- United States

- /

- Specialty Stores

- /

- NYSE:CANG

US Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As the U.S. stock market experiences mixed performances amid anticipation of key economic data, investors are keeping a close eye on potential opportunities. Penny stocks, often representing smaller or newer companies, remain an intriguing segment of the market despite their vintage name. With careful analysis of financial strength and growth potential, these stocks can offer value and stability to investors seeking promising opportunities among lesser-known companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81 | $5.79M | ★★★★★★ |

| Inter & Co (NasdaqGS:INTR) | $4.25 | $1.93B | ★★★★☆☆ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $100.69M | ★★★★★★ |

| Kiora Pharmaceuticals (NasdaqCM:KPRX) | $3.7257 | $11.81M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.32 | $11.77M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.86M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.49 | $44.59M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.37 | $28.91M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.97 | $91.74M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.45 | $365.18M | ★★★★☆☆ |

Click here to see the full list of 727 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

CuriosityStream (NasdaqCM:CURI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CuriosityStream Inc. operates as a factual content streaming service and media company with a market cap of approximately $85.99 million.

Operations: The company's revenue segment consists solely of its streaming service, generating $51.78 million.

Market Cap: $85.99M

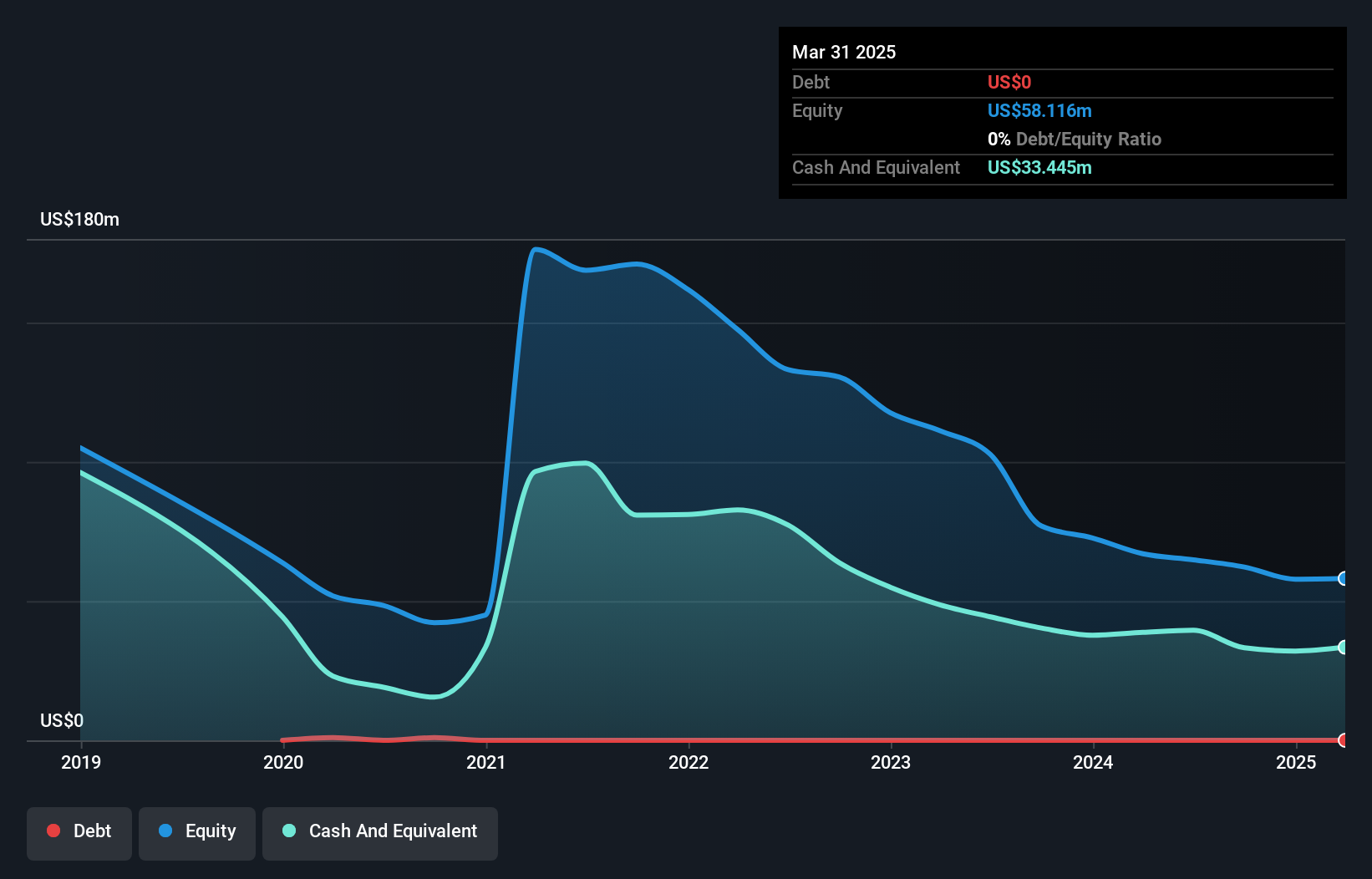

CuriosityStream, with a market cap of US$85.99 million, has shown resilience despite being unprofitable. The company reported US$12.6 million in third-quarter sales for 2024, down from the previous year but significantly reduced its net loss to US$3.06 million from US$26.57 million a year ago. It maintains a strong cash position with no debt and sufficient runway for over three years due to positive free cash flow growth of 18.8% annually. However, the stock remains volatile and shareholders experienced dilution last year despite recent share buybacks totaling 0.4%.

- Take a closer look at CuriosityStream's potential here in our financial health report.

- Gain insights into CuriosityStream's future direction by reviewing our growth report.

Cango (NYSE:CANG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cango Inc. operates an automotive transaction service platform in the People’s Republic of China, connecting various stakeholders in the automotive industry, with a market cap of approximately $529.13 million.

Operations: The company's revenue is generated from the Retail - Gasoline & Auto Dealers segment, amounting to CN¥266.69 million.

Market Cap: $529.13M

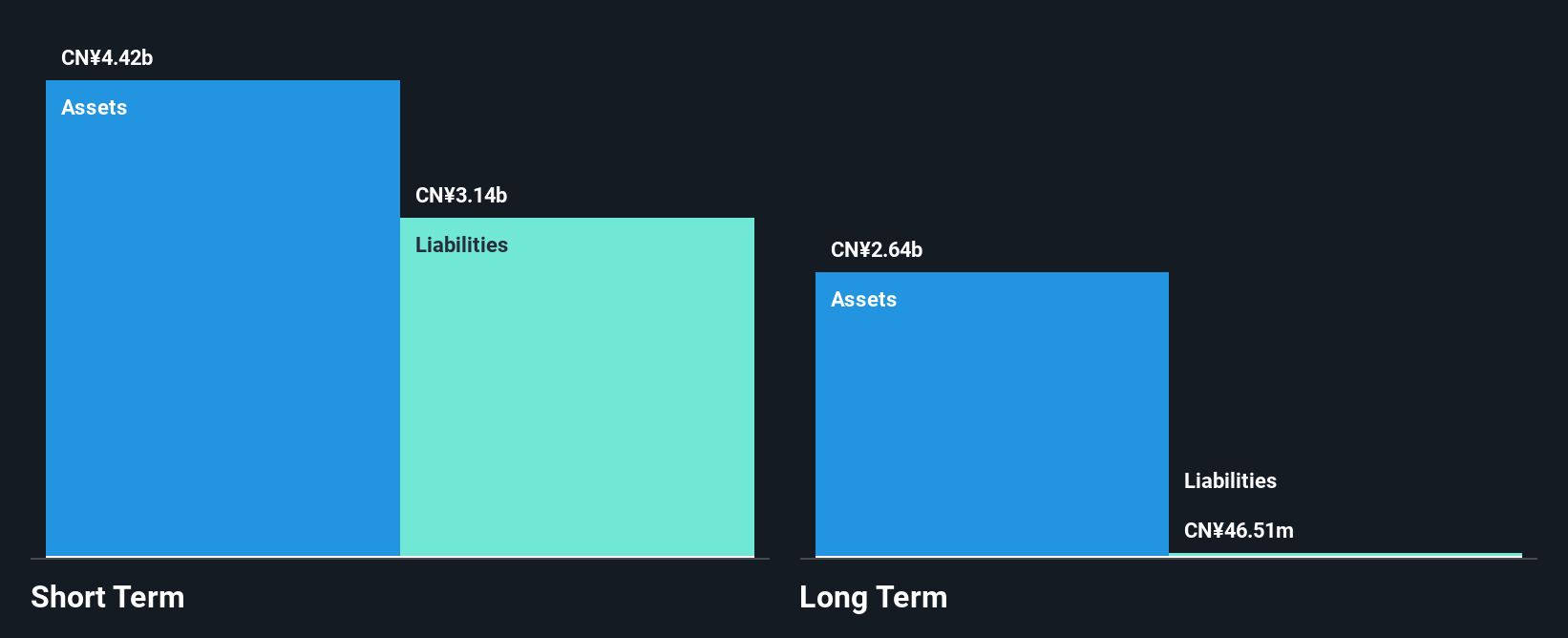

Cango Inc., with a market cap of US$529.13 million, has recently become profitable, reporting net income of CN¥67.88 million for Q3 2024 compared to a loss the previous year. Despite a sharp decline in revenue from CN¥353.64 million to CN¥26.95 million year-over-year, the company maintains strong financial health with short-term assets significantly exceeding liabilities and debt well-covered by operating cash flow. Recent initiatives include share buybacks worth $1.7 million and an auditor change to MaloneBailey without any reported disagreements with former auditor EY, indicating stable internal controls and governance practices despite high stock volatility.

- Click to explore a detailed breakdown of our findings in Cango's financial health report.

- Explore historical data to track Cango's performance over time in our past results report.

Grove Collaborative Holdings (NYSE:GROV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Grove Collaborative Holdings, Inc. operates as a plastic neutral consumer products retailer in the United States with a market cap of $60.60 million.

Operations: The company generates revenue primarily through its online retail segment, which accounts for $213.78 million.

Market Cap: $60.6M

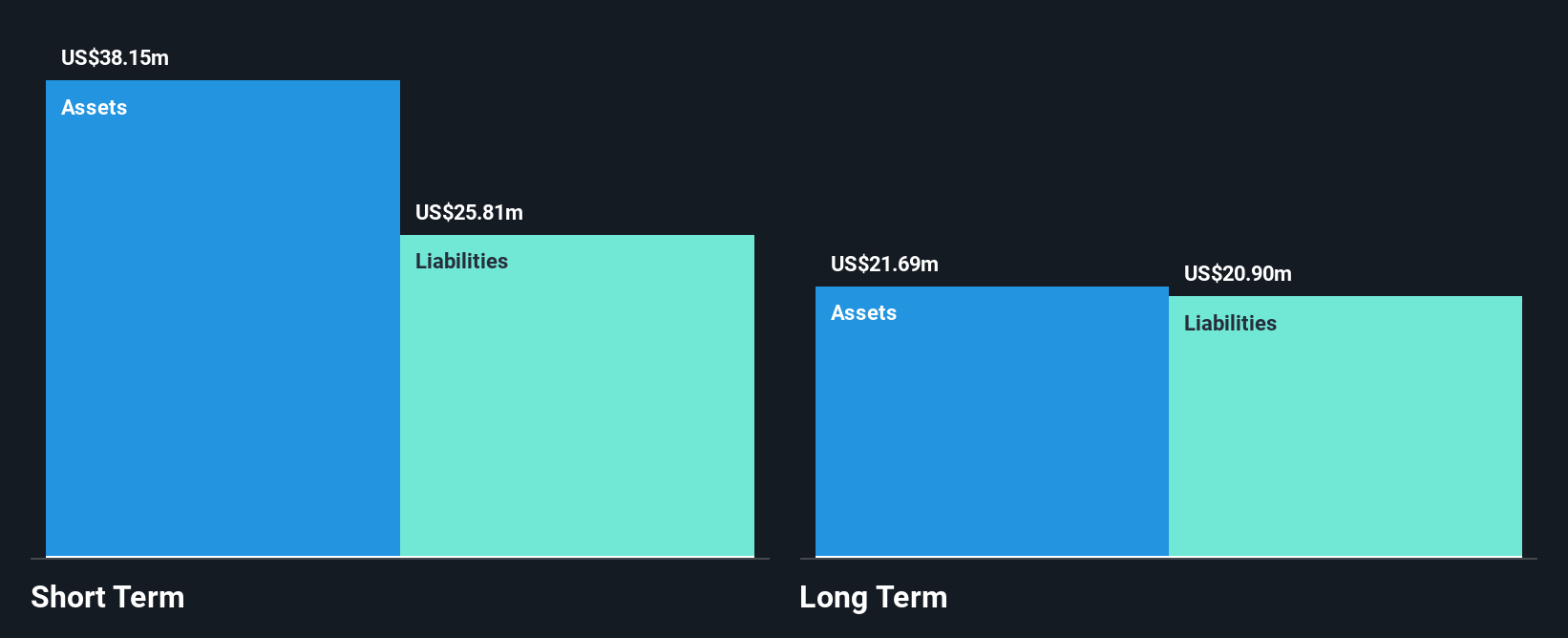

Grove Collaborative Holdings, Inc., with a market cap of US$60.60 million, has demonstrated a reduction in net losses from US$9.81 million to US$1.34 million year-over-year for Q3 2024 despite declining sales from US$61.75 million to US$48.28 million in the same period. The company holds sufficient cash runway for over three years based on current free cash flow and has more cash than total debt, indicating financial stability amidst ongoing unprofitability and shareholder dilution concerns due to increased shares outstanding by 5.1%. Recent management changes include the transition of Executive Chair Stuart Landesberg to a non-employee board role by February 2025.

- Dive into the specifics of Grove Collaborative Holdings here with our thorough balance sheet health report.

- Gain insights into Grove Collaborative Holdings' outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Unlock our comprehensive list of 727 US Penny Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CANG

Cango

Operates an automotive transaction service platform that connects dealers, original equipment manufacturers, car buyers, and other industry participants in the People’s Republic of China, British Virgin Islands, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives