- United States

- /

- Specialty Stores

- /

- NYSE:HD

Has the Recent Slide in Home Depot Created a New Opportunity for Investors?

Reviewed by Bailey Pemberton

- If you are wondering whether Home Depot is quietly turning into a bargain or if the market is right to be cautious, you are not alone. That is exactly what we are going to unpack here.

- The stock has slipped recently, down about 2.5% over the last week, 7.0% over the past month, and 11.1% year to date, even though it is still up 11.9% over 3 years and 45.5% over 5 years.

- Recent headlines have focused on shifting consumer spending toward smaller home projects and ongoing debates about how higher interest rates could cool big ticket renovation demand. Both of these factors have weighed on sentiment. At the same time, analysts and industry watchers continue to highlight Home Depot's dominant market position and long term housing stock tailwinds as reasons the pullback might be overdone.

- On our checks, Home Depot only scores 1/6 for being undervalued. We will look at what the main valuation approaches are saying and then finish with a more nuanced way of thinking about what the market might really be pricing in.

Home Depot scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Home Depot Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today's dollars. It is essentially asking what Home Depot's future cash earnings are worth right now.

Home Depot generated around $14.1 billion in Free Cash Flow over the last twelve months, and analysts expect this to climb steadily over time. Projections, extended beyond analyst coverage by Simply Wall St, point to Free Cash Flow of roughly $22.6 billion in 2035, implying moderate, compounding growth rather than explosive expansion.

Using these cash flow projections in a two stage Free Cash Flow to Equity model gives an estimated intrinsic value of about $296 per share. Based on this DCF estimate, the current share price appears to be roughly 16.7% higher, which suggests that Home Depot may be overvalued on a pure cash flow basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Home Depot may be overvalued by 16.7%. Discover 903 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Home Depot Price vs Earnings

For profitable, mature businesses like Home Depot, the Price to Earnings ratio is often the go to yardstick because it directly links what investors pay for the stock to the profits the company is generating today. A higher PE can be justified if investors expect stronger growth ahead or see the earnings stream as relatively low risk, while slower growth or higher uncertainty usually warrant a lower, more conservative multiple.

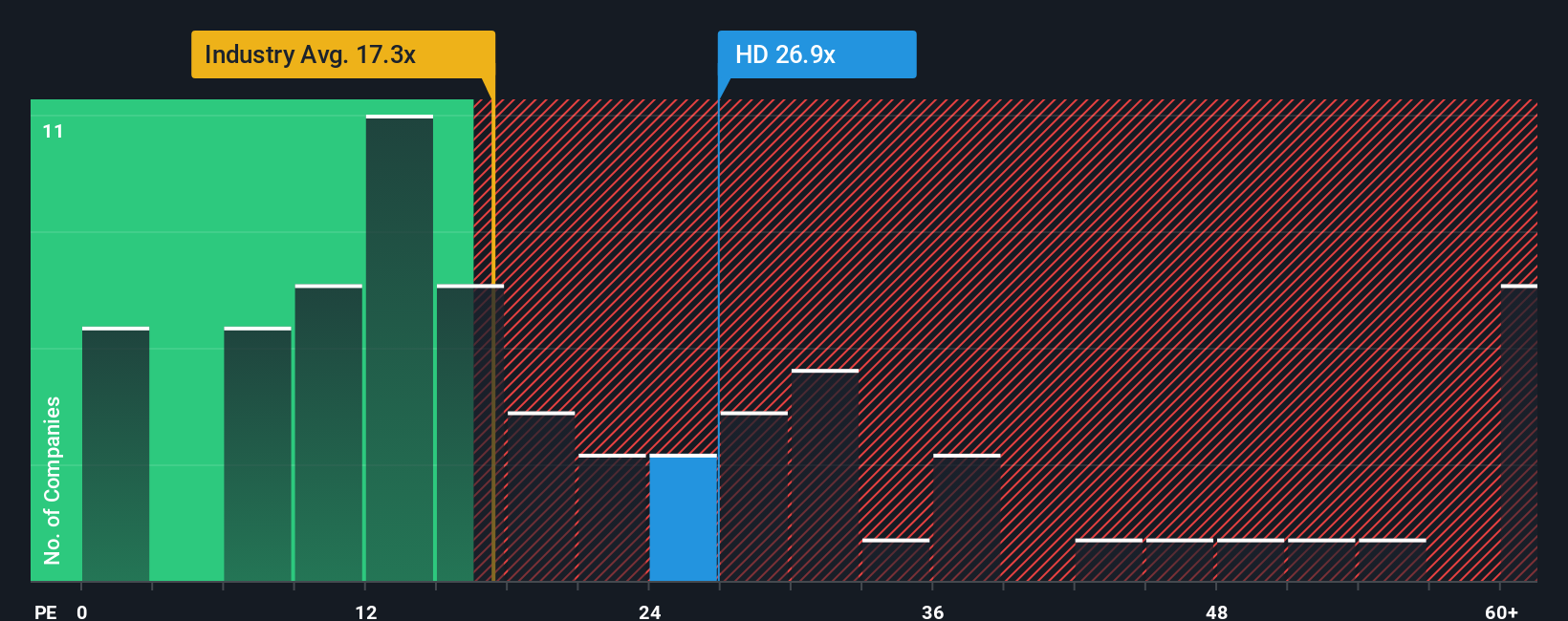

Home Depot currently trades on a PE of about 23.6x, which is above the broader Specialty Retail industry average of roughly 18.9x but slightly below the peer group average of around 25.9x. Simply Wall St also calculates a Fair Ratio of 23.8x for Home Depot, which reflects what investors might reasonably pay given its growth outlook, profitability, size and risk profile, rather than just copying whatever multiple the rest of the sector trades on.

Because this Fair Ratio is very close to the current PE, it suggests the market is broadly in the right ballpark when valuing Home Depot on earnings, with neither a glaring premium nor a clear bargain on offer at present.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Home Depot Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework where you describe the story you believe about a company, then connect that story to concrete forecasts for revenue, earnings and margins, and finally to a fair value that you can compare with today’s share price.

On Simply Wall St, Narratives live in the Community page and are used by millions of investors as an accessible tool to turn their views into numbers. Instead of just seeing a PE or DCF output, you see how a company’s story flows into a financial model and a clear buy, hold or sell view.

Narratives also stay up to date, automatically refreshing when new information like earnings, news or guidance arrives. This means your fair value view can evolve as the facts change rather than remaining fixed on an outdated model.

For Home Depot, for example, one investor Narrative might lean into technology investments, Pro customer growth and aging housing stock to support a higher fair value closer to the most bullish analyst target of about $481 per share. A more cautious Narrative might focus on weaker big ticket demand, margin pressure and macro risks to justify a fair value nearer the most bearish target of about $335 per share. This gives you a clearer sense of whether you think the current price sits in opportunity or risk territory.

Do you think there's more to the story for Home Depot? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Home Depot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HD

Home Depot

Operates as a home improvement retailer in the United States and internationally.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026