Examining the Current Ownership of Kohl's Corporation's (NYSE:KSS)

When capital seeks refuge, rumors can be a powerful driver - as is the case with Kohl's Corporation (NYSE: KSS), which gapped over 30% on the expression of interest from Sycamore Partners and Acacia Research/Starboard Value LP.

See our latest analysis for Kohl's

January Barometer

So far, 2022 is shaping out to be a downslide year for the equities market. Generally, the first month's performance is regarded as "The January Barometer" – a theory that returns in January predict the rest of the year.

This idea has been around since 1967, when it was discussed in the book "Stock Trader's Almanach" by Yale Hirsch. While this theory has been criticized, it may have some self-reinforcing effect, as the correlation between it and the U.S market is stronger than the rest of the world (where it is not that known).

Analysts Ponder on the Value

As the broad market heads to the correction territory, some companies become takeover targets. While this can happen for various reasons, the most obvious is due to cost synergies as companies look to consolidate their operations.

According to Credit Suisse, Sycamore Partners outbid the Acacia Research / Starboard Value consortium, offering at least US$65 per share. Yet, according to Credit Suisse, Kohl's might be worth US$70-80 per share. Meanwhile, Citi estimates the DCF value at US$73 per share, considering the offers received to be reasonable.

On the upper side of the spectrum is Cowen, who has an estimation of US$85 per share.

Who Currently Owns Kohl's?

Kohl's has a market capitalization of US$6.5b, so it's too big to fly under the radar. We'd expect to see both institutions and retail investors owning a portion of the company.

Let's take a closer look to see what the different types of shareholders can tell us about Kohl's.

What Does The Institutional Ownership Tell Us About Kohl's?

Institutions typically measure themselves against a benchmark when reporting to their investors, so they often become more enthusiastic about a stock once it's included in a major index.

As you can see, institutional investors have a fair amount of stake in Kohl's. This implies the analysts working for those institutions have looked at the stock, and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk of being in a 'crowded trade.' Various parties may compete to sell stock fast when the trade goes wrong. This risk is higher in a company without a history of growth.

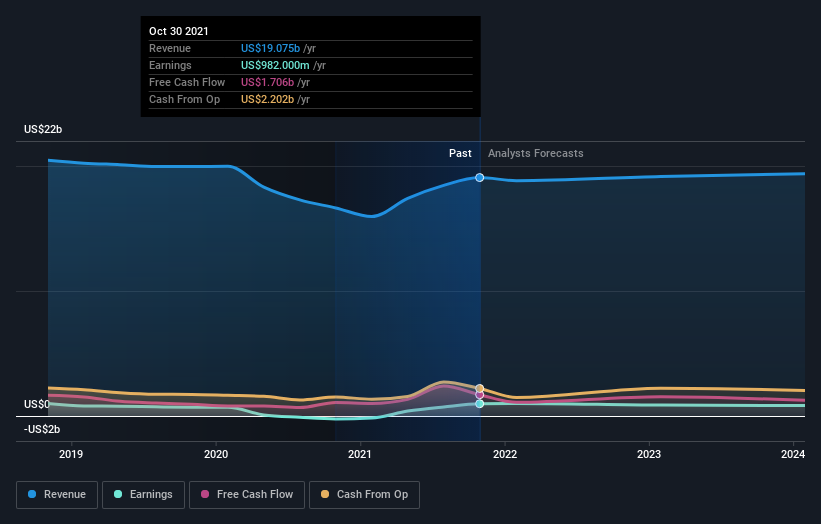

You can see Kohl's historical earnings and revenue below, but keep in mind there's always more to the story.

Institutional investors own over 50% of the company, so together, they can probably strongly influence board decisions. It looks like hedge funds own 5.3% of Kohl's shares. That is worth noting since hedge funds are often quite active investors who may influence management.

Many want to see value creation (and a higher share price) in the short term or medium term. Our data shows that The Vanguard Group, Inc. is the largest shareholder with 10% of shares outstanding. Meanwhile, the second and third largest shareholders hold 9.9% and 5.3% of the shares outstanding, respectively.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Kohl's

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. The company management answer to the board, and the latter should represent the interests of shareholders.

Insider ownership is positive when it signals leadership is thinking like the company's actual owners. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Shareholders would probably be interested to learn that insiders own shares in Kohl'sCorporation. This is a big company, so it is good to see this level of alignment. Insiders own US$68m worth of shares (at current prices). It is good to see this level of investment by insiders. You can check here to see if those insiders have been buying recently.

Next Steps:

Our analysis showed that institutions own a significant piece of Kohl's In fact, it was an institution that likely initiated the acquisition as Macellum Advisors just recently released a letter urging Kohl's to explore strategic options - including a sale. While we cannot speculate on the valuations from institutions, we'd like to point out that our intrinsic valuation points out that it might be on the higher side of the spectrum.

IIt'salways worth thinking about the different groups who own shares in a company. But to understand KKohl'sbetter, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Kohl's of which 1 can't be ignored!) you should know about.

If you would prefer to discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full-year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:KSS

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives