A Look at Macy’s (M) Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Macy's.

After a strong surge over the last month, Macy's recent gains continue a broader trend that has caught the eye of many investors. The 90-day share price return stands at an impressive 69.54%, fueling optimism and suggesting that momentum is building. Meanwhile, the one-year total shareholder return of 45.26% highlights how the current rally fits into larger gains for long-term holders.

If Macy’s momentum has you thinking about what else could be on the move, this is a perfect moment to broaden your investing search and discover fast growing stocks with high insider ownership

With shares surging well above analyst price targets, investors are left to wonder whether Macy’s is truly undervalued after its stellar run or if the market has already factored in all future growth potential.

Most Popular Narrative: 8.2% Undervalued

According to julio, the narrative sets Macy's fair value above its last close price, suggesting the stock may be attractively priced despite its recent rally. This balance between current gains and future potential creates more debate among investors.

Macy’s owns significant real estate that can be sold to provide liquidity, pay down debt, and finance new investments. The firm intends to raise about $600 million to $750 million from real estate sales over the next three years.

Want to know the mechanics behind this valuation? There is a focus on digital sales, asset monetization, and an earnings profile that sets Macy’s apart from rivals. Are these drivers enough to support such a high fair value? See which financial levers julio thinks could reshape the narrative.

Result: Fair Value of $24.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent store closures and declining profit margins remain real risks that could quickly undermine confidence in Macy’s current valuation narrative.

Find out about the key risks to this Macy's narrative.

Another View: Fair Value Through a Different Lens

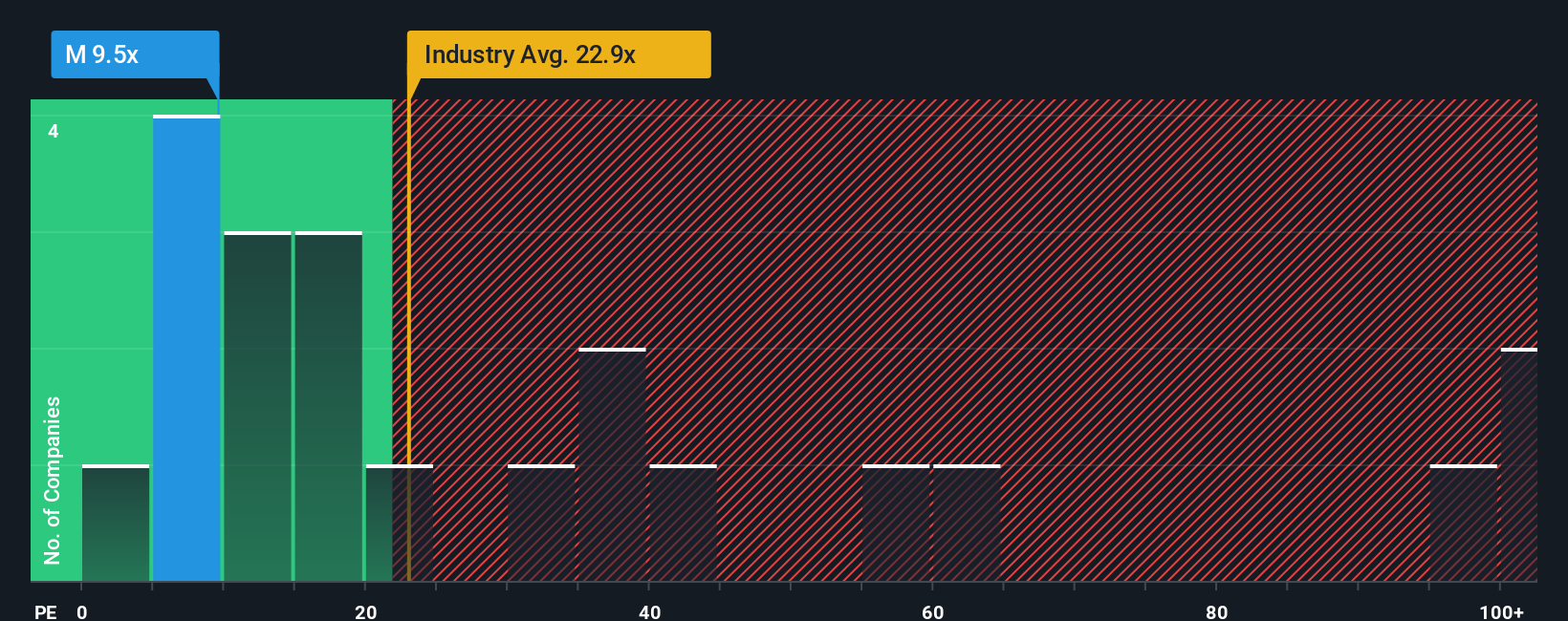

Some investors compare Macy’s current price using its price-to-earnings ratio. Right now, Macy’s ratio is 12.2x, which is lower than both the global industry average (19.8x) and its peer average (23.3x). The fair ratio estimate is 17.2x, so the market could reprice the stock higher or signals a margin of safety.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Macy's for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 934 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Macy's Narrative

If you have a different perspective or want to dig deeper into the details yourself, it’s quick and easy to build your own take on Macy’s story. Do it your way

A great starting point for your Macy's research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Great investing does not stop with a single stock. Make your next move count by using our powerful tools to uncover exceptional opportunities before the crowd catches on.

- Boost your passive income by targeting high-yield shares through these 15 dividend stocks with yields > 3% offering over 3% annual returns.

- Capitalize on the next wave of technology by evaluating the future potential of artificial intelligence leaders with these 25 AI penny stocks.

- Start strong by finding hidden gems trading below their intrinsic value in these 934 undervalued stocks based on cash flows to maximize your growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:M

Macy's

An omni-channel retail organization, operates stores, websites, and mobile applications in the United States.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.