Kohl's (NYSE:KSS) recently saw significant leadership changes, including the termination of CEO Ashley Buchanan and the appointment of Michael Bender as interim CEO, followed by John Schlifske becoming the new Chair of the Board. These events coincided with a 10% decline in Kohl's stock price over the past week. While the broader market remained flat during this period, such substantial shifts in leadership could have increased investor uncertainty, potentially influencing the company's stock performance. The resignation of Christine Day and the reduction in board size likely added to this cautious sentiment among investors.

The recent leadership changes at Kohl's, including the CEO termination and Board restructuring, introduced a period of uncertainty that seems to have impacted investor sentiment and may be influencing revenue and earnings forecasts. These shifts come amid efforts to refocus on core categories, optimize merchandise strategy, and enhance the omnichannel shopping experience. However, such substantial organizational changes can lead to operational challenges, potentially affecting customer engagement and, consequently, revenue and net margins.

Over the past five years, Kohl's has seen a total shareholder return decline of 49.63%. While the company has been making moves to stabilize, this longer-term performance suggests significant challenges in maintaining investor confidence. Compared to the past year's performance, when Kohl's underperformed the US market, returning below 8%, these figures underscore ongoing competitive struggles within the retail sector.

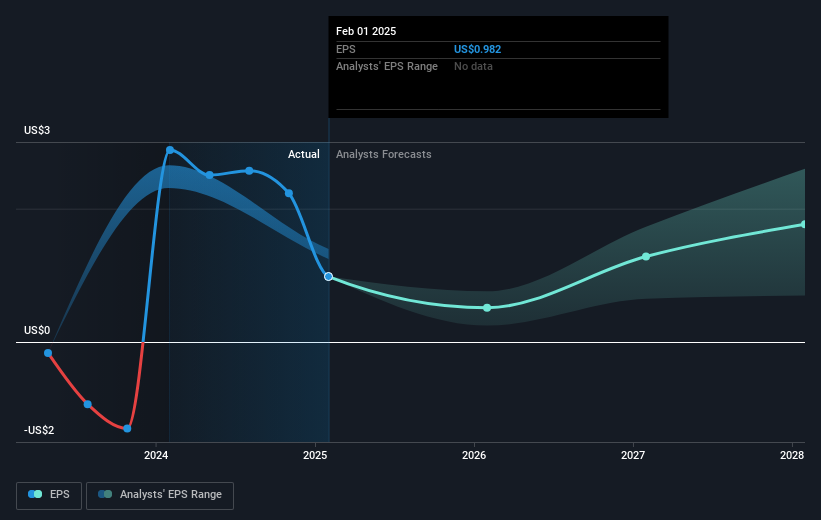

Revenue forecasts suggest a 5% annual decline amid decreasing sales and digital setbacks, while earnings are projected to increase to US$239.3 million by 2028. With the recent strategic moves, investors may be cautious, influencing share price expectations. Kohl's current share price of US$6.82 represents a 29.4% discount to the consensus analyst price target of US$9.66, reflecting differing views on potential recovery and value realization. As changes take hold, it remains pivotal for investors to consider both the operational adjustments and market factors in evaluating future prospects.

Examine Kohl's earnings growth report to understand how analysts expect it to perform.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kohl's, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued moderate.

Similar Companies

Market Insights

Community Narratives