Assessing Kohl's After 33% Stock Jump and New Payment Strategy News

Reviewed by Bailey Pemberton

If you have Kohl's stock on your radar, you're likely wondering whether recent moves signal a turning point or just more of the same ups and downs. Over the past year, Kohl’s price tag has been anything but static. The stock has bounced back 17.1% year-to-date but is still trailing by 9.5% over the past 12 months. For short-term traders, last week’s 2.4% gain might feel encouraging, especially with all the buzz about retail investors piling into names like Kohl's. Some analysts are raising their price targets in response to a stronger-than-expected quarter, which could signal that sentiment is shifting.

There is more to the story than just market speculation or meme stock action. While Kohl's continues to battle headwinds such as changing consumer habits and payment strategy pivots, the stock’s valuation has quietly become compelling. Running the numbers across six key valuation checks, Kohl’s appears undervalued in five of them. This gives the company a value score of 5 out of 6, which is not something you see every day in this industry and suggests there may be an opportunity amid all the noise.

What goes into that valuation score, and how should investors weigh it against everything else happening with the stock? Next, we will break down each approach to valuing Kohl’s shares. For those interested in a smarter, more holistic way to judge fair value, we will finish with an approach you will not want to miss.

Why Kohl's is lagging behind its peers

Approach 1: Kohl's Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its expected future cash flows and then discounting them back to today's dollars. This approach centers on how much cash Kohl’s can generate for its shareholders over time.

Kohl’s most recent reported Free Cash Flow stands at $430.96 million. Looking ahead, analysts anticipate this metric to climb steadily, with projections reaching $832.92 million by 2035. While analyst estimates cover about five years, further growth projections beyond that are extrapolated based on historical trends and reasonable assumptions.

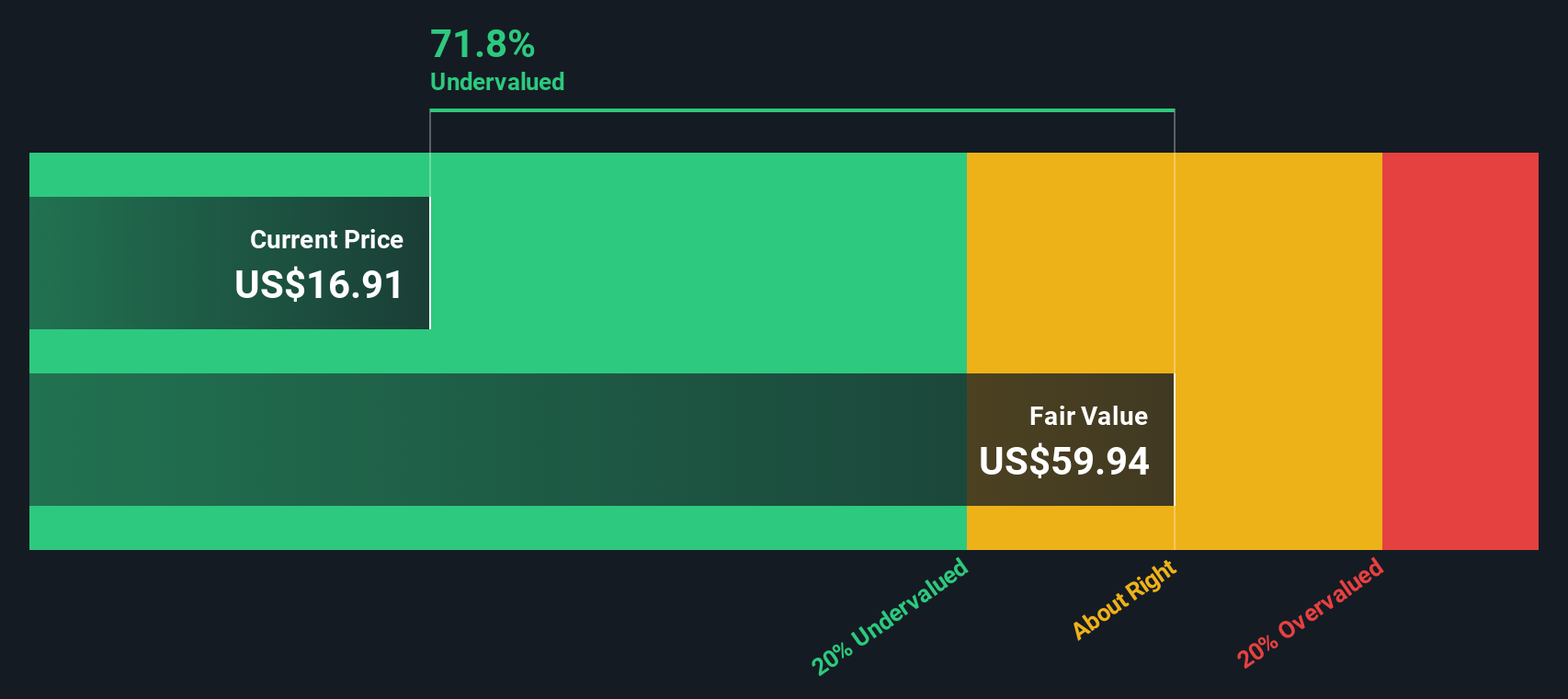

Using the two-stage Free Cash Flow to Equity model, the DCF calculation results in an estimated fair value for Kohl’s shares of $59.94 per share. This is a significant discount compared to its current share price, suggesting the stock is trading at about 72.6% below its projected value based on future cash flows.

Kohl’s current valuation implies the market is either underestimating its cash-generating potential or pricing in elevated risks. According to this DCF approach, investors may be looking at a clear opportunity.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kohl's is undervalued by 72.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kohl's Price vs Earnings

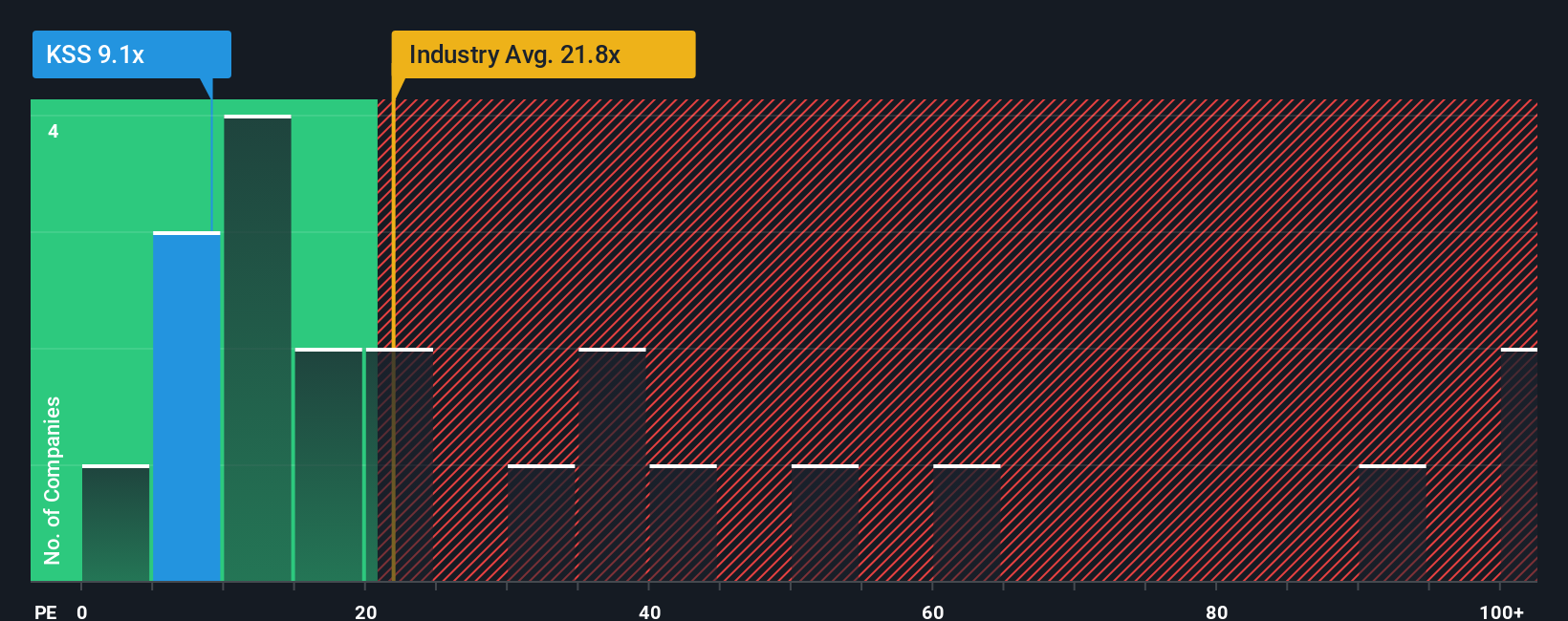

For companies that are generating steady profits like Kohl's, the Price-to-Earnings (PE) ratio is often the go-to metric for investors. It gives a quick snapshot of how much you are paying for each dollar of earnings, making it a practical tool for comparing valuation across the sector, especially when a company is consistently profitable.

However, what counts as a "normal" or "fair" PE ratio is shaped by more than just past results. Factors like how fast earnings are expected to grow, as well as the risk profile of the business, directly influence whether a lower or higher multiple is justified. Fast-growing, lower-risk companies usually command higher multiples, while riskier or slower-growing names tend to get discounted by the market.

Right now, Kohl’s trades at a PE ratio of 8.8x. That is a deep discount compared to the industry average of 21.7x and significantly below key peers, which average 32.7x. Of course, raw comparisons do not tell the full story. This is where Simply Wall St's proprietary Fair Ratio comes in. This metric calculates a tailored PE ratio of 22.2x for Kohl's, factoring in not just peer and industry multiples, but also the company’s expected earnings growth, its profit margins, risk profile, and market cap. This makes the Fair Ratio a more “apples to apples” benchmark for real-world valuation.

With Kohl's trading at 8.8x and its Fair Ratio sitting at 22.2x, the stock appears to be materially undervalued on a PE basis, suggesting significant upside for investors willing to look past the headline noise.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kohl's Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company, backed up by your expectations for its future—things like revenue, earnings, and profit margins—all connected to your own idea of fair value.

More than just numbers, Narratives let you explain why you believe a stock is undervalued, overvalued, or just right. They blend everything you know and expect about the business into a single, actionable forecast. On Simply Wall St's Community page, millions of investors use Narratives to take control of their decision making, with dynamic updates whenever fresh news or earnings are released.

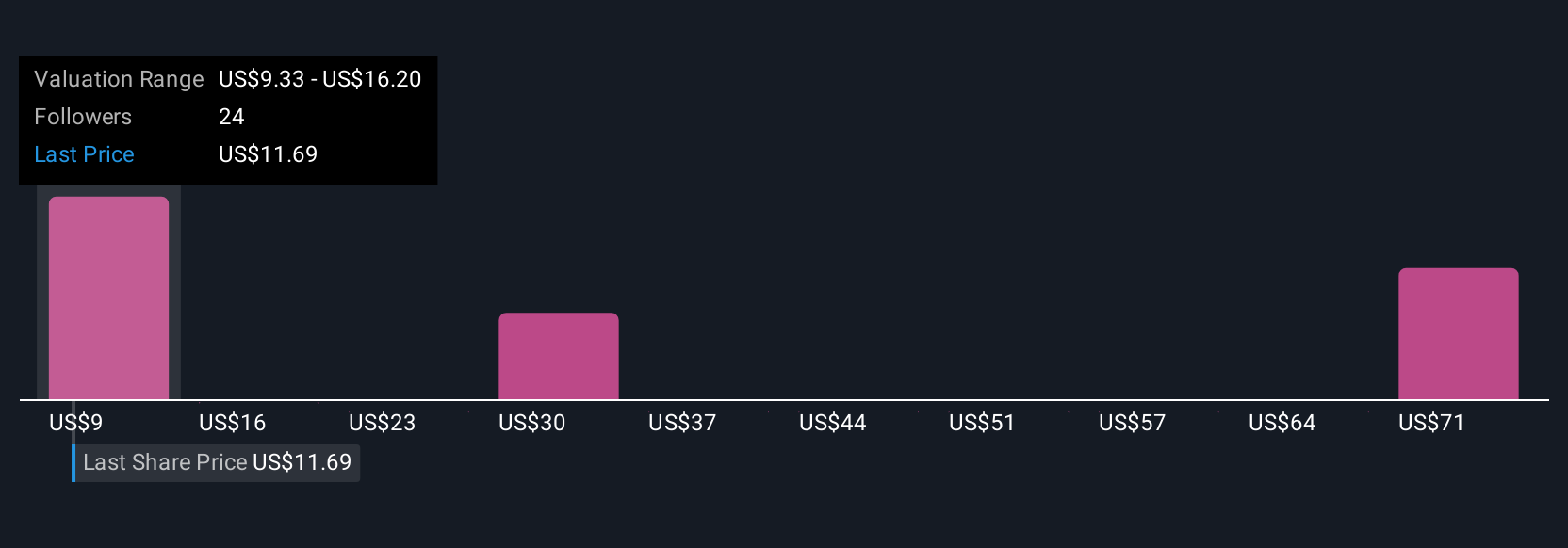

Narratives make it easy to see how your view stacks up against the crowd. You can instantly compare your Fair Value with the latest share price and quickly decide if now is the right time to buy or sell. For example, some investors currently see Kohl’s long-term fair value at $34 per share, based on robust real estate assets and cash flow. Others set targets as low as $4.50 if they expect traffic declines and weak margins to persist.

Whether you are an optimist or a skeptic, Narratives give you a structured, up-to-the-minute way to link the story you believe to the decisions you make.

For Kohl's, we’ll make it really easy for you with previews of two leading Kohl's Narratives:

Fair Value: $34.00

Undervalued by: 51.7%

Revenue Growth Rate: 48.0%

- Kohl's is trading far below its estimated liquidation and real estate values, with the market significantly underestimating financial strength and cash flow potential.

- The company’s recent share price drop is seen as a market overreaction spurred by macroeconomic fears, not by fundamental decline. Core stores remain profitable and debt manageable.

- Short interest is high, but the narrative suggests bankruptcy risk is exaggerated and there is substantial upside even with conservative valuation assumptions.

Fair Value: $14.92

Overvalued by: 10.1%

Revenue Growth Rate: -1.5%

- Declining core customer transactions, lagging digital transformation, and higher labor costs are expected to pressure revenue and profit for Kohl's traditional retail operations.

- The narrative bases its fair value on analyst consensus, reflecting minimal earnings growth, flat profit margins, and a revenue decline over the next three years.

- Analysts believe that despite recent improvements, the share price exceeds reasonable future earnings expectations unless turnaround progress substantially outpaces forecasts.

Do you think there's more to the story for Kohl's? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohl's might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KSS

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives