What Kohl's (KSS)'s Launch of FLX Kidswear Reveals About Its Proprietary Brand Strategy

Reviewed by Sasha Jovanovic

- Recently, Kohl's expanded its proprietary brands portfolio by launching FLX apparel for kids, offering activewear and athleisure styles aimed at comfort, versatility, and value in stores and online, with further store expansion planned for 2026.

- This move brings a popular adult-focused brand to a younger demographic, reflecting Kohl's ongoing strategy to refresh its offerings and appeal to evolving family needs amid broader retail shifts.

- We'll explore how the launch of FLX kidswear may influence Kohl's investment narrative, especially its efforts to strengthen proprietary brands.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Kohl's Investment Narrative Recap

At its core, an investment in Kohl’s relies on the belief that ongoing brand reinvention, expanded proprietary offerings, and strengthened omnichannel capabilities can offset declining store traffic and persistent competitive pressures. The launch of FLX kidswear is an incremental step in this plan, but by itself does not materially move the needle for near-term revenue growth or address the biggest risk: structurally declining demand among core value-oriented shoppers.

Among recent updates, Kohl's Q2 earnings report stands out. The company delivered net income growth despite year-over-year declines in sales, with management emphasizing progress on its 2025 initiatives, including improving gross margins and executing cost controls, both essential to offset challenges identified in the current risk profile. Yet, even as growth strategies continue, the traction required to reverse negative sales trends remains uncertain.

Yet looming in the background, investors should not ignore the ongoing structural shift away from traditional department stores...

Read the full narrative on Kohl's (it's free!)

Kohl's narrative projects $15.2 billion revenue and $199.4 million earnings by 2028. This requires a 1.6% annual revenue decline and a $9.6 million decrease in earnings from the current $209.0 million.

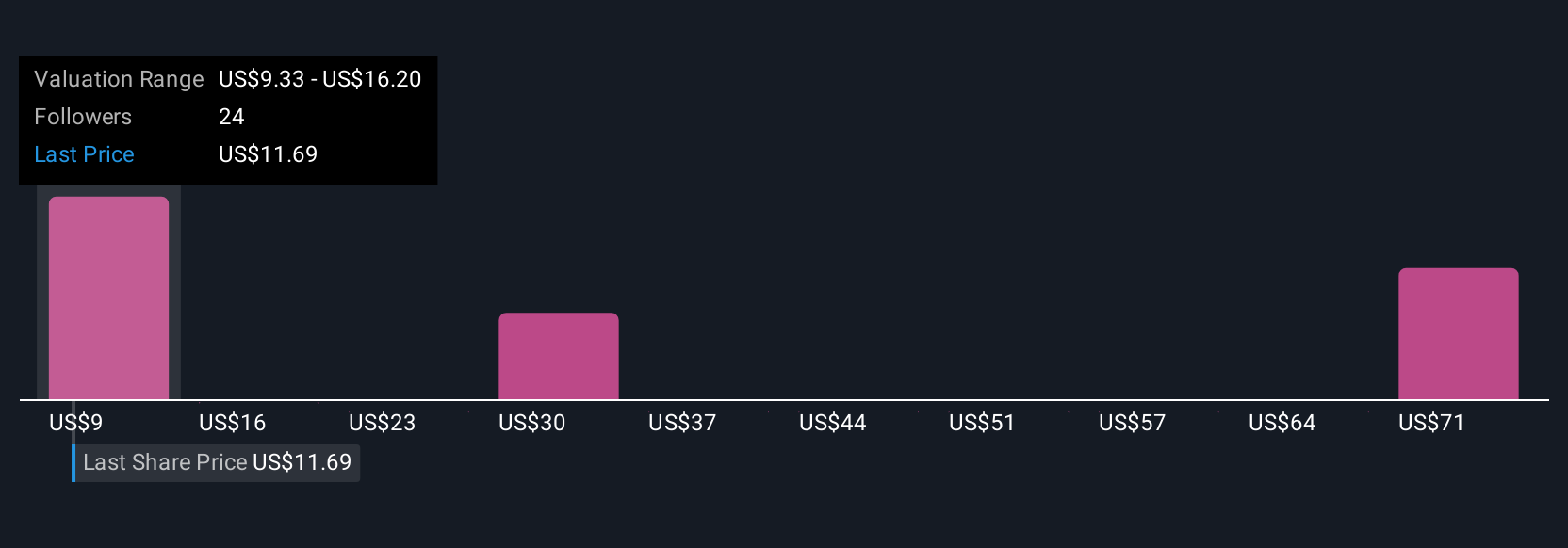

Uncover how Kohl's forecasts yield a $14.92 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Fair value estimates from 5 Simply Wall St Community members span from US$14.72 to US$59.94, showing a broad mix of opinions. While perspectives run the gamut, shrinking demand from Kohl's core shoppers underscores the uncertainty facing future earnings and revenue growth, explore how these contrasting views may influence your own outlook.

Explore 5 other fair value estimates on Kohl's - why the stock might be worth 13% less than the current price!

Build Your Own Kohl's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Kohl's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kohl's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives