- United States

- /

- Specialty Stores

- /

- NYSE:LOW

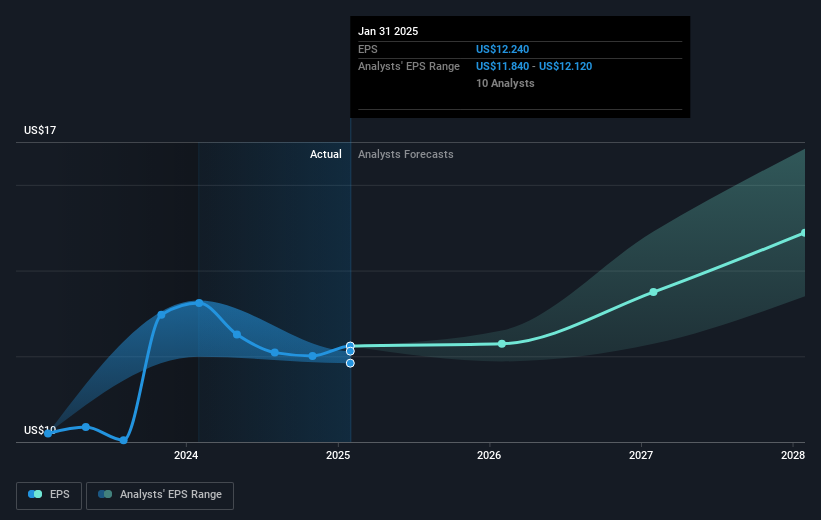

Lowe's Companies (NYSE:LOW) 2025 Sales Decline To US$83.7 Billion With Earnings Guidance At US$12.15 To US$12.40 EPS

Reviewed by Simply Wall St

Lowe's Companies (NYSE:LOW) recently reported its earnings results and 2025 corporate guidance. The company announced a decrease in sales and net income for the fiscal year ending January 31, 2025, with sales at $83,674 million and net income at $6,957 million, both down from the previous year. In response, shares moved marginally by 0.16% over the last week, which could be related to stable sales expectations for 2025, with guidance predicting total sales between $83.5 billion and $84.5 billion. Meanwhile, broader U.S. stock markets have seen volatility, with mixed movements as evidenced by fluctuations in the Dow Jones, Nasdaq, and S&P 500. Although broader market concerns about tariffs and economic health have led to notable declines elsewhere, Lowe's seems to be relatively stable amid this context. Such resilience may indicate investor confidence in the company's steady outlook compared to the wider market's recent turbulence.

Take a closer look at Lowe's Companies's potential here.

The last five years have seen Lowe's Companies, Inc. deliver a robust total shareholder return of 138.53%, driven by consistent efforts to enhance shareholder value. This period has included ongoing share repurchases, such as the recent buyback updates in November and August 2024, totaling several million shares. These buybacks have likely contributed to bolstering the stock performance. Additionally, Lowe's commitment to providing reliable dividends, highlighted by their declarations in August and November 2024, has further supported investor returns.

Throughout this time, Lowe's has also focused on innovation and strategic partnerships. The introduction of the Lowe's Digital Home Platform in November 2024 and a partnership with Sunrun in February 2024 exemplify these endeavors, likely enhancing the company's market presence. However, despite these efforts, Lowe's underperformed against both the US market and the Specialty Retail industry over the past year, with the market yielding a return of 16.9% and the industry returning 9.1%, compared to the company's performance.

- See how Lowe's Companies measures up with our analysis of its intrinsic value versus market price.

- Assess the downside scenarios for Lowe's Companies with our risk evaluation.

- Got skin in the game with Lowe's Companies? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives