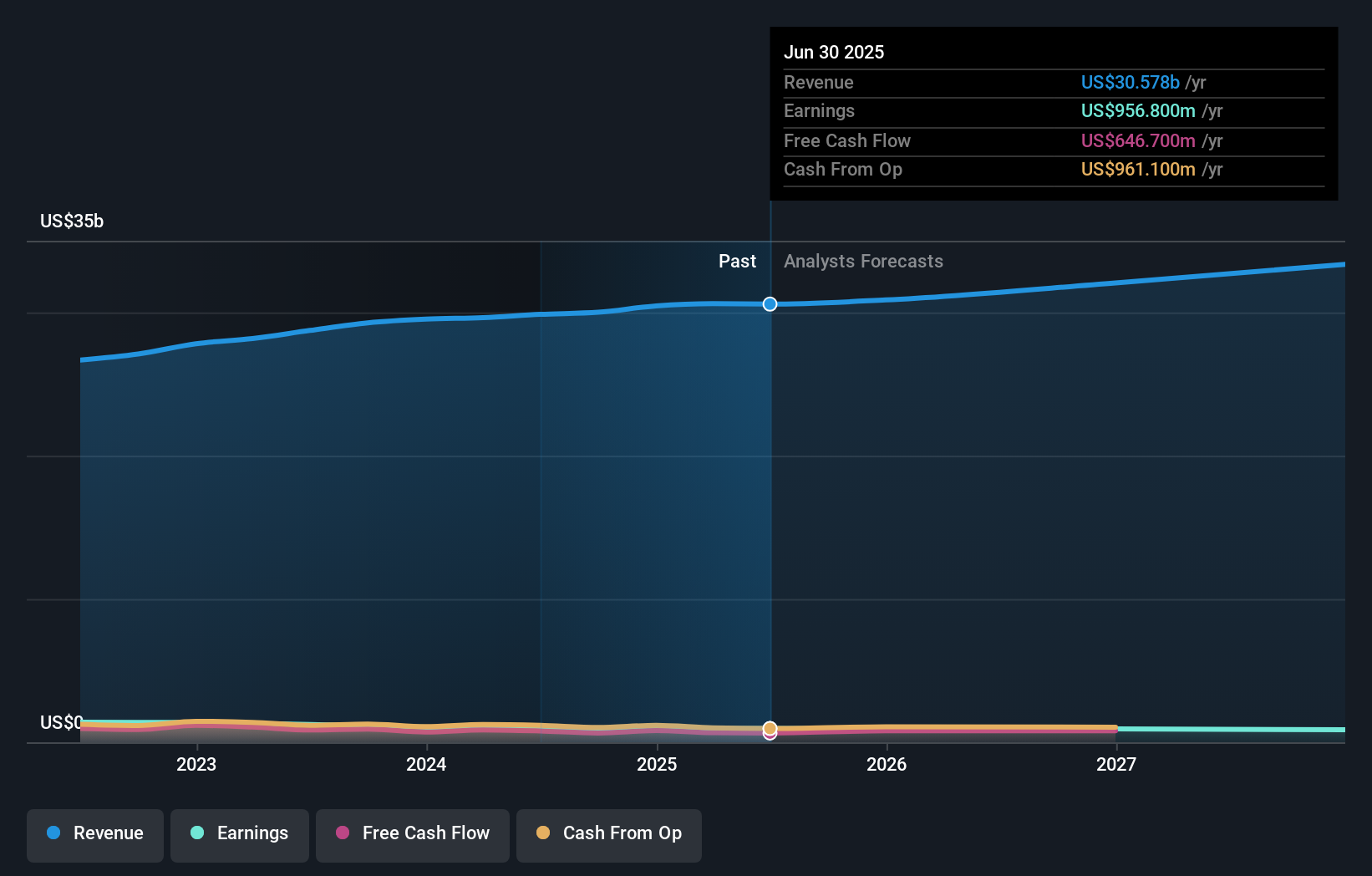

Penske Automotive Group's outlook anticipates $34.2 billion in revenue and $924.8 million in earnings by 2028. This scenario is based on a 3.8% annual revenue growth rate and a $32 million decrease in earnings from the current level of $956.8 million.

Uncover how Penske Automotive Group's forecasts yield a $179.86 fair value, a 8% upside to its current price.

Exploring Other Perspectives

From the Simply Wall St Community, there is only one fair value estimate for Penske Automotive Group at US$179.86, showing no range in member outlooks. Yet, as service and parts revenue growth forms a major catalyst, your understanding of the company’s future may differ, explore more community views to see how opinions compare.

Explore another fair value estimate on Penske Automotive Group - why the stock might be worth just $179.86!

Build Your Own Penske Automotive Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Penske Automotive Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Penske Automotive Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Penske Automotive Group's overall financial health at a glance.

No Opportunity In Penske Automotive Group?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PAG

Penske Automotive Group

A diversified transportation services company, operates automotive and commercial truck dealerships worldwide.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives