Thinking about what to do with Macy's stock? You are not alone. Whether you are a seasoned investor or just getting curious about retail names, Macy's has definitely been making some interesting moves that are catching attention. In the last week alone, shares have jumped 7.9% and year-to-date they are up 7.6%. If you zoom out further, Macy's has managed a stunning 191.0% return over the last five years. Not every retailer can say the same, especially as brick-and-mortar models continue to evolve with e-commerce trends.

This recent performance has not been all smooth sailing, but it does suggest a shifting perception about Macy's risk and upside. Investors could be responding to broader market optimism, or perhaps some subtle shifts in how Macy's is positioning itself within both fashion and department store segments. The key question now, of course, is whether the stock is actually undervalued and if those gains have room to run.

Looking at the numbers, Macy's currently scores a solid 4 out of 6 on a classic valuation check. This means it is considered undervalued against four out of six major measures. That is a strong signal for value-seekers, but numbers only tell part of the story. We will walk through the key valuation approaches that experts use and, by the end, I will share a perspective that just might give you the clearest angle of all.

Why Macy's is lagging behind its peers

Approach 1: Macy's Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to present value. This method aims to determine what those future dollars are worth today, considering uncertainty and the time value of money.

For Macy's, the DCF model uses the latest reported Free Cash Flow (FCF) of $457.7 million and projects changes over the next decade. Analysts expect Macy's annual FCF to reach about $656.5 million in 2026 and then $683.5 million in 2027, based on their detailed research. Beyond that, projections are extrapolated, anticipating some decline and then modest stabilization, with FCF expected at $441.8 million in 2035.

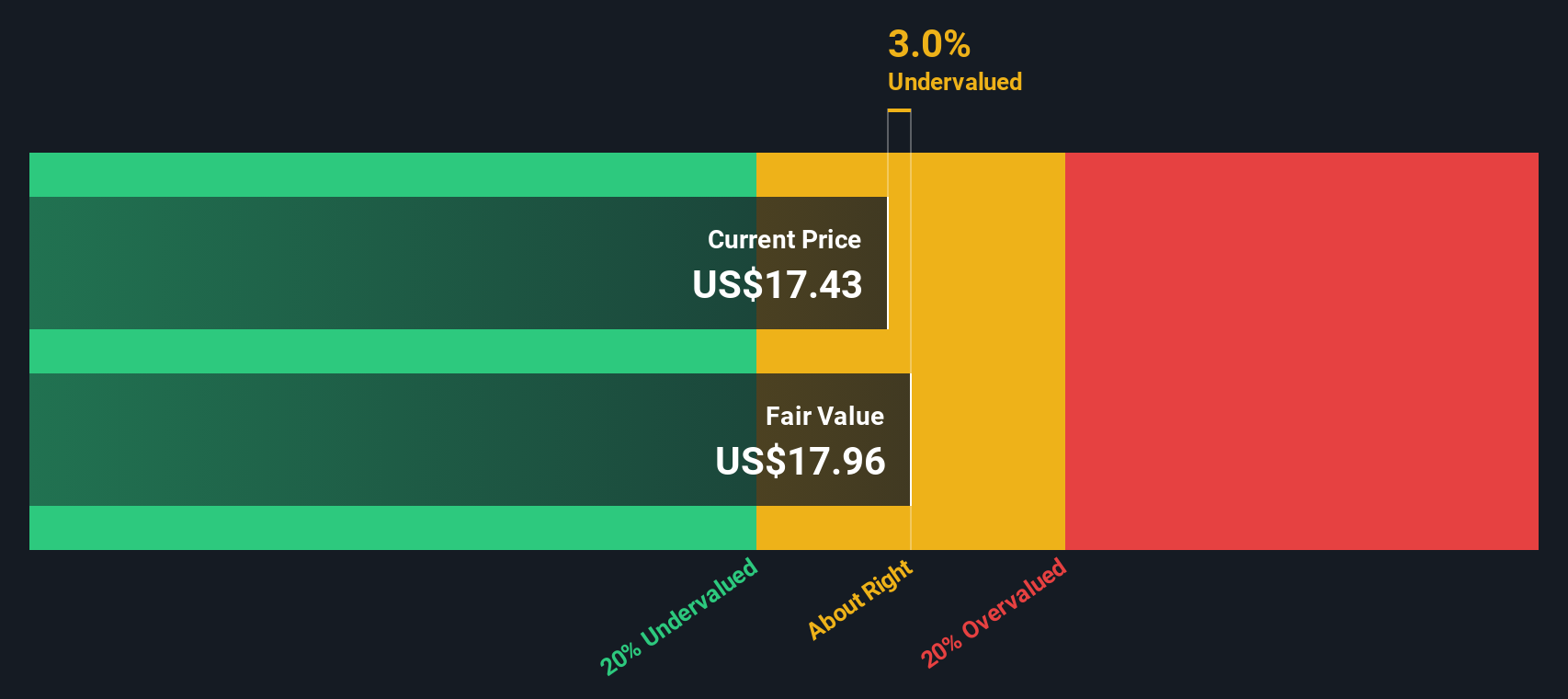

After calculating these future estimates and discounting them to today’s value, the DCF model arrives at a fair intrinsic value of $18.52 per share for Macy’s. Compared to where the stock currently trades, this implies it is about 3.8% undervalued.

The bottom line is that, according to the DCF approach, Macy’s share price is close to its intrinsic value.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Macy's's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Macy's Price vs Earnings

One of the most popular ways to value a profitable company like Macy’s is by using the Price-to-Earnings (PE) ratio. This metric tells investors how much they are paying for each dollar of company earnings, which is a crucial consideration when a business is generating consistent profits. The PE ratio makes it easier to compare companies of different sizes and evaluate whether a stock price seems justified relative to its earnings.

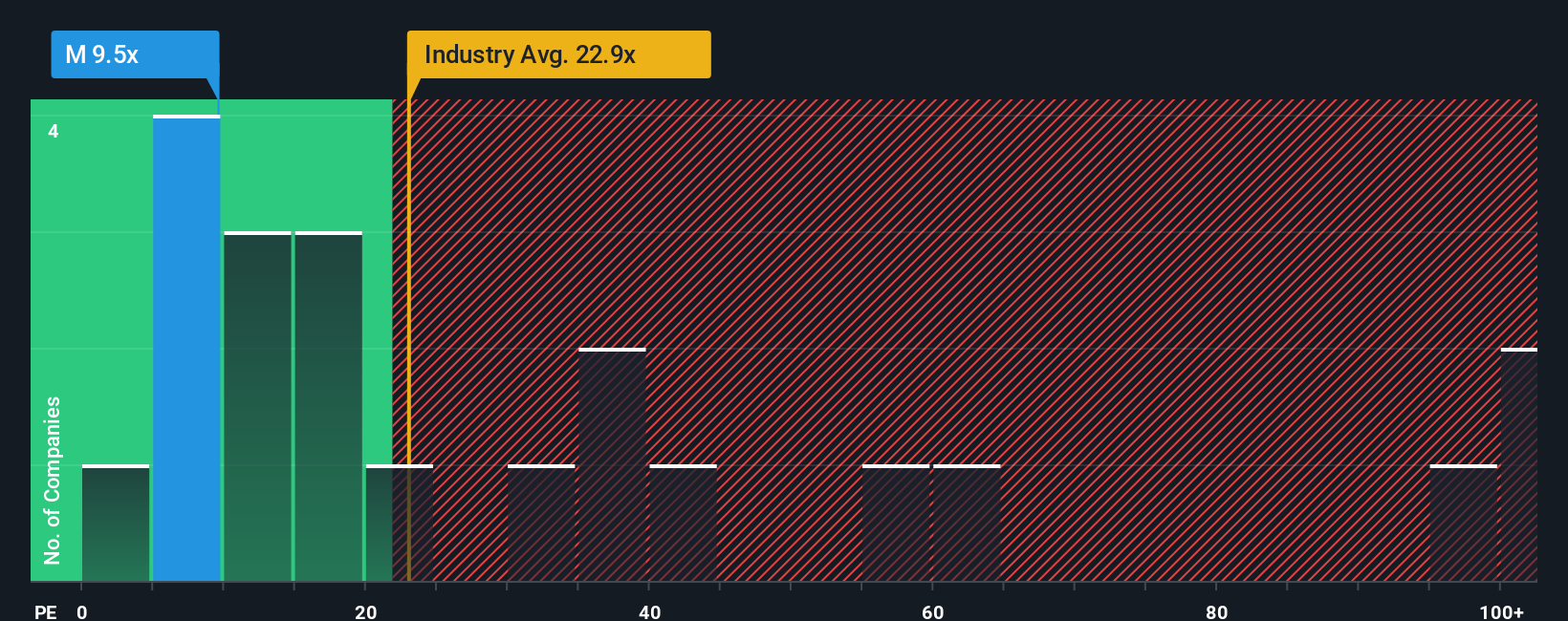

However, what counts as a “fair” PE ratio can vary widely based on factors such as growth expectations, business risks, and market sentiment. Fast-growing companies or those with fewer risks usually command higher PE ratios, while riskier or slower-growing firms trade at a discount. For context, Macy’s current PE ratio stands at 9.69x, which is much lower than the Multiline Retail industry average of 20.89x and the peer average of 28.38x. At first glance, this suggests Macy’s may be undervalued compared to its industry and peers.

This is where Simply Wall St’s proprietary “Fair Ratio” comes into play. The Fair Ratio estimates what Macy’s PE multiple should be given its growth outlook, profit margins, market cap, industry conditions, and risk profile. It goes beyond simple peer or industry averages by adjusting for Macy’s specific characteristics. For Macy’s, the Fair Ratio is 16.83x. Since Macy’s actual PE ratio (9.69x) is notably below this fair level, it indicates the market might be underestimating Macy’s earning power and future prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Macy's Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your own story about a company, combining your perspective and expectations for things like future revenue, earnings, and margins into a single, easy-to-understand thesis behind the numbers. Narratives connect what you know about a business—its challenges, strengths, and strategy—to a financial forecast and then estimate a fair value, letting your beliefs drive your investment decisions.

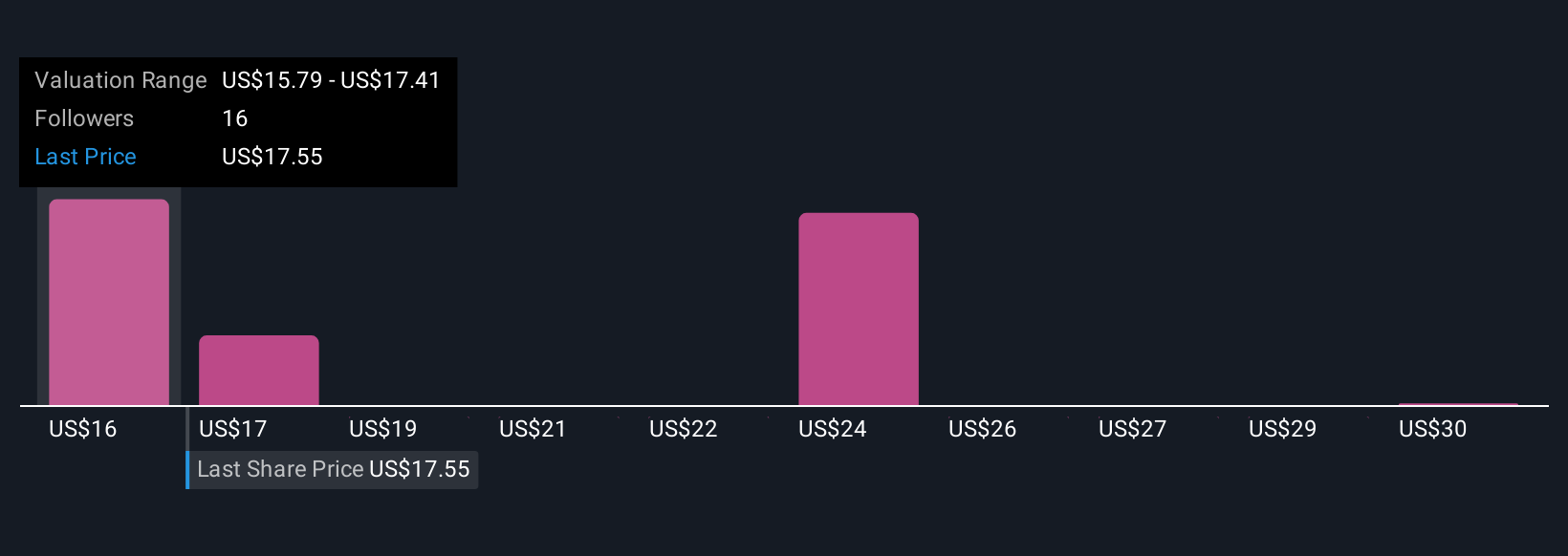

On Simply Wall St, Narratives are an accessible and dynamic tool available on the Community page, used by millions of investors to clarify their stance. Narratives help you decide when to buy or sell by comparing your assessed Fair Value to the current market Price, updating in real time as news, earnings, or new data come in. For instance, one Macy’s Narrative might see a fair value near $24 if you expect real estate monetization and e-commerce growth to boost results. Another might put fair value as low as $6 if you believe margin pressures and brick-and-mortar struggles will win out.

For Macy's, we’ll make it really easy for you with previews of two leading Macy's Narratives:

🐂 Macy's Bull CaseFair Value: $24.43

Undervalued by approximately 27.0%

Revenue Growth Rate: 5.57%

- Macy’s owns a large real estate portfolio, with the potential to raise $600 to $750 million over three years for debt reduction and new investments.

- Digital strength with over $7 billion in annual e-commerce sales and growing opportunities via a new media network.

- Challenges include long-term store closures and declining sales and margins, with the risk that turnaround efforts may fall short.

Fair Value: $15.79

Overvalued by approximately 12.9%

Revenue Growth Rate: -6.11%

- Omni-channel and store modernization investment is improving efficiency and customer experience, but pressures remain from e-commerce competition and consumer trends.

- Analysts expect falling revenues but some margin improvement, with share buybacks and portfolio optimization supporting nearer-term results.

- Risks include persistent margin pressures, dependence on discretionary spending, and the possibility that digital initiatives do not keep pace with market leaders.

Do you think there's more to the story for Macy's? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives