- United States

- /

- Specialty Stores

- /

- NYSE:LAD

Is Lithia Motors a Bargain After Recent Share Price Dip and DCF Outlook?

Reviewed by Bailey Pemberton

- If you have been wondering whether Lithia Motors at around $339 a share is a genuine value opportunity or just another cyclical auto play, you are in the right place.

- The stock has dipped about 1.4% over the last week, but it is still up roughly 15.5% over the past month, even though it remains slightly negative year to date and over the last year. This hints that sentiment might be turning after a softer stretch.

- Recently, investors have been digesting updates on Lithia’s ongoing dealership acquisition strategy and network expansion. These signal that management is still leaning into growth despite a choppy auto demand backdrop. At the same time, headlines around used car pricing, interest rate expectations, and consumer credit trends have added nuance to how the market is pricing auto retailers and their long term earnings power.

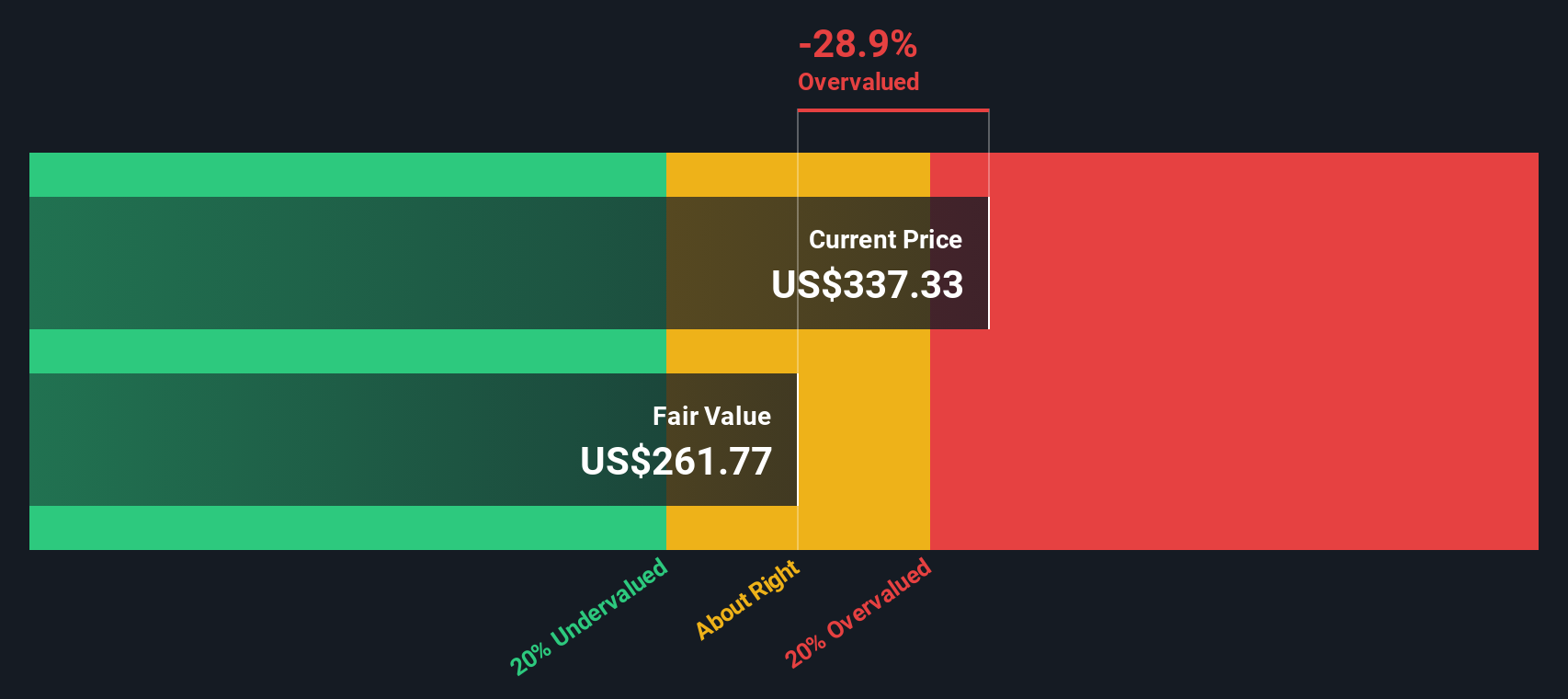

- Against that backdrop, Lithia screens as attractively priced on our framework, scoring a 5/6 valuation check, which suggests it looks undervalued on most of the classic metrics we track. Next, we will break down those valuation approaches in detail, and then circle back to a more holistic way of thinking about what the stock is really worth.

Find out why Lithia Motors's -5.0% return over the last year is lagging behind its peers.

Approach 1: Lithia Motors Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today, to reflect the time value and risk of those dollars.

For Lithia Motors, the latest twelve month Free Cash Flow is slightly negative at around $47 million, which reflects near term investment and working capital swings rather than mature, steady state economics. Looking ahead, analysts and extrapolated estimates point to a sharp improvement, with Free Cash Flow expected to reach about $1.56 billion by 2029 and continue to grow toward roughly $2.67 billion by 2035. These projections come from a 2 Stage Free Cash Flow to Equity model, in which early years use analyst forecasts and later years are extrapolated by Simply Wall St.

When all those future cash flows are discounted back, the model suggests an intrinsic value of about $739.66 per share, implying the stock is trading at roughly a 54.1% discount to its estimated worth. On this framework, Lithia screens as meaningfully undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lithia Motors is undervalued by 54.1%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Lithia Motors Price vs Earnings

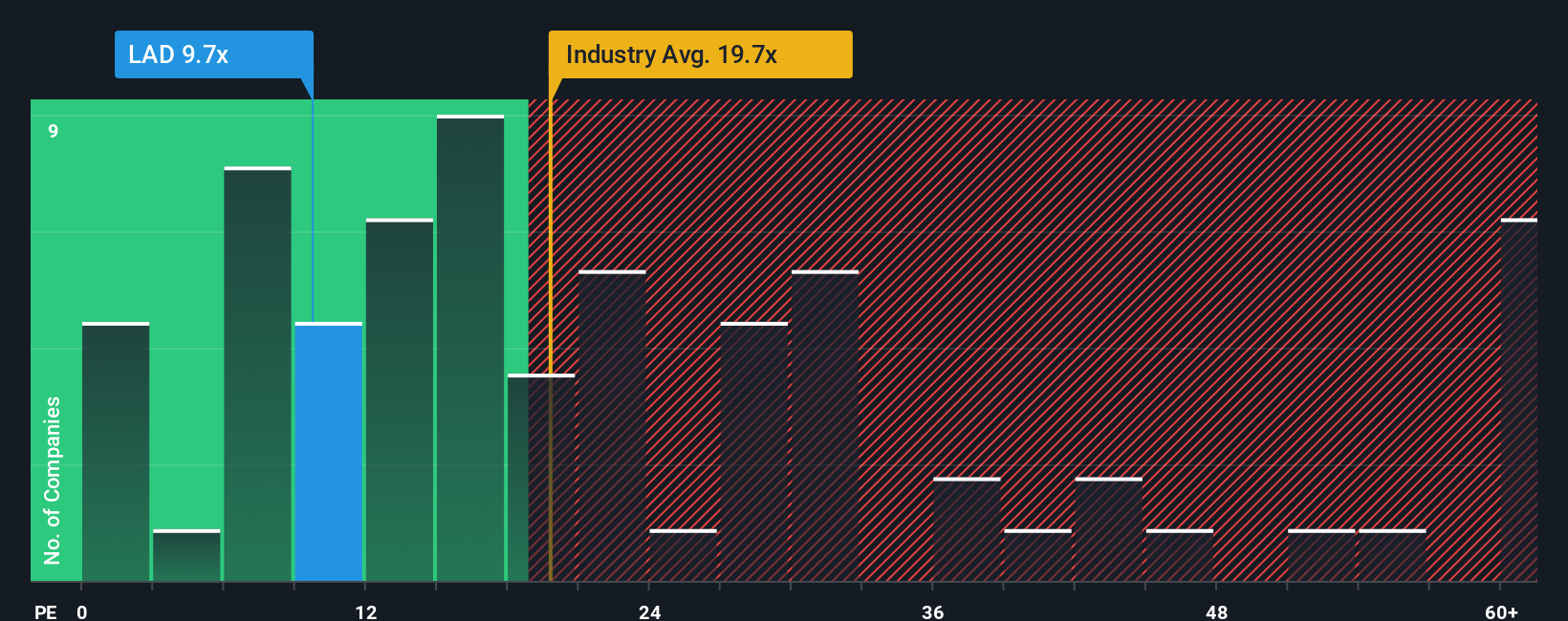

For a consistently profitable business like Lithia Motors, the Price to Earnings ratio is a useful yardstick because it links what investors pay for each share directly to the company’s underlying earnings power. In general, faster growing, higher quality, and less risky companies can justify a higher PE multiple, while slower growth or higher uncertainty usually warrants a lower one.

Right now, Lithia trades on a PE of about 9.1x, noticeably below the Specialty Retail industry average of roughly 21.1x and also below the peer group average of about 13.1x. To go a step further, Simply Wall St calculates a proprietary “Fair Ratio” for each stock, which for Lithia comes out at around 16.6x. This Fair Ratio estimates what a reasonable PE should be given factors like Lithia’s earnings growth outlook, its industry, profit margins, size, and risk profile.

Because the Fair Ratio is tailored to Lithia’s specific fundamentals, it is more informative than a simple peer or industry comparison. With the shares trading at 9.1x compared to a Fair Ratio of 16.6x, the stock screens as significantly undervalued on this multiple-based view.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lithia Motors Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you turn your view of Lithia Motors into a clear story, link that story to specific forecasts for revenue, earnings, and margins, and then translate those forecasts into a fair value you can compare to today’s price to help you decide how to approach the stock. The whole Narrative automatically updates as new news or earnings arrive, and it allows for very different but equally structured perspectives. For example, one investor might believe that luxury acquisitions, digital platforms, and financing scale easily justify a fair value closer to the high analyst target of around 500 dollars. Another, more cautious investor might focus on acquisition risks, margin pressure, and disruption to argue for something nearer the low target of about 310 dollars. All of this is available within an accessible, guided framework used by millions of other investors.

Do you think there's more to the story for Lithia Motors? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LAD

Lithia Motors

Operates as an automotive retailer in the United States, the United Kingdom, and Canada.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion