Kohl's (KSS): Fresh Look at Valuation After Q2 Earnings Beat and Strategic Progress

Reviewed by Kshitija Bhandaru

Kohl's (KSS) shares have surged 18% since the company delivered second-quarter results that beat expectations on both revenue and earnings. Management pointed to meaningful progress on its 2025 strategic initiatives, which investors seem to be watching closely.

See our latest analysis for Kohl's.

After a bumpy stretch, Kohl's recent 17.7% stock surge following its earnings beat shows renewed optimism about its turnaround story. The longer-term view remains mixed, with a five-year total shareholder return of just 5.6%. Momentum is clearly building in the short term as investors respond to tangible progress, but some are still weighing the broader challenges facing retailers like Kohl's.

If you're looking to expand your watchlist beyond retail, now is a great time to explore fresh ideas with our fast growing stocks with high insider ownership.

With all eyes on Kohl's recent rally, the key question now is whether shares remain undervalued given mixed long-term returns or if the market has already priced in a recovery and future growth. Is there still a buying opportunity?

Most Popular Narrative: 13% Overvalued

Kohl’s narrative price target of $14.92 is below the current share price of $16.91, signaling that its recent rally may have outpaced what analysts consider reasonable based on fundamentals. The narrative reflects higher confidence after a better-than-expected earnings report, but not enough to support the stock’s current price.

Enhanced own brands, the Sephora partnership, digital upgrades, and strict cost controls may boost margins, drive customer growth, and support lasting revenue improvement. Catalysts: About Kohl's, operates as an omnichannel retailer in the United States.

Want to know which retail transformation bets underpin this valuation? The secret weapon is not just beauty counters or buzz. The key assumptions driving this narrative include bold moves in profitability, traffic, and brand strategy. Curious about the real numbers fueling these analyst forecasts? Dive into the narrative to see the details behind the premium placed on Kohl's turnaround.

Result: Fair Value of $14.92 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a strong recovery in proprietary brands or rapid digital gains could defy expectations and reignite growth well beyond current analyst forecasts.

Find out about the key risks to this Kohl's narrative.

Another View: SWS DCF Model Shows Different Story

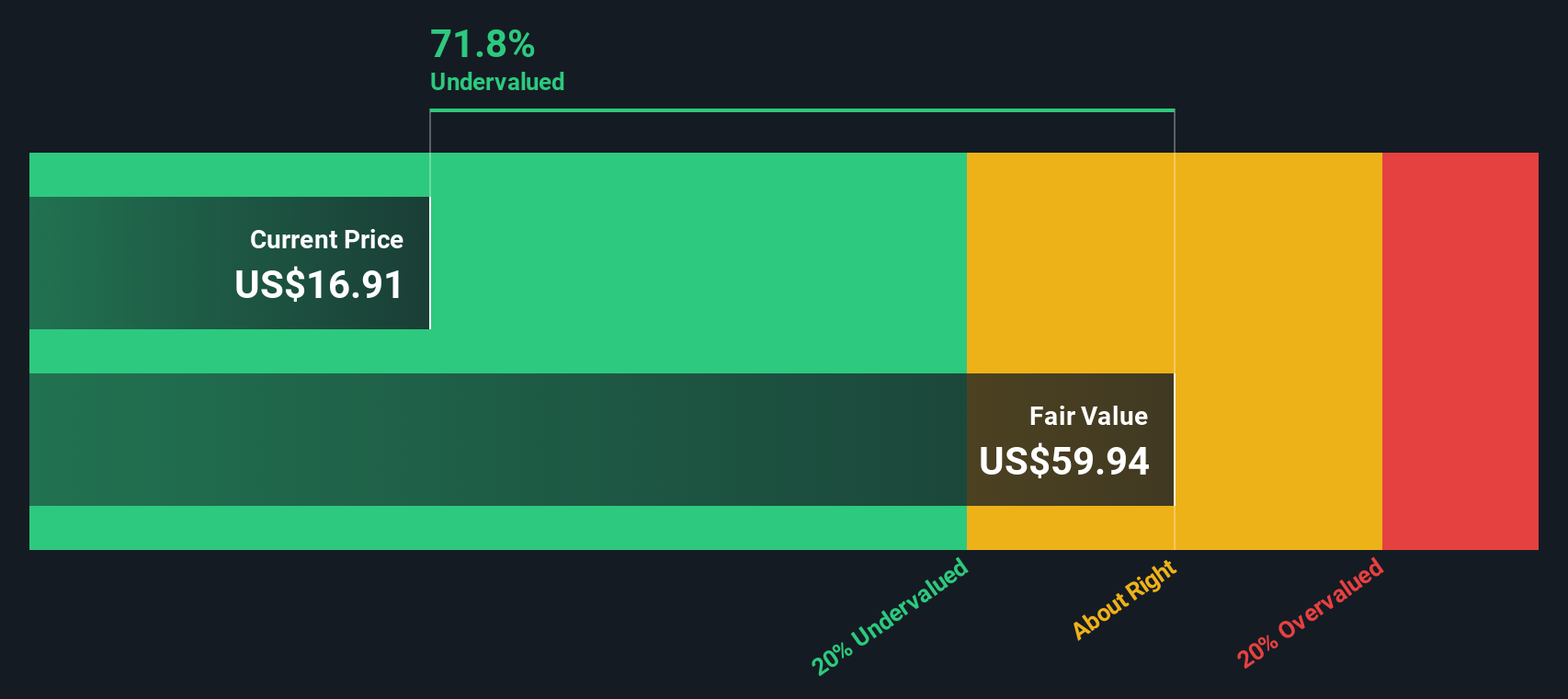

While analysts currently see Kohl's as overvalued based on earnings multiples, our SWS DCF model points in a very different direction. The DCF suggests shares could be significantly undervalued, which implies that market pessimism about Kohl's long-term cash flows might be overdone. Which approach gets closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kohl's Narrative

If you want to dig into the underlying numbers yourself or take a different perspective, you can craft your own narrative quickly and easily in just a few minutes, all with our Do it your way.

A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Expand your horizons with handpicked stocks that could be tomorrow’s winners. Don’t miss out on these unique angles.

- Maximize potential by tracking steady cash flows and unlock value with these 896 undervalued stocks based on cash flows, offering robust fundamentals many investors overlook.

- Boost your yield with these 19 dividend stocks with yields > 3% to find companies rewarding shareholders with consistent and attractive dividends above 3%.

- Ride the innovation wave and tap into the future of medicine through these 32 healthcare AI stocks, where technology meets life-changing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives