Sizing Up Kohl's After 33% Meme Rally and Analyst Price Target Hike

Reviewed by Bailey Pemberton

Trying to figure out what to do with Kohl's stock right now? You are not alone. Plenty of investors are tuning in after a rollercoaster few months, with headlines ranging from analysts bumping up their price targets to the stock becoming a center of “meme” stock buzz. Despite short-term swings, uncertainty, and even some skepticism about how the company is handling its bills, Kohl's shares have attracted lots of attention from retail investors hoping for a turnaround.

Let us unpack the movements. Over the past week, Kohl’s was down just 0.3%, which seems like barely a ripple compared to a 10.3% drop over the last month. Year-to-date, however, the stock is actually up more than 10%. This is a reminder that sentiment can shift quickly, especially when social media chatter and analyst opinions start heating up. Remember when Evercore ISI jumped their price target from $8 to $13? Moves like that catch eyes, even as the longer-term picture remains tougher, with shares off nearly 32% across three years and almost 21% over the last twelve months.

But what about valuation? Are shares cheap by the numbers? Using our six-point checklist, Kohl’s scores a 5, signaling it is undervalued by most standard measures. That alone makes a deeper look worthwhile. Stick around as we dive into how the numbers add up across each method, and why the key to truly sizing up Kohl’s might go beyond the checklists entirely.

Why Kohl's is lagging behind its peers

Approach 1: Kohl's Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company's future cash flows and discounting them back to today's value to estimate what the business is really worth right now. Essentially, it answers the question: if you could collect all of Kohl’s future cash flows in today’s dollars, how much would that be?

For Kohl’s, current Free Cash Flow sits at $430.96 million. Analysts forecast growth in these cash flows over the coming years, suggesting Free Cash Flow could reach approximately $628 million by 2028. Since analysts typically provide up to five years of outlooks, projections beyond this are estimated using long-term growth trends, resulting in an expected figure of $832.92 million in 2035.

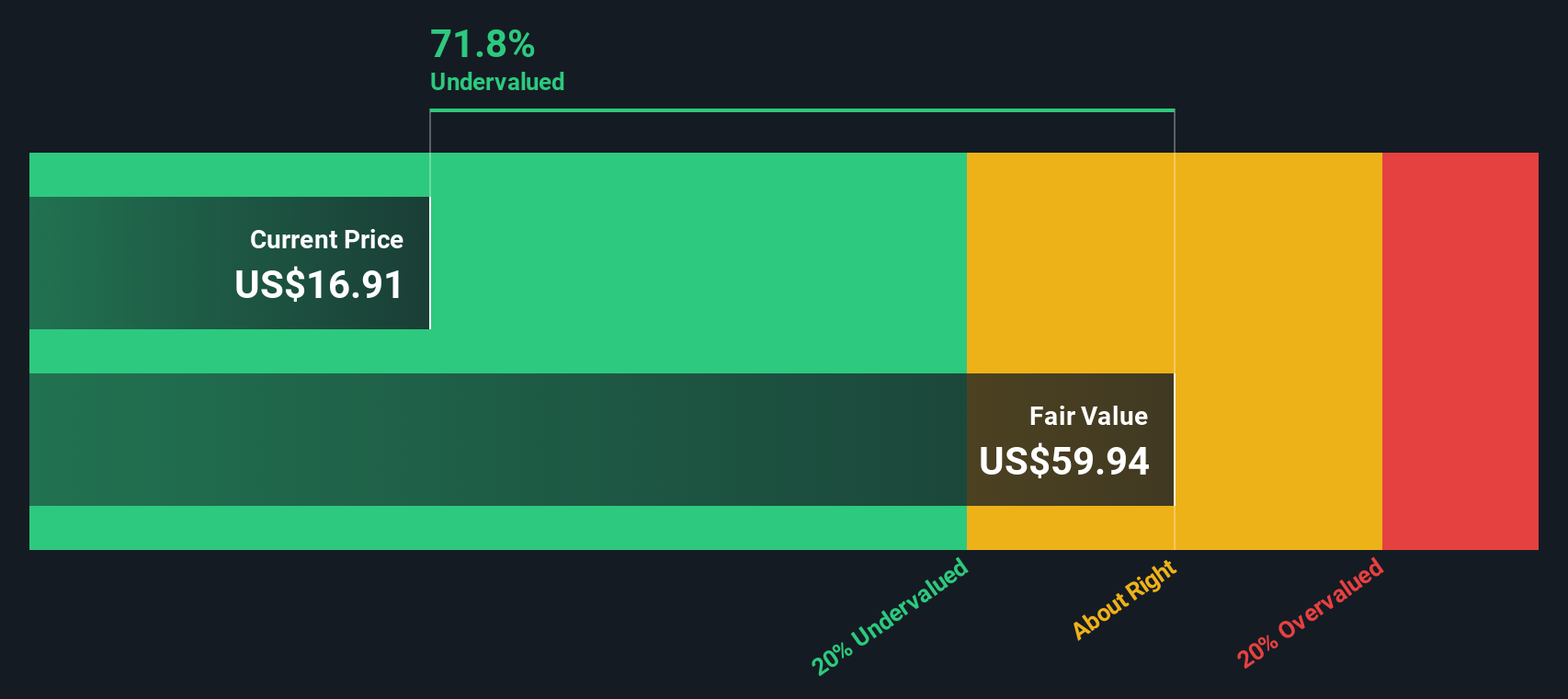

Entering these projections into the 2 Stage Free Cash Flow to Equity model, Kohl’s intrinsic value is calculated to be $59.94 per share. With the stock trading at a price that is around 74.2% below this calculated value, the DCF suggests Kohl’s is deeply undervalued by the market at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kohl's is undervalued by 74.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kohl's Price vs Earnings

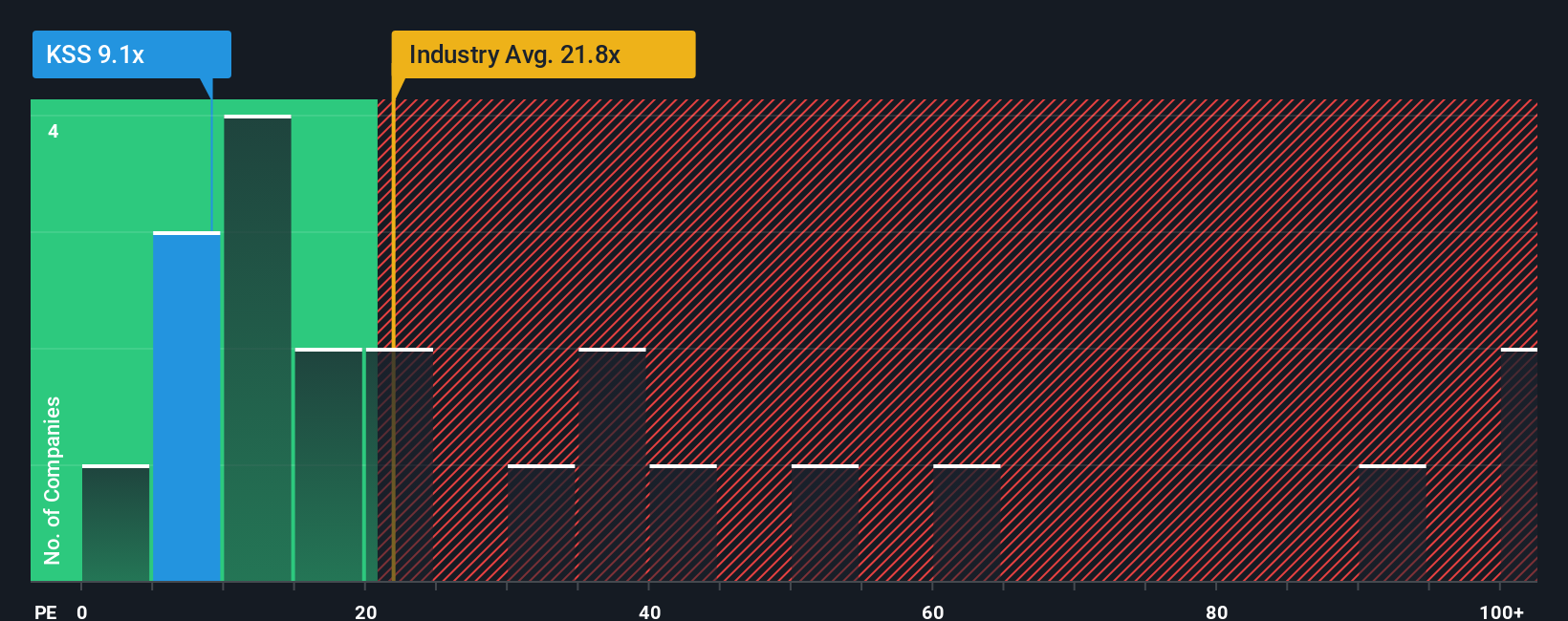

The Price-to-Earnings (PE) ratio is widely used for valuing profitable companies like Kohl’s, since it compares the company’s market price to its annual earnings. This allows investors to quickly gauge how much they are paying for each dollar of profit. Generally, growing companies or those with more predictable earnings command higher PE ratios. Riskier or slower-growing firms tend to trade at lower multiples.

Kohl’s is currently trading at a PE ratio of 8.3x, which is markedly lower than both the Multiline Retail industry average of 21.4x and the peer average of 38.7x. At first glance, this suggests that the market has priced in more risk or lower future earnings growth for Kohl’s compared to its competitors.

However, Simply Wall St’s proprietary “Fair Ratio” for Kohl’s is 22.3x. This metric goes a step further than typical industry or peer comparisons. The Fair Ratio incorporates factors such as the company’s expected earnings growth, profit margins, underlying risks, industry context, and market capitalization to provide a more tailored and realistic benchmark.

When we compare Kohl’s actual PE of 8.3x to its Fair Ratio of 22.3x, the stock appears significantly undervalued by this metric. This reflects far more pessimism in the stock price than the company’s fundamentals and outlook might warrant.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kohl's Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company: the reasoning, expectations, and numbers that explain how you believe its future will unfold and what a fair value should be. Narratives connect your perspective on Kohl’s situation to a financial forecast and ultimately to a fair value, making the investment case clearer and more actionable.

Narratives are easy to create or follow, and are available to everyone on the Simply Wall St Community page, allowing you to see how millions of other investors think about the same stock. When you use Narratives, you are not just crunching numbers; you are drawing a line from Kohl's real-world challenges and opportunities, through your own estimates for future revenue, earnings, and margins, right to a price target that you can compare with what the market is offering today. Because Narratives automatically update with fresh data (like new earnings reports or breaking news), you can quickly sense if it is time to reconsider your view or act on new information.

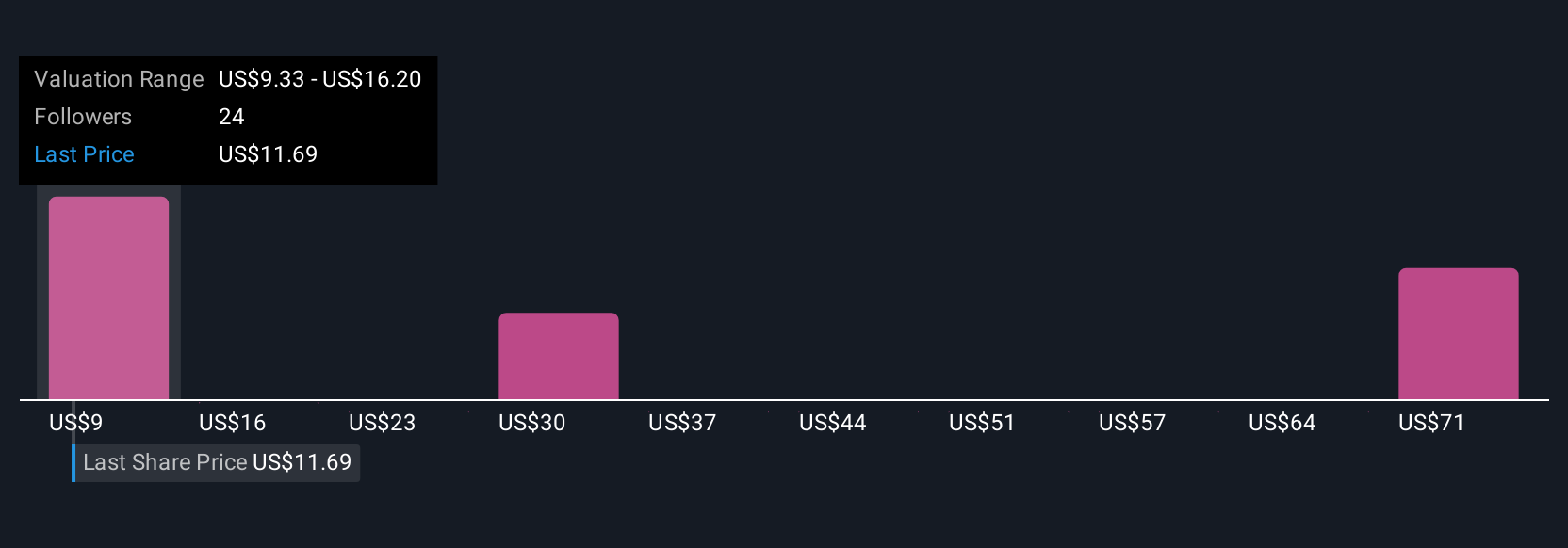

For example, some investors currently believe Kohl’s could be worth $34 per share based on real estate and turnaround potential, while others see risks limiting value closer to $4.50. Exploring these Narratives side-by-side can help you decide which view aligns best with your own research.

For Kohl's, we’ll make it really easy for you with previews of two leading Kohl's Narratives:

Fair Value: $34.00

Undervalued by 54.4%

Implied Revenue Growth Rate: 48.01%

- The narrative argues that the market has overreacted to recent declines, pricing Kohl’s below even its liquidation value, despite strong free cash flow and valuable real estate assets.

- Short interest is high and the risk of bankruptcy is viewed as overstated, with the company managing debt and store profitability effectively.

- The fund behind this view sees potential for a buyout or privatization, suggesting current prices offer a strong entry point for long-term investors and citing a long-term price target of $34 per share.

Fair Value: $14.92

Overvalued by 3.8%

Implied Revenue Growth Rate: -1.52%

- This perspective highlights ongoing declines in store traffic and structural headwinds from shifting consumer behavior away from traditional retail, limiting future growth prospects.

- Margin pressures from increased promotions, higher labor costs, and lagging digital transformation are expected to hinder earnings and profitability.

- Analysts, despite some optimism around new partnerships and cost controls, ultimately believe the current share price exceeds realistic fair value, with most forecasts suggesting stagnation or decline.

Do you think there's more to the story for Kohl's? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives