Does Jumia Offer Real Value After Its 200% Surge and Expansion News in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Jumia Technologies stock? You’re not alone. Lately, this once-under-the-radar e-commerce player has been turning heads with some impressive price movement. The stock jumped 7.1% just over the last week, surged 48.7% in the past month, and is up an astonishing 206.9% year-to-date. Long-term holders have also seen benefits, with gains of 115.3% in the past year and 98.2% over three years. Even the five-year return, a solid 13.8%, suggests resilience despite all the ups and downs.

What’s behind all this action? It’s clear that global market sentiment for emerging tech businesses is shifting, and Jumia seems to be catching some of that positive momentum. Excitement about Africa’s digital economy, changing risk perceptions, and some encouraging updates around local market expansion all likely helped nudge the stock higher. At the same time, it’s important to keep these rallies in perspective if you’re weighing your next move. Jumia’s valuation score currently sits at 0, which means that by standard measures, the company isn’t undervalued in any of the six checks that analysts commonly use.

So, how should you actually approach valuing Jumia now that the stock price has taken off? In the next section, we’ll break down some of the most traditional valuation tools and see how Jumia stacks up. And stick around to the end because there is a more nuanced way to size up its true value that just might surprise you.

Jumia Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Jumia Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This gives investors a sense of what the business might be worth, regardless of day-to-day market swings.

For Jumia Technologies, the current reported Free Cash Flow is negative at $-91.2 Million, indicating heavy investment or operating losses. Looking ahead, projections suggest that by the end of 2028, Jumia's Free Cash Flow could reach $7.9 Million. These estimates rely on analyst forecasts for the next five years, with any longer-term numbers extrapolated from existing data.

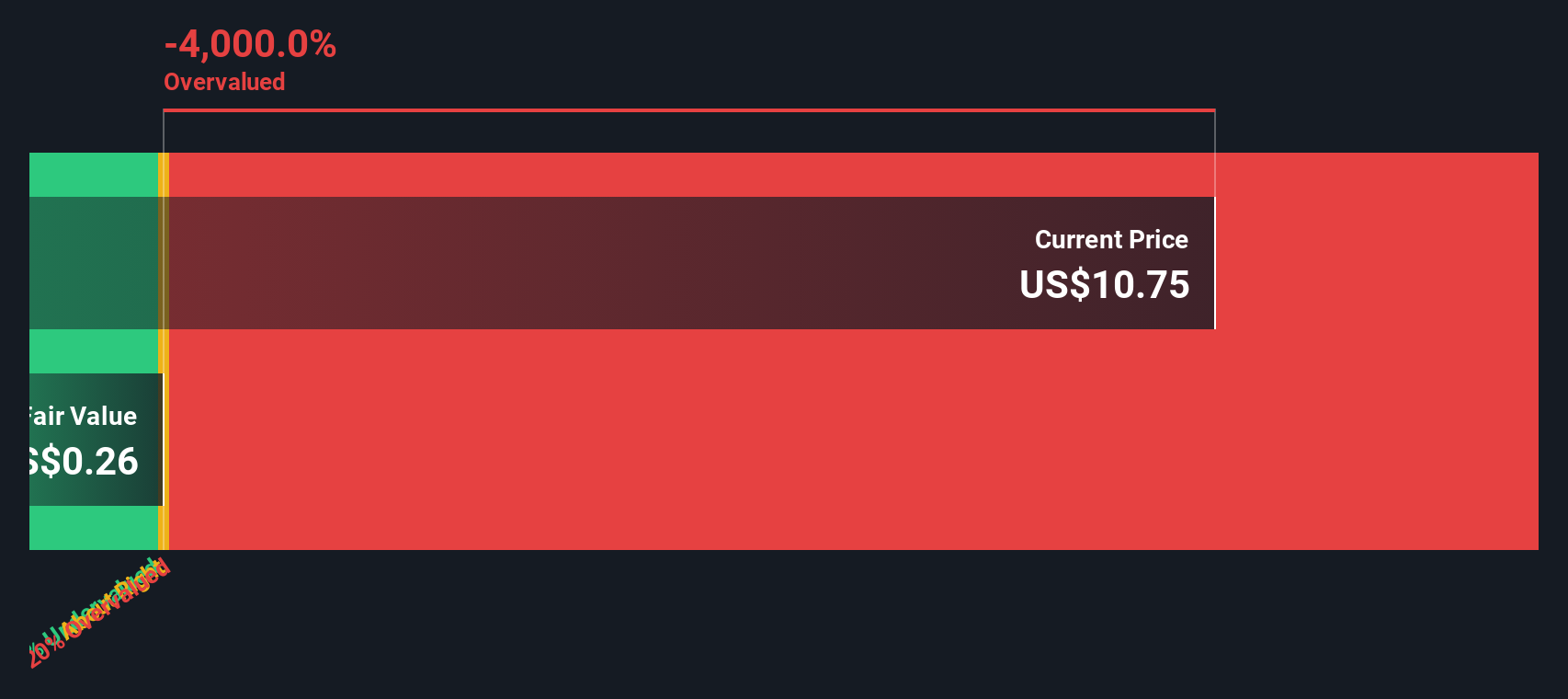

Despite these forward-looking projections, the DCF model arrives at a fair value of only $0.26 per share. Compared to the current stock price, this implies Jumia is trading at a significant premium. The model suggests the stock is about 4,485.1% overvalued. In other words, even with optimistic cash flow improvements, the price on the market far exceeds what the company's fundamental value appears to justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Jumia Technologies may be overvalued by 4485.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Jumia Technologies Price vs Sales

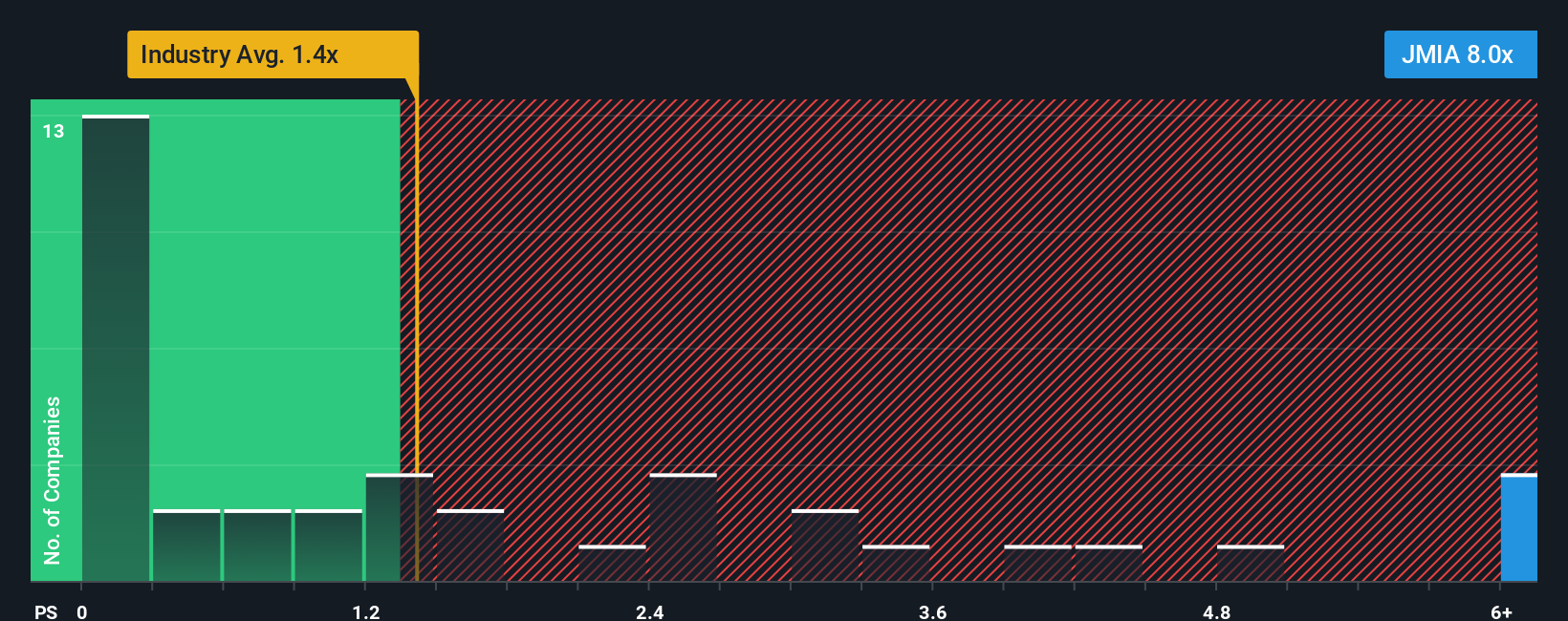

Valuing a company by its Price-to-Sales (P/S) ratio is a common approach, especially for young or unprofitable businesses like Jumia Technologies. Since Jumia is not yet profitable, traditional metrics such as Price-to-Earnings are less useful. This makes P/S a more relevant gauge of investor sentiment and market expectations.

Growth expectations and perceived risks play a pivotal role in what is considered a “fair” P/S ratio. Fast-growing companies or those with major potential in large markets often command a premium. Conversely, higher risks or inconsistent performance can keep those multiples in check among cautious investors.

Jumia currently trades at a P/S of 8.94x, which stands far above both the Multiline Retail industry average of 1.66x and its peer average of 0.87x. This premium might suggest high optimism for the company’s future. To put these numbers in perspective, we turn to the proprietary Simply Wall St “Fair Ratio.” The Fair Ratio for Jumia is calculated at 1.52x, a benchmark that incorporates critical factors like anticipated growth, profitability, risk profile, and even market capitalization. Unlike simple industry or peer comparisons, the Fair Ratio offers a more tailored reference point for Jumia’s situation by accounting for both its opportunities and challenges.

With the actual P/S multiple so much higher than the Fair Ratio, this points to Jumia’s shares being significantly overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Jumia Technologies Narrative

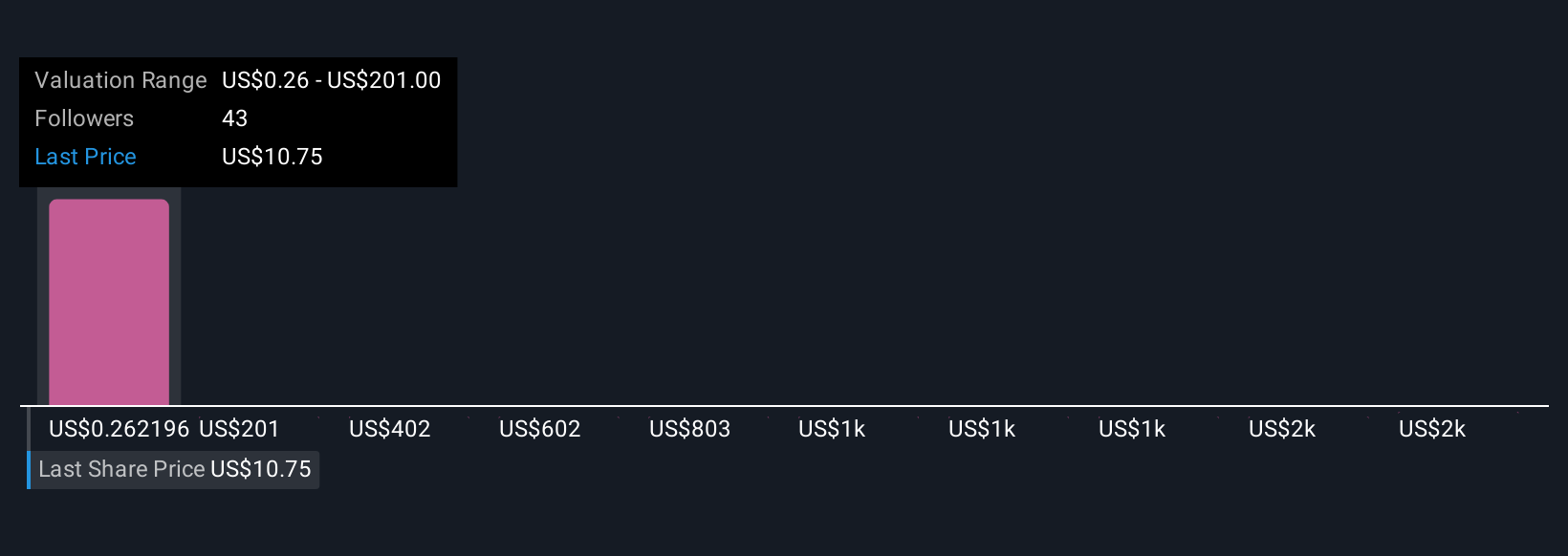

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal investment story, connecting what you believe about a company’s future, such as revenue, margins, and profit outlooks, with how those beliefs translate into a fair value. Rather than just looking at static ratios or relying only on analyst estimates, Narratives allow you to combine your assumptions with fresh data to see what the business is truly worth to you.

On Simply Wall St’s Community page, investors can explore and create Narratives using intuitive, accessible tools trusted by millions of users. Narratives make it easy to compare your fair value to the current price, helping you decide when a stock looks attractively priced or potentially overvalued. In addition, they automatically update as soon as new news or earnings come in.

For example, Jumia Technologies currently inspires a wide range of Narratives. Some investors see a bright future with rapid African e-commerce growth, estimating a fair value up to $6.99 per share, while others focus on persistent losses and risks, arriving at much lower values. Narratives let you test your expectations and make smarter, more dynamic decisions every time the story evolves.

Do you think there's more to the story for Jumia Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JMIA

Jumia Technologies

Operates an e-commerce platform in West Africa, North Africa, East and South Africa, Europe, the United Arab Emirates, and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives