- United States

- /

- Specialty Stores

- /

- NYSE:KMX

Is CarMax Stock a Value Opportunity After a 52% Slide in 2025?

Reviewed by Bailey Pemberton

- Wondering if CarMax is a beaten down bargain or a value trap at current levels? This article will walk you through what the stock price is really implying.

- After sliding 6.2% over the last week, CarMax is still up 12.5% for the past month, yet it remains deeply underwater with a -52.6% year to date return and -54.3% over the last year.

- Those sharp moves have come as investors reassess used car demand, financing costs, and consumer credit conditions, while also watching how CarMax adapts to an increasingly digital retail environment. News around tighter auto lending standards and shifting used vehicle price trends has kept sentiment volatile, which helps explain the stock’s dramatic drawdown.

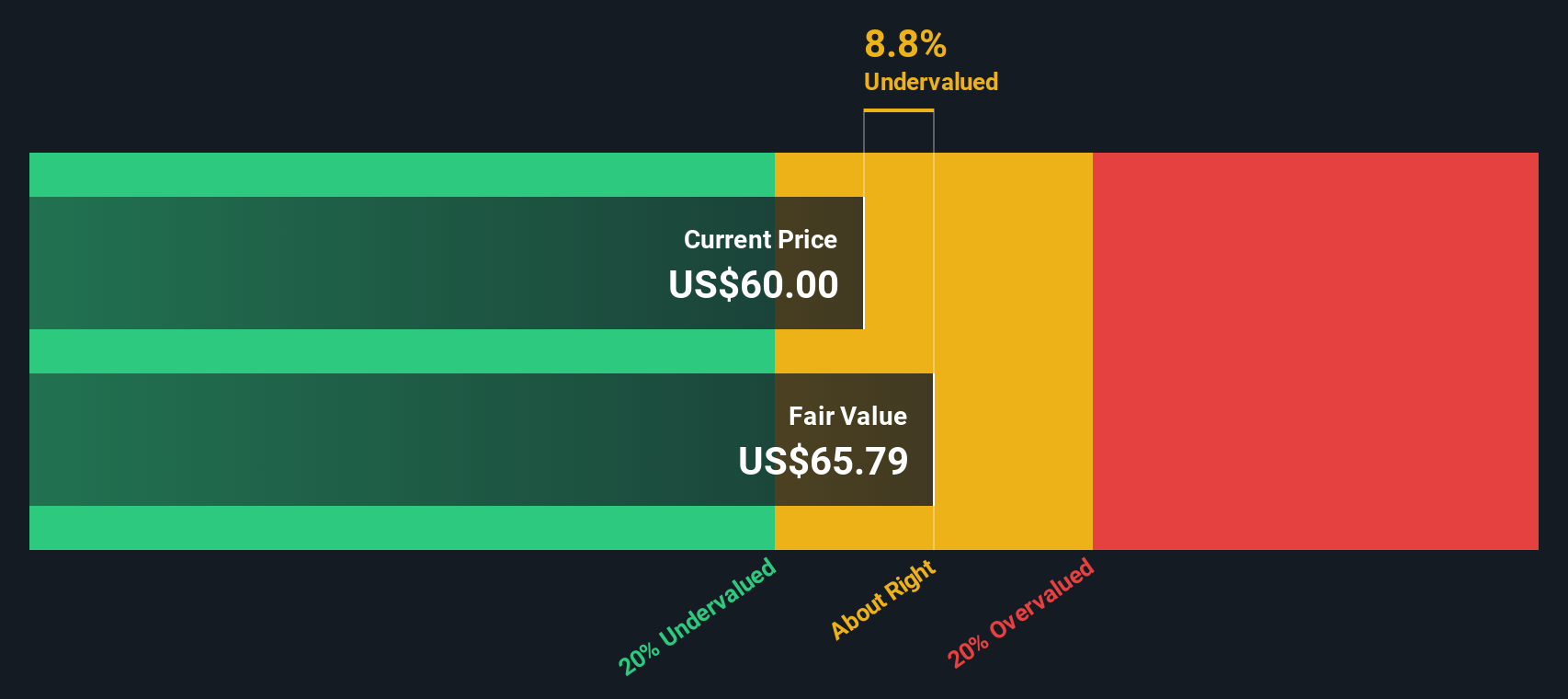

- Right now, CarMax scores a 4/6 on our valuation checks. This suggests it looks undervalued on several fronts, but not all. Next we will break down what different valuation approaches say about the stock, and later we will look at a more complete way to think about its true worth beyond just the headline multiples.

Find out why CarMax's -54.3% return over the last year is lagging behind its peers.

Approach 1: CarMax Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today’s value. For CarMax, the model uses a 2 Stage Free Cash Flow to Equity approach.

CarMax has generated trailing twelve month free cash flow of about $2.0 billion. Analysts and extrapolated estimates point to free cash flow of roughly $0.42 billion in 2035, implying more moderate cash generation further out as growth normalizes. These projections, all in $, are discounted back to today using a required return to reflect risk and the time value of money.

On this basis, the DCF model points to an intrinsic value of about $40.58 per share. Compared with the current share price, this implies the stock trades at roughly a 5.2% discount, which is a modest gap rather than a deep bargain. In other words, the market price and the DCF value are broadly in the same ballpark.

Result: ABOUT RIGHT

CarMax is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

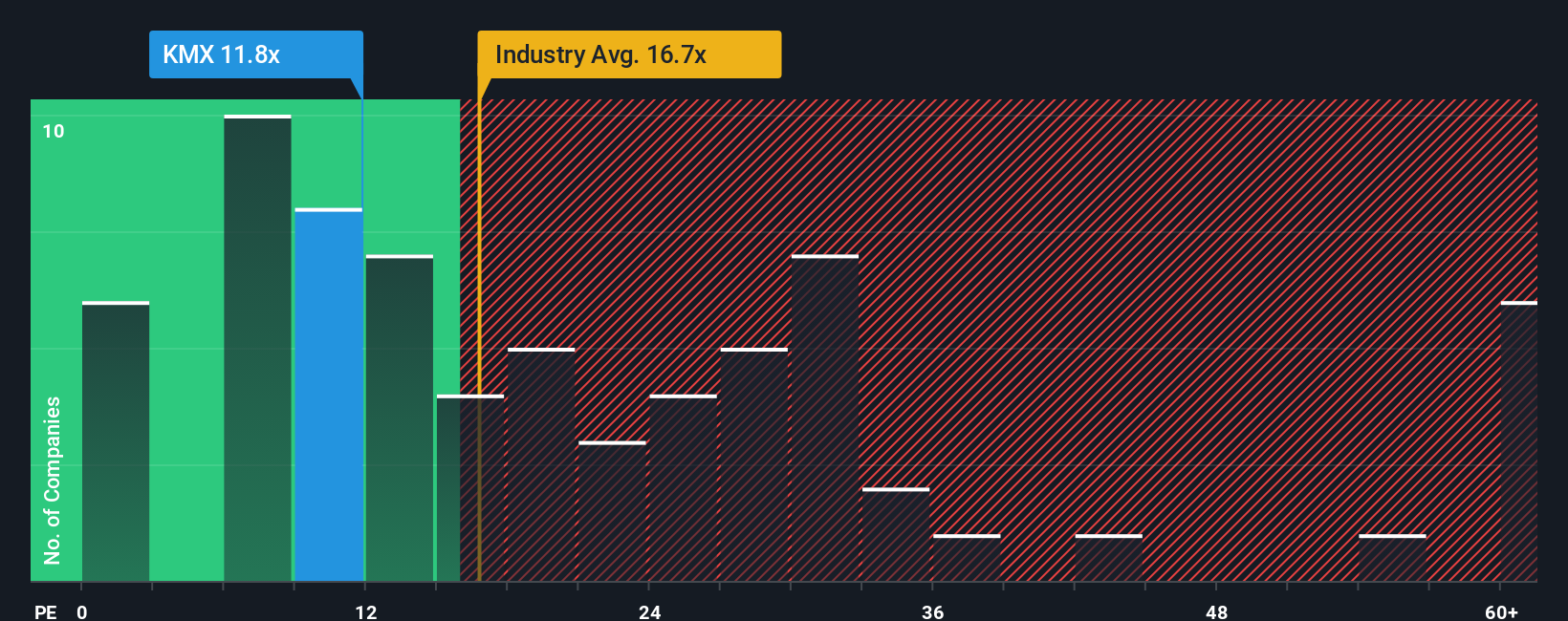

Approach 2: CarMax Price vs Earnings

For a profitable business like CarMax, the price to earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current profit. In general, companies with stronger and more reliable growth are often viewed as deserving a higher PE, while businesses facing slower growth or higher risk tend to trade on lower multiples to compensate investors.

CarMax currently trades on a PE of about 12.0x. That sits slightly below both its peer group average of roughly 12.3x and well below the broader Specialty Retail industry average of around 20.3x, indicating that the market is assigning a discount to the stock relative to many retailers.

Simply Wall St also calculates a Fair Ratio for CarMax of 18.7x, which is an estimate of the PE the company might reasonably command given its earnings growth profile, margins, industry, size, and risk characteristics. This is more tailored than simple peer or industry comparisons because it factors in CarMax specific qualities rather than assuming all retailers should trade on the same multiple. With the Fair Ratio meaningfully above the current 12.0x, the shares appear undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1465 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CarMax Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you attach a clear story to your numbers. You do this by linking your view of CarMax’s business drivers to a specific forecast for revenue, earnings and margins, and then to a Fair Value you can compare against today’s share price to decide whether to buy, hold or sell. This all updates dynamically when new news or earnings are released so your thesis always reflects the latest information. For example, one CarMax Narrative might assume that digital sales, broader credit spectrum lending and cost efficiencies play out well, supporting a Fair Value near the higher end of current targets around $120. A more cautious Narrative could emphasize execution risks, credit quality concerns and pressure from digital first rivals to arrive at a much lower Fair Value closer to $52. This neatly illustrates how different, but structured, perspectives on the same company can lead to very different investment conclusions.

Do you think there's more to the story for CarMax? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion