- United States

- /

- Specialty Stores

- /

- NYSE:KMX

CarMax (KMX) Q3 2026 EPS Drop Tests Bullish Margin-Expansion Narrative

Reviewed by Simply Wall St

CarMax (KMX) opened Q3 2026 with revenue of about $5.8 billion and basic EPS of $0.43, setting a cooler tone compared with the more profitable earlier quarters of the fiscal year. The company has seen revenue move from roughly $6.5 billion in Q4 2025 to $8.0 billion in Q1 2026 and $7.1 billion in Q2 2026, while EPS stepped through $0.58, $1.38, and $0.64 over those same periods. This progression gives investors a clear view of how earnings power has moderated as margins have quietly come under pressure.

See our full analysis for CarMax.With the headline numbers on the table, the next step is to see how this latest margin picture lines up with the big narratives investors have built around CarMax and where the fresh data might force a rethink.

See what the community is saying about CarMax

Five year earnings slide contrasts with 14% growth forecast

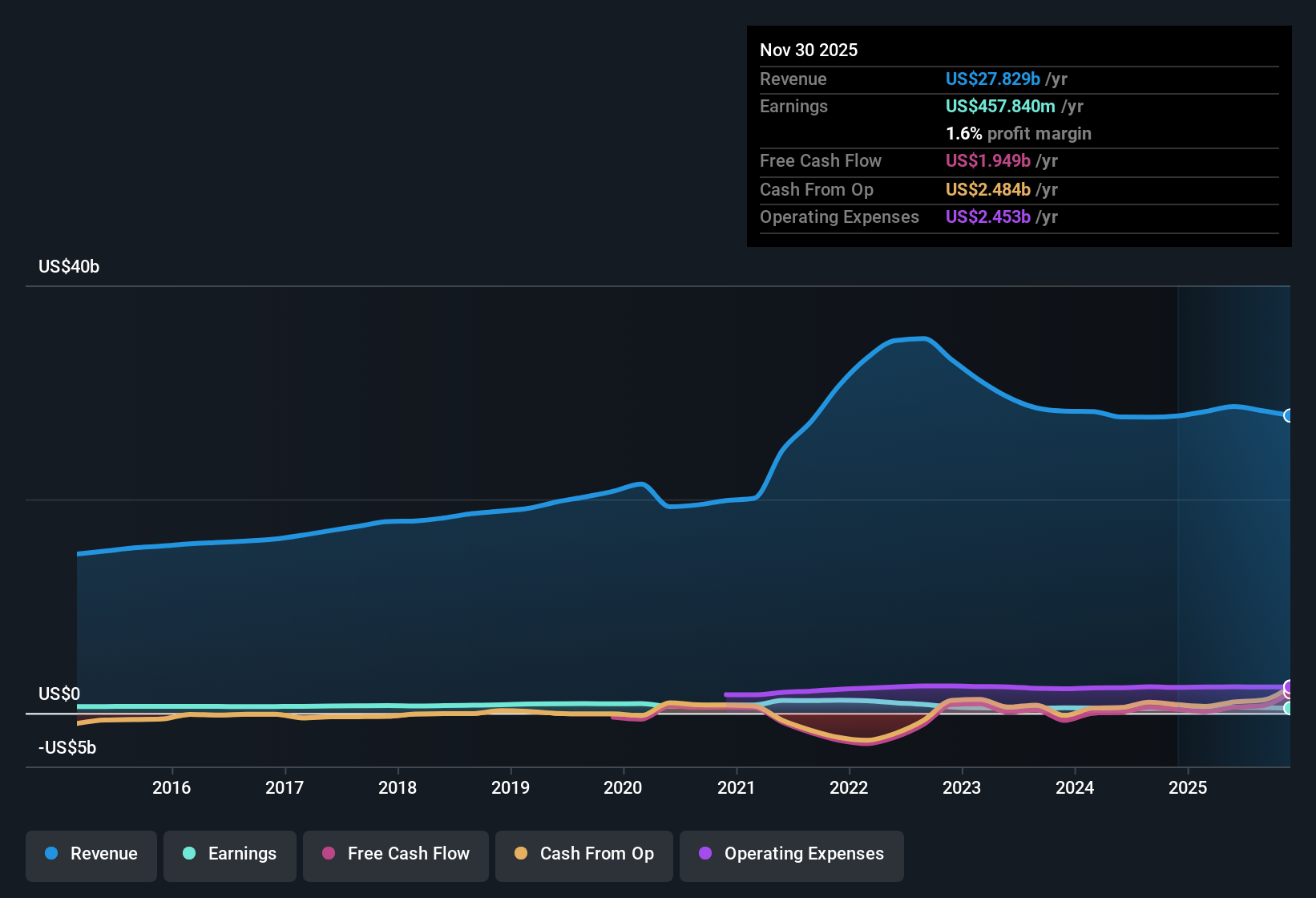

- Trailing twelve month net income is about $457.8 million on $27.8 billion of revenue, yet data also show earnings have fallen roughly 20% per year over the past five years even as forecasts now point to about 14.25% annual earnings growth.

- Consensus narrative expects digital sales growth and better vehicle sourcing to lift margins over time, which sits awkwardly against a net profit margin of 1.6% versus 1.7% a year ago and TTM EPS easing from $3.62 in Q1 2026 to $3.05 by Q3 2026.

- Those bullish on digital and omnichannel expansion argue it should eventually support higher earnings, but the recent step down in quarterly net income from $210.4 million in Q1 2026 to $62.2 million in Q3 2026 shows that any margin improvement is not yet visible in the reported figures.

- Optimists also point to cost reductions and reconditioning efficiencies as future tailwinds, yet the modest margin compression and negative earnings growth versus the five year average highlight that these savings have not offset current top line and cost pressures so far.

Margins thin while revenue growth expectations soften

- Over the last year the net profit margin has been 1.6%, slightly below the prior 1.7%, and analysis data indicate revenue is expected to decline by about 1.2% per year over the next three years even as analysts model profit margins rising from 1.9% to 3.1%.

- Critics focus on the risk that higher sourcing and loan costs will keep pressuring margins, and the small step down from a 1.7% to 1.6% net margin together with quarterly revenue sliding from $8.0 billion in Q1 2026 to $5.8 billion in Q3 2026 offers some support for that cautious view.

- Bears also highlight that wholesale gross profit per unit has already come under pressure and that expanding full credit spectrum lending could require higher loan loss provisions, which would become harder to absorb if revenue continues to drift lower.

- At the same time, the forecast for earnings to grow around 14.25% per year despite only flat to slightly negative revenue expectations suggests any downside surprise on costs or credit quality could quickly undermine the more optimistic margin story.

Leverage risk and valuation leave little room for mistakes

- The stock trades at $39.34, modestly above a DCF fair value estimate of $35.11, with a 12.3 times P/E that is roughly in line with peers at 12.2 times but below the US market on 19.1 times and the US Specialty Retail average on 21.1 times, while debt is flagged as not being well covered by operating cash flow.

- Bears argue that weak debt coverage and a five year earnings decline make even this apparently low multiple vulnerable, and the combination of leverage concerns with the share price sitting above DCF fair value means investors are relying heavily on that forecast 14.25% annual earnings growth to justify taking balance sheet risk.

- The fact that trailing twelve month EPS has slipped from $3.62 in Q1 2026 to $3.05 in Q3 2026 reinforces the worry that historical earnings power is under strain just as the company is expected to grow into its valuation.

- With revenue growth expected at about negative 1.2% per year and margins only slightly positive today, any disappointment on execution or credit performance would leave limited buffer before the current price premium to DCF fair value starts to look stretched.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CarMax on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers in a different light and consider that the story may point elsewhere. Then take a few minutes to shape your own view, Do it your way.

A great starting point for your CarMax research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

CarMax faces thinning margins, negative five year earnings trends, and leverage concerns, all while the share price leans on optimistic growth assumptions.

If that mix of pressured profitability and balance sheet risk leaves you uneasy, use our solid balance sheet and fundamentals stocks screener (1944 results) to quickly find businesses built on stronger finances and more resilient cash coverage.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMX

CarMax

Through its subsidiaries, operates as a retailer of used vehicles and related products in the United States.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion