- United States

- /

- Specialty Stores

- /

- NYSE:LOW

Assessing Lowe's (LOW) Current Valuation Following Recent Share Price Stabilization

Reviewed by Kshitija Bhandaru

Lowe's Companies (LOW) stock has moved sideways lately, with a slight uptick of around 1% today. Despite some recent volatility and underwhelming returns over the past year, investors may find its valuation interesting at current levels.

See our latest analysis for Lowe's Companies.

Lowe's share price has seen its fair share of swings, with a sharp correction in the past month and a year-to-date dip. That said, momentum may be stabilizing as recent volatility gives way to longer-term gains; the stock still sports a 28% total shareholder return over three years. Investors are weighing these moves in light of broader valuations and the company’s track record of profitability.

If you’re wondering what other opportunities the market may be offering right now, it could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With shares trading nearly 20% below consensus analyst price targets and the company maintaining steady growth, the real question is whether Lowe's is undervalued at these levels or if the market has already accounted for future gains.

Most Popular Narrative: 16.8% Undervalued

Lowe’s narrative fair value of $281.84 is noticeably above the latest close at $234.48. The narrative reflects expectations of future growth and margin improvement, setting the tone for a bullish outlook.

Ongoing pent-up demand from delayed home improvement projects, combined with record-high aging U.S. housing stock and an estimated 18 million new homes needed by 2033, points to a significant runway for future growth in renovation, repair, and new construction; this will positively affect revenue and support sustained top-line expansion as the housing cycle recovers.

Curious what’s fueling this ambitious price target? The real story is in the assumptions, including improving profit margins and growth metrics typically reserved for market leaders. Can such numbers justify a premium multiple? Find out what bold forecasts drive this valuation and why analysts are seeing green lights for future earnings.

Result: Fair Value of $281.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, major acquisitions bring integration risk, and persistent labor shortages could pressure Lowe's profit margins. Both of these factors could reshape investor optimism.

Find out about the key risks to this Lowe's Companies narrative.

Another View: What Do Market Multiples Say?

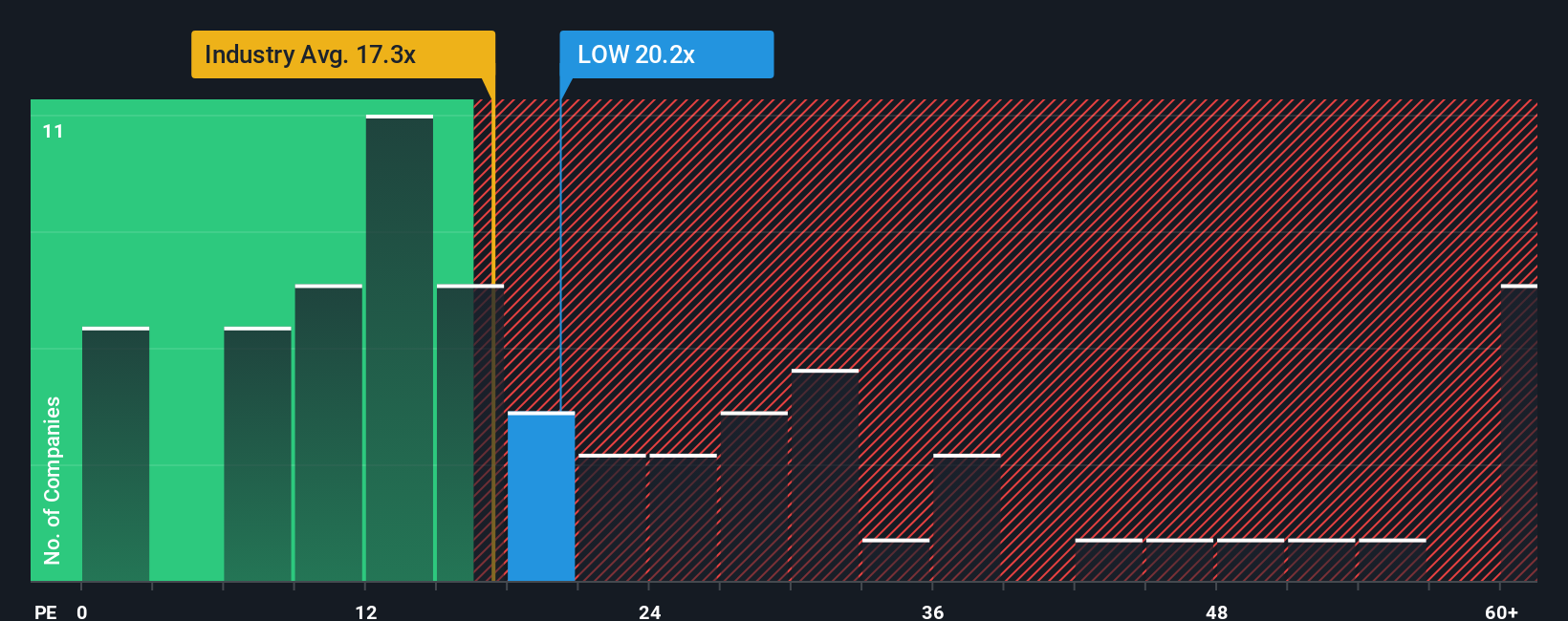

Looking at valuation from another perspective, Lowe’s shares currently trade at a price-to-earnings ratio of 19.2x. This is higher than the industry average of 15.8x, making shares look a bit expensive relative to sector peers. Although this is below the peer group average of 32.2x, it is still notable. The market’s fair ratio is estimated at 20.9x, which suggests some room for upward movement, but also highlights that expectations are already built in. Is there still value left in this price, or could optimism be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Lowe's Companies Narrative

If you see things differently or like to dive into the numbers yourself, you can easily shape your own narrative in just a few minutes: Do it your way

A great starting point for your Lowe's Companies research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Action today could put you ahead tomorrow. Get smart about your next move and tap into fresh opportunities beyond Lowe's using our powerful screeners.

- Unlock growth potential and explore the next wave of healthcare breakthroughs by investigating these 33 healthcare AI stocks which is making waves in medical innovation.

- Boost your portfolio with steady cash flow by targeting these 18 dividend stocks with yields > 3% that offer yields above 3% for consistent income.

- Seize overlooked value and look beyond the noise with these 891 undervalued stocks based on cash flows based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LOW

Lowe's Companies

Operates as a home improvement retailer in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026